BIH Bernie Madoff

- Thread starter BeAllied

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thought he was dead for a while, actually.

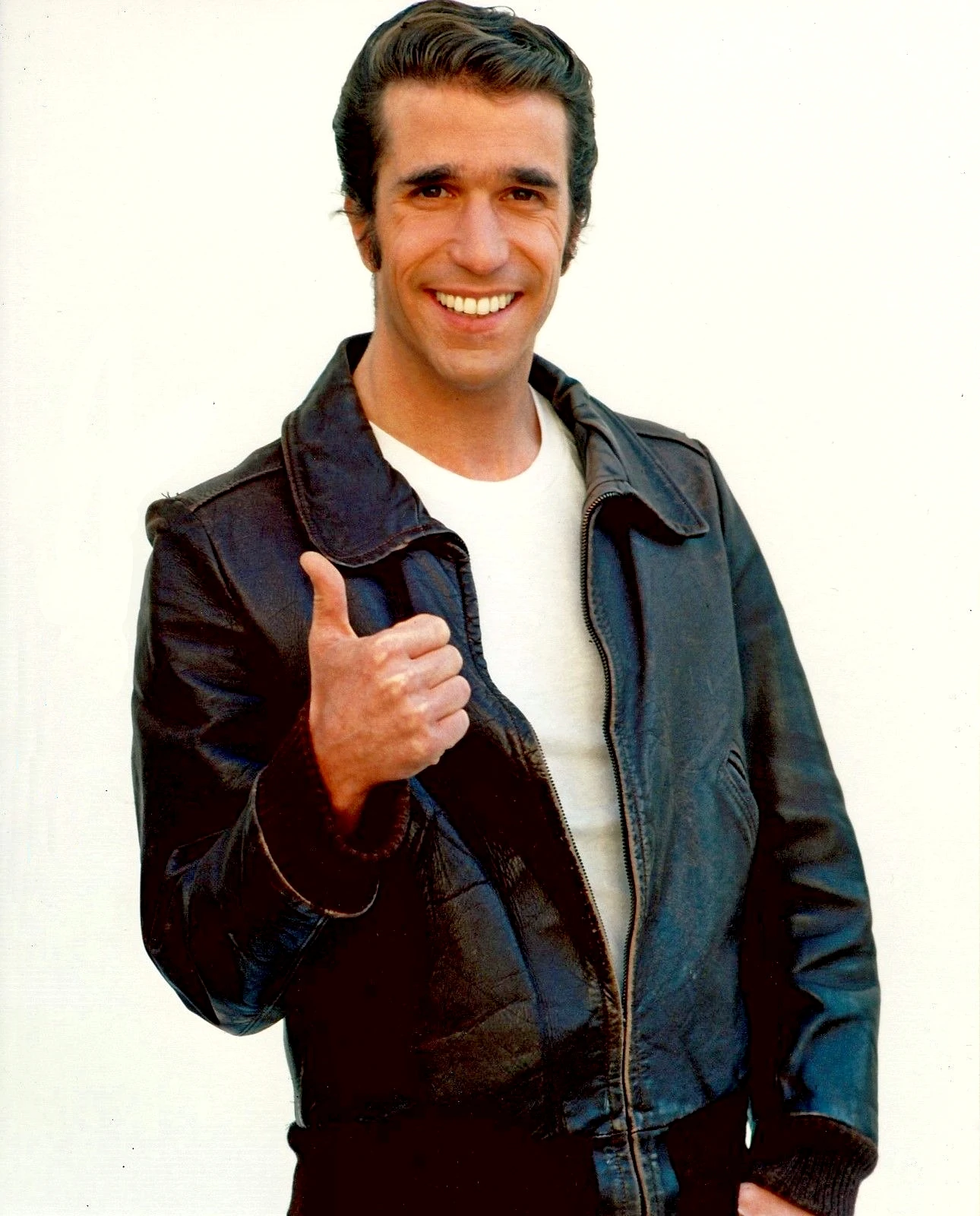

Is Andrew McCarthy 12 in this pic, or nah?

Mr. Bernie done went and M-A-D-D-O-F-T with y'all's money.

In 1999, financial analyst Harry Markopolos had informed the SEC that he believed it was legally and mathematically impossible to achieve the gains Madoff claimed to deliver. According to Markopolos, it took him four minutes to conclude that Madoff's numbers did not add up, and another minute to suspect they were fraudulent.[77]

Slightly too Butch for the Paddock but always prepared. RIP talking head.

Which makes it even more mind-blowing that it went on as long as it did. If it looks too good to be true, it probably is.In 1999, financial analyst Harry Markopolos had informed the SEC that he believed it was legally and mathematically impossible to achieve the gains Madoff claimed to deliver. According to Markopolos, it took him four minutes to conclude that Madoff's numbers did not add up, and another minute to suspect they were fraudulent.[77]

In 1999, financial analyst Harry Markopolos had informed the SEC that he believed it was legally and mathematically impossible to achieve the gains Madoff claimed to deliver. According to Markopolos, it took him four minutes to conclude that Madoff's numbers did not add up, and another minute to suspect they were fraudulent.[77]

I either read his book or one that featured his conclusions prominently. Amazing that so many smart rich people fell for what was in retrospect an obvious Ponzi scheme, no way anyone could produce the numbers that he did year in and year out.

Similar to Elizabeth Holmes and Theranos. Not a ponzi scheme, but the amount of seemingly intelligent people that bought into it shocked me.

Bernie hit these two for $100 million.

Last edited:

The power of wishful thinkingI either read his book or one that featured his conclusions prominently. Amazing that so many smart rich people fell for what was in retrospect an obvious Ponzi scheme, no way anyone could produce the numbers that he did year in and year out.

Rich people didn't fall for it because they were too dumb to know it was crooked. Rich people fell for it because they assumed it was crooked in a way that would defy prosecution, which is what they expect from their financial advisers.Amazing that so many smart rich people fell for what was in retrospect an obvious Ponzi scheme, no way anyone could produce the numbers that he did year in and year out.

Anyone figure put what time he entered Hell? I lost track