Lawrence: Trump presidency effectively over after repeal failure

- Thread starter moe

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ouch.

Hahahhaha hahahahha

You'll see why this failing hurts the Dems more than the GOP. This was the closest you all were going to get to a compromise and fixing the ACA. It's either Dead on its own, or the next GOP led plan guts it like a fish.

I suspect we'll hear more caterwauling from the Left who claims Trump's agenda is dead now after he presents his tax cut proposals.

Then he'll be resurrected as just another crazy Right winger.

Or once Neil Gorsuch is confirmed and Trump's immigration policy is upheld, then he'll be just another Right wing racist Religious bigot to the Left.

So, he's only dead for the next few days or so until he proposes something they don't like again.

Then he'll be resurrected as just another crazy Right winger.

Or once Neil Gorsuch is confirmed and Trump's immigration policy is upheld, then he'll be just another Right wing racist Religious bigot to the Left.

So, he's only dead for the next few days or so until he proposes something they don't like again.

Ouch.

Wishful thinking from a die hard antagonist. What you are counting is Chicken crap with the eggs still being laid. Hardly the time to begin counting the number of chickens you are going to have this time next year.

HahahahhahaI have to admit I'm a little scared. This pulling of National Healthcare Reform and moving on to the next item of legislation is eerily similar to Nazi Germany.

I suspect we'll hear more caterwauling from the Left who claims Trump's agenda is dead now after he presents his tax cut proposals.

Then he'll be resurrected as just another crazy Right winger.

Or once Neil Gorsuch is confirmed and Trump's immigration policy is upheld, then he'll be just another Right wing racist Religious bigot to the Left.

So, he's only dead for the next few days or so until he proposes something they don't like again.

You really in favor of that tax plan? Cutting the top rate for the Super Rich from 39.5 to 25% is not how you raise revenue for that $54 Billion dollar defense spending increase and fix our infrastructure. They happen to benefit the MOST from a safe and secure America let them pay the brunt of it. Almost as idiotic as Bush cutting taxes in the middle of 2 wars while sending volunteers to a meat grinder over and over! When you are at war sacrifices are made and the rich have the most to lose so they NEED to pay up for that protection!

As for Gorsuch he can be next AFTER Merrick Garland is confirmed.

You really in favor of that tax plan? Cutting the top rate for the Super Rich from 39.5 to 25% is not how you raise revenue for that $54 Billion dollar defense spending increase and fix our infrastructure.

Yes I am in favor of allowing the "Super Rich" and everyone else who earns their incomes to keep more of their own money.

I'll guarantee two things about you (and I know nothing about you except that you genuflect at the Leftist altar of income redistribution)

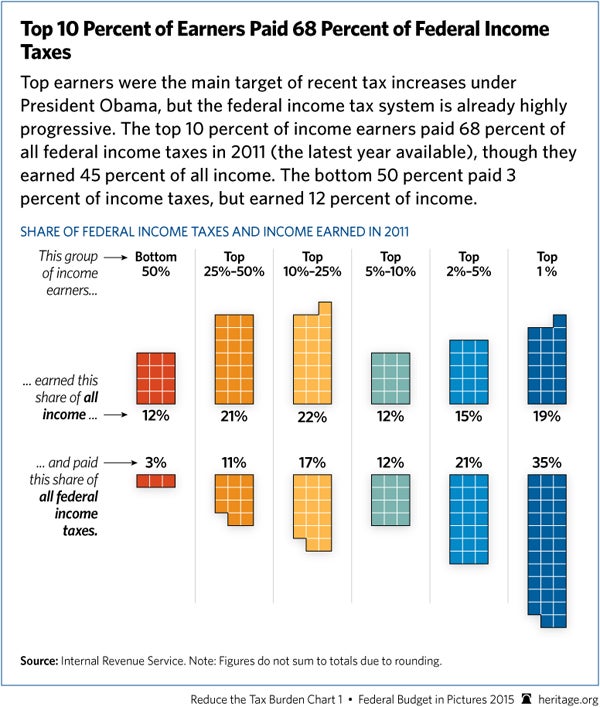

a) You have no idea how much of a percentage of the total taxes collected the so called "super rich" already do pay.

b) You don't send in a dime extra than you're legally required to pay...and you likely complain about paying that much or at least you certainly do claim every deduction you can legally take to limit your own tax liability.

So I'm wrong about you?

OK then. Tell me how much of the tax burden the "super rich" are already paying? How much more do you think they should be paying beyond that?

And please, inform the OT board how much additional you send in each year after paying your "fair share" while you ache to see folks who earn 1 more dollar than you send in an amount beyond their particular legal requirements.

Now I also know something else about you because you're a Leftist and as phony as a 3 dollar bill about who should pay extra in taxes when you don't.

You either won't respond to this post, or answer the questions I've asked you honestly. If you somehow manage to do either, you'd join those of us who want to see our taxes dramatically lowered "super rich" or not.

Last edited:

As for the taxes, its trying to free up capital to ensure job creation and expansion and promote growth. The wealthy that you obviously have an issue with are the people that create those jobs. It's not real hard to understand, the GDP has been near stagnant in growth under the left's plan. Time to try something else that has proven to work in the past.You really in favor of that tax plan? Cutting the top rate for the Super Rich from 39.5 to 25% is not how you raise revenue for that $54 Billion dollar defense spending increase and fix our infrastructure. They happen to benefit the MOST from a safe and secure America let them pay the brunt of it. Almost as idiotic as Bush cutting taxes in the middle of 2 wars while sending volunteers to a meat grinder over and over! When you are at war sacrifices are made and the rich have the most to lose so they NEED to pay up for that protection!

As for Gorsuch he can be next AFTER Merrick Garland is confirmed.

Unfortunately for you, Merrick Garland is no longer under consideration.

You're putting a lot of faith in a guy who plays in a truck like a 5 year old and can't spell 'tap'.lolYes I am in favor of allowing the "Super Rich" and everyone else who earns their incomes to keep more of their own money.

I'll guarantee two things about you (and I know nothing about you except that you genuflect at the Leftist altar of income redistribution)

a) You have no idea how much of a percentage of the total taxes collected the so called "super rich" already do pay.

b) You don't send in a dime extra than you're legally required to pay...and you likely complain about paying that much or at least you certainly do claim every deduction you can legally take to limit your own tax liability.

So I'm wrong about you?

OK then. Tell me how much of the tax burden the "super rich" are already paying? How much more do you think they should be paying beyond that?

And please, inform the OT board how much additional you send in each year after paying your "fair share" while you ache to see folks who earn 1 more dollar than you send in an amount beyond their particular legal requirements.

Now I also know something else about you because you're a Leftist and as phony as a 3 dollar bill about who should pay extra in taxes when you don't.

You either won't respond to this post, or answer the questions I've asked you honestly. If you somehow manage to do either, you'd join those of us who want to see our taxes dramatically lowered "super rich" or not.

You're putting a lot of faith in a guy who plays in a truck like a 5 year old and can't spell 'tap'.lol

That's so clever Best Virginia, and frankly irrelevant to the very specific questions and comments I made in the previous post from your fellow Leftist demanding more earned income from the so called "Super Rich".

So in deference to your response here, I'll simply pose the same questions to you. Not going to retype, or repost them, so stop asking for handouts and simply scroll up to post #9 in this thread and read the questions. If you're convinced enough of the correctness in your positions about who is or should be paying our nation's tax burden, answer my questions to Bulya.

Everything I wrote to him applies also to you Best Va. You've already given me an indication of your response by this senseless post trying to make a caricature out of the President instead of dealing with the substance of the queries I posted...which is fine nothing was gained or lost in that post except infatuation with your obvious puerility.

Now that you've made your comedic contributions to our discourse, why don't you try being more grown up and honestly, intelligently, and thoughtfully answer my questions with some facts to back up your response?

I'll wait for your post as I'm still waiting for Bulya's.

Yes I am in favor of allowing the "Super Rich" and everyone else who earns their incomes to keep more of their own money.

I'll guarantee two things about you (and I know nothing about you except that you genuflect at the Leftist altar of income redistribution)

a) You have no idea how much of a percentage of the total taxes collected the so called "super rich" already do pay.

b) You don't send in a dime extra than you're legally required to pay...and you likely complain about paying that much or at least you certainly do claim every deduction you can legally take to limit your own tax liability.

So I'm wrong about you?

OK then. Tell me how much of the tax burden the "super rich" are already paying? How much more do you think they should be paying beyond that?

And please, inform the OT board how much additional you send in each year after paying your "fair share" while you ache to see folks who earn 1 more dollar than you send in an amount beyond their particular legal requirements.

Now I also know something else about you because you're a Leftist and as phony as a 3 dollar bill about who should pay extra in taxes when you don't.

You either won't respond to this post, or answer the questions I've asked you honestly. If you somehow manage to do either, you'd join those of us who want to see our taxes dramatically lowered "super rich" or not.

I don't get the "leftist" sentiment I have this thing called common sense. Trickle down economics are a proven lie so that that argument is out. Simple math you want to spend more then you need more revenue. As for the Super Rich they are taxed at the lowest rate in American History right now. I want to go back to 1955 America(not socially just economically) and Ike when the rich payed FAR MORE as a percentage of income then as opposed to now and America was humming along fine. He used that tax base to build the Interstate system and Americans could live off 1 income if needed. The rich BENEFITED the most from that infrastructure is allowed them to move more goods and services all over America. They got their tax investment back tenfold. When it comes to war the rich have the most to lose so they should be surcharged for that protection especially if it is an All-Volunteer Military protecting their asses. Bring back the draft let EVERYONE serve including women how is that for "leftist"?

You got your beliefs and I got mine. It is what it is. FWIW I am a Capitalist and own 2 businesses but I believe in humanity and taking care of each other. Jesus would not be a fan of CEO pay compared to minimum wage I can assure you. As for my taxes I do what the law allows just like your President. If I was a Billionaire I wouldn't pay more taxes I would do more charity work that I know would get a return on the dollar. Since I am not in that tax bracket I give my time and the money I can afford to charitable work with Veteran's Groups and shelters for abused women and neglected children.

Credit where it's due....that was funnyI have to admit I'm a little scared. This pulling of National Healthcare Reform and moving on to the next item of legislation is eerily similar to Nazi Germany.

I don't get the "leftist" sentiment I have this thing called common sense. Trickle down economics are a proven lie so that that argument is out. Simple math you want to spend more then you need more revenue. As for the Super Rich they are taxed at the lowest rate in American History right now. I want to go back to 1955 America(not socially just economically) and Ike when the rich payed FAR MORE as a percentage of income then as opposed to now and America was humming along fine. He used that tax base to build the Interstate system and Americans could live off 1 income if needed. The rich BENEFITED the most from that infrastructure is allowed them to move more goods and services all over America. They got their tax investment back tenfold. When it comes to war the rich have the most to lose so they should be surcharged for that protection especially if it is an All-Volunteer Military protecting their asses. Bring back the draft let EVERYONE serve including women how is that for "leftist"?

You got your beliefs and I got mine. It is what it is. FWIW I am a Capitalist and own 2 businesses but I believe in humanity and taking care of each other. Jesus would not be a fan of CEO pay compared to minimum wage I can assure you. As for my taxes I do what the law allows just like your President. If I was a Billionaire I wouldn't pay more taxes I would do more charity work that I know would get a return on the dollar. Since I am not in that tax bracket I give my time and the money I can afford to charitable work with Veteran's Groups and shelters for abused women and neglected children.

Thanks for not answering my two very simple questions: What percentage of the total taxes do the so called "super rich pay now"? and how much extra do you send in beyond your legal limits?

I know you don't want to answer it (or can't) and instead would rather just offer Leftist platitudes...but the voters have answered those questions for you, and the vast majority of them want their taxes cut. Enter Trump.

Tax cuts which historically incidentally lead to revenue increases and is the best way to balance deficit loaded budgets by also cutting wasteful and/or needless spending.

Tax cuts increase revenues:

https://www.forbes.com/sites/mikepa...uts-increase-government-revenue/#3289f6534bf2

Last edited:

Trickle down economics are a proven lie

You can't even define it. You don't know what it is beyond some Leftist "talking point", yet you practice it every day whenever you spend a dollar for some item or service someone else provides for you.

You seem to share a common affliction of most Leftists. A fundamental lack of understanding of basic economics and free market economic principles.

It's anathema to you and most Leftist statists.

The problem with common sense, it's not so common.I don't get the "leftist" sentiment I have this thing called common sense. Trickle down economics are a proven lie so that that argument is out. Simple math you want to spend more then you need more revenue. As for the Super Rich they are taxed at the lowest rate in American History right now. I want to go back to 1955 America(not socially just economically) and Ike when the rich payed FAR MORE as a percentage of income then as opposed to now and America was humming along fine. He used that tax base to build the Interstate system and Americans could live off 1 income if needed. The rich BENEFITED the most from that infrastructure is allowed them to move more goods and services all over America. They got their tax investment back tenfold. When it comes to war the rich have the most to lose so they should be surcharged for that protection especially if it is an All-Volunteer Military protecting their asses. Bring back the draft let EVERYONE serve including women how is that for "leftist"?

You got your beliefs and I got mine. It is what it is. FWIW I am a Capitalist and own 2 businesses but I believe in humanity and taking care of each other. Jesus would not be a fan of CEO pay compared to minimum wage I can assure you. As for my taxes I do what the law allows just like your President. If I was a Billionaire I wouldn't pay more taxes I would do more charity work that I know would get a return on the dollar. Since I am not in that tax bracket I give my time and the money I can afford to charitable work with Veteran's Groups and shelters for abused women and neglected children.

You speak of the wealthy like they are some secret cabal, and maybe you are talking about those 20 or so folks. I don't really consider them wealthy as I do all powerful impervious to outside pressures. Regardless, the notion that they benefit the most is absurd. We all benefit from a strong economy. We all benefit from job creation. Maybe you just understand the connections, but what you were asserting is ridiculous, almost laughable.

The problem with common sense, it's not so common.

You speak of the wealthy like they are some secret cabal, and maybe you are talking about those 20 or so folks. I don't really consider them wealthy as I do all powerful impervious to outside pressures. Regardless, the notion that they benefit the most is absurd. We all benefit from a strong economy. We all benefit from job creation. Maybe you just understand the connections, but what you were asserting is ridiculous, almost laughable.

Haters gonna hate.

I wouldn't argue that benefits expand beyond the wealthy, but you have to admit that the benefits are not equal. There are much larger benefits for the wealthy. I really don't have much of a problem with this, due to the concentration of wealth to begin with....it seems only legitimate that more benefits be for those generating the additional benefits for the working class. However, the massive gap already has created a problem in our society.....in where I have to pay $100+ to see a football game. I'm not preaching redistribution in the traditional sense.....but I'm for a different type of economic structure. Where those that work hard benefit the most. Let the wealthy be wealthy, but let's focus on making life better for the rest of us.....without always going through them first. Jobs are created when people have money to spend, people have money to spend when they have jobs.....I'd like to see the jobs created through massive government projects. High speed trains, subways systems, recycling endeavors, rebuilt bridges, better schools, etc....The problem with common sense, it's not so common.

You speak of the wealthy like they are some secret cabal, and maybe you are talking about those 20 or so folks. I don't really consider them wealthy as I do all powerful impervious to outside pressures. Regardless, the notion that they benefit the most is absurd. We all benefit from a strong economy. We all benefit from job creation. Maybe you just understand the connections, but what you were asserting is ridiculous, almost laughable.

You can't even define it. You don't know what it is beyond some Leftist "talking point", yet you practice it every day whenever you spend a dollar for some item or service someone else provides for you.

You seem to share a common affliction of most Leftists. A fundamental lack of understanding of basic economics and free market economic principles.

It's anathema to you and most Leftist statists.

Hey I got a business degree from WVU so go ahead and belittle my education. As far as your graphic I can find one that says 10 different things than the one you posted. Quoting Forbes is like quoting BriteBart or whatever Bannon's lies are called. Dick Trickle is more believable than Trickle Down VooDoo Economics I've witnessed it my whole life didn't work for Ronnie like cutting taxes during 2 wars didn't work for W.

Obviously you are cemented in your opinions as am I so this is my last post to the subject. I wish you and Comrade Trump good luck the the next 4 years you both are going to need it!

I lied I have a parting shot.

Key Facts

Overview

The federal income tax is designed to be progressive — tax rates increase in steps as income rises. For decades this helped restrain disparities in income and helped provide revenue to make public services available to all Americans. Today the system has badly eroded — many multi-millionaires and billionaires pay a lower tax rate than average American families.

Ironically, this has happened while the gap between the wealthy and everyone else has grown wider than ever. The extremely rich aren’t only earning and owning more — many are also passing wealth to their heirs tax free, creating a new American aristocracy with vast fortunes.

How the rich avoid paying taxes — and what to do about it

Conservatives claim the wealthy are overtaxed. But the overall share of taxes paid by the top 1% and the top 5% is about their share of total income. This shows that the tax system is not progressive when it comes to the wealthy. The richest 1% pay an effective federal income tax rate of 24.7%. That is a little more than the 19.3% rate paid by someone making an average of $75,000. And 1 out of 5 millionaires pays a lower rate than someone making $50,000 to $100,000.

Conservatives claim that the estate tax is a “death tax,” wrongly implying that the tax is paid when every American dies. In fact, the tax primarily is paid by estates of multi-millionaires and billionaires. The vast majority of deaths — 99.9% — do not trigger estate taxes today.

Key Facts

- The richest 1% of Americans own 35% of the nation’s wealth. The bottom 80% own just 11% of the nation’s wealth.

- In the 1950s and 1960s, when the economy was booming, the wealthiest Americans paid a top income tax rate of 91%. Today, the top rate is 43.4%.

- The richest 1% pay an effective federal income tax rate of 24.7% in 2014; someone making an average of $75,000 is paying a 19.7% rate.

- The average federal income tax rate of the richest 400 Americans was just 20 percent in 2009.

- Taxing investment income at a much lower rate than salaries and wages are taxed loses $1.3 trillion over 10 years.

- 1,470 households reported income of more than $1 million in 2009 but paid zero federal income taxes on it.

- CEOs of major corporations earn nearly 300 times more than an average worker.

- 30 percent of income inequality is due to unfair taxes and budget cuts to services and benefits.

- The largest contributor to increasing income inequality has been changes in income from capital gains and dividends.

- It’s time for the wealthiest Americans and big corporations to pay their fair share of taxes. When they take unfair advantage of the many loopholes in the tax code the rest of us pick up the tab.

- Instead of cutting education funding for our children, we should ask millionaires to pay a tax rate at least as high their secretary’s.

- Instead of cutting Social Security and Medicare, we should ask the wealthy to give up a few tax loopholes so that we can make sure everyone has a secure retirement.

Overview

The federal income tax is designed to be progressive — tax rates increase in steps as income rises. For decades this helped restrain disparities in income and helped provide revenue to make public services available to all Americans. Today the system has badly eroded — many multi-millionaires and billionaires pay a lower tax rate than average American families.

Ironically, this has happened while the gap between the wealthy and everyone else has grown wider than ever. The extremely rich aren’t only earning and owning more — many are also passing wealth to their heirs tax free, creating a new American aristocracy with vast fortunes.

How the rich avoid paying taxes — and what to do about it

- Tax income from investments like income from work. Billionaires like Warren Buffett pay a lower tax rate than millions of Americans because federal taxes on investment income (unearned income) are lower than the taxes many Americans pay on salary and wage income (earned income). Because Buffett gets a high percentage of his total income from investments, he pays a lower income tax rate than his secretary. Currently, the top statutory tax rate on investment income is just 23.8%, but it’s 43.4% on income from work. To reduce this inequity, we should raise tax rates on capital gains and dividends so they match the tax rates on salaries and wages. These loopholes lose $1.3 trillion over 10 years.

- Cap tax deductions at 28% for the wealthiest Americans. The rich are able to get much bigger tax breaks for the same tax deductions taken by the middle class. For example, a wealthy family living in a McMansion gets a much bigger tax deduction on the interest on their large mortgage than a middle-class family gets on the interest on their small mortgage on a two-bedroom house. President Obama has proposed to limit the tax break on deductions that the richest 3% can take to 28 cents on the dollar. In other words, the rich would get the same tax benefit per dollar of deductions as a household in the 28% tax bracket, but not more (as they do now) at the higher 39.6% bracket. This would raise $500 billion over 10 years.

- Strengthen the estate tax. Some of the ultra-rich are able to take advantage of loopholes so they pay almost nothing in inheritance taxes. Others take advantage of the fact that the exemption levels for the estate tax are very high — $5.3 million per individual ($10.6 million per couple). President Obama proposes to restore the exemptions to their 2009 levels — $3.5 million for an individual ($7 million for a couple) taxed at a 45% top rate. This and other reforms would raise $131 billion over 10 years. Only three estates for every 1,000 deaths would be affected.

- Another way to ensure that large inheritances are taxed is to close the income tax loophole that lets wealthy people avoid capital gains taxes by holding their assets until they die. Their heirs then escape paying taxes on these gains. This would raise about $650 billion over 10 years. We should also end specialized trusts that allow families, such as the Waltons who own more than half of Walmart, to completely avoid paying estate and gift taxes.

- Pass the Buffett Rule. The Buffett rule, inspired by billionaire Warren Buffett, would require millionaires to pay a minimum tax rate of 30%. This will guarantee that the wealthy will not pay a smaller share of their income in taxes than a middle-class family pays. It would raise $72 billionover 10 years.

- Close the Wall Street carried interest loophole. Wealthy private equity managers use a loophole to pay the lower 23.8% capital gains tax rate on the compensation they receive for managing other people’s money. We should close this loophole so that they pay the same rate as others at their income level who receive their compensation as salary. This would raise $17 billion over 10 years.

- Eliminate the payroll tax loophole for S corporations. This loophole allows many self-employed people to use “S corporations” to avoid payroll taxes. Used by Newt Gingrich and John Edwards to avoid taxes, closing this loophole would require treating this income as salary rather than profit, making it subject to payroll taxes. This would raise $25 billion over 10 years.

Conservatives claim the wealthy are overtaxed. But the overall share of taxes paid by the top 1% and the top 5% is about their share of total income. This shows that the tax system is not progressive when it comes to the wealthy. The richest 1% pay an effective federal income tax rate of 24.7%. That is a little more than the 19.3% rate paid by someone making an average of $75,000. And 1 out of 5 millionaires pays a lower rate than someone making $50,000 to $100,000.

Conservatives claim that the estate tax is a “death tax,” wrongly implying that the tax is paid when every American dies. In fact, the tax primarily is paid by estates of multi-millionaires and billionaires. The vast majority of deaths — 99.9% — do not trigger estate taxes today.

Hey I got a business degree from WVU so go ahead and belittle my education. As far as your graphic I can find one that says 10 different things than the one you posted. Quoting Forbes is like quoting BriteBart or whatever Bannon's lies are called. Dick Trickle is more believable than Trickle Down VooDoo Economics I've witnessed it my whole life didn't work for Ronnie like cutting taxes during 2 wars didn't work for W.

Obviously you are cemented in your opinions as am I so this is my last post to the subject. I wish you and Comrade Trump good luck the the next 4 years you both are going to need it!

I do defend freedom, liberty, low taxes and limited Government Bulya. But the notion that only folks on the Right cling to their beliefs while you folks on the Left are totally "open and accepting and tolerant" of all opposing views is a joke without a punch line.

Why is it that you folks on the Left don't defend what you really have allegiance to? Leviathan. Consuming as much of our Freedom and incomes as it can swallow and even more than that when it can?

You are just as dedicated to income redistribution as I am to lower taxes. However in the arena of ideas, my side wins hands down because Freedom and low taxes have always worked better than confiscatory taxation and big Government controls.

Voters already know this, and that is why your side is losing and will always lose when Americans are free to freely make their choice between the two.

Last edited:

I lied I have a parting shot.

Key Facts

Talking points

- The richest 1% of Americans own 35% of the nation’s wealth. The bottom 80% own just 11% of the nation’s wealth.

- In the 1950s and 1960s, when the economy was booming, the wealthiest Americans paid a top income tax rate of 91%. Today, the top rate is 43.4%.

- The richest 1% pay an effective federal income tax rate of 24.7% in 2014; someone making an average of $75,000 is paying a 19.7% rate.

- The average federal income tax rate of the richest 400 Americans was just 20 percent in 2009.

- Taxing investment income at a much lower rate than salaries and wages are taxed loses $1.3 trillion over 10 years.

- 1,470 households reported income of more than $1 million in 2009 but paid zero federal income taxes on it.

- CEOs of major corporations earn nearly 300 times more than an average worker.

- 30 percent of income inequality is due to unfair taxes and budget cuts to services and benefits.

- The largest contributor to increasing income inequality has been changes in income from capital gains and dividends.

—————————-

- It’s time for the wealthiest Americans and big corporations to pay their fair share of taxes. When they take unfair advantage of the many loopholes in the tax code the rest of us pick up the tab.

- Instead of cutting education funding for our children, we should ask millionaires to pay a tax rate at least as high their secretary’s.

- Instead of cutting Social Security and Medicare, we should ask the wealthy to give up a few tax loopholes so that we can make sure everyone has a secure retirement.

Overview

The federal income tax is designed to be progressive — tax rates increase in steps as income rises. For decades this helped restrain disparities in income and helped provide revenue to make public services available to all Americans. Today the system has badly eroded — many multi-millionaires and billionaires pay a lower tax rate than average American families.

Ironically, this has happened while the gap between the wealthy and everyone else has grown wider than ever. The extremely rich aren’t only earning and owning more — many are also passing wealth to their heirs tax free, creating a new American aristocracy with vast fortunes.

How the rich avoid paying taxes — and what to do about it

Other ways to close tax loopholes for the wealthy

- Tax income from investments like income from work. Billionaires like Warren Buffett pay a lower tax rate than millions of Americans because federal taxes on investment income (unearned income) are lower than the taxes many Americans pay on salary and wage income (earned income). Because Buffett gets a high percentage of his total income from investments, he pays a lower income tax rate than his secretary. Currently, the top statutory tax rate on investment income is just 23.8%, but it’s 43.4% on income from work. To reduce this inequity, we should raise tax rates on capital gains and dividends so they match the tax rates on salaries and wages. These loopholes lose $1.3 trillion over 10 years.

- Cap tax deductions at 28% for the wealthiest Americans. The rich are able to get much bigger tax breaks for the same tax deductions taken by the middle class. For example, a wealthy family living in a McMansion gets a much bigger tax deduction on the interest on their large mortgage than a middle-class family gets on the interest on their small mortgage on a two-bedroom house. President Obama has proposed to limit the tax break on deductions that the richest 3% can take to 28 cents on the dollar. In other words, the rich would get the same tax benefit per dollar of deductions as a household in the 28% tax bracket, but not more (as they do now) at the higher 39.6% bracket. This would raise $500 billion over 10 years.

- Strengthen the estate tax. Some of the ultra-rich are able to take advantage of loopholes so they pay almost nothing in inheritance taxes. Others take advantage of the fact that the exemption levels for the estate tax are very high — $5.3 million per individual ($10.6 million per couple). President Obama proposes to restore the exemptions to their 2009 levels — $3.5 million for an individual ($7 million for a couple) taxed at a 45% top rate. This and other reforms would raise $131 billion over 10 years. Only three estates for every 1,000 deaths would be affected.

- Another way to ensure that large inheritances are taxed is to close the income tax loophole that lets wealthy people avoid capital gains taxes by holding their assets until they die. Their heirs then escape paying taxes on these gains. This would raise about $650 billion over 10 years. We should also end specialized trusts that allow families, such as the Waltons who own more than half of Walmart, to completely avoid paying estate and gift taxes.

What conservatives say — and why it’s wrong

- Pass the Buffett Rule. The Buffett rule, inspired by billionaire Warren Buffett, would require millionaires to pay a minimum tax rate of 30%. This will guarantee that the wealthy will not pay a smaller share of their income in taxes than a middle-class family pays. It would raise $72 billionover 10 years.

- Close the Wall Street carried interest loophole. Wealthy private equity managers use a loophole to pay the lower 23.8% capital gains tax rate on the compensation they receive for managing other people’s money. We should close this loophole so that they pay the same rate as others at their income level who receive their compensation as salary. This would raise $17 billion over 10 years.

- Eliminate the payroll tax loophole for S corporations. This loophole allows many self-employed people to use “S corporations” to avoid payroll taxes. Used by Newt Gingrich and John Edwards to avoid taxes, closing this loophole would require treating this income as salary rather than profit, making it subject to payroll taxes. This would raise $25 billion over 10 years.

Conservatives claim the wealthy are overtaxed. But the overall share of taxes paid by the top 1% and the top 5% is about their share of total income. This shows that the tax system is not progressive when it comes to the wealthy. The richest 1% pay an effective federal income tax rate of 24.7%. That is a little more than the 19.3% rate paid by someone making an average of $75,000. And 1 out of 5 millionaires pays a lower rate than someone making $50,000 to $100,000.

Conservatives claim that the estate tax is a “death tax,” wrongly implying that the tax is paid when every American dies. In fact, the tax primarily is paid by estates of multi-millionaires and billionaires. The vast majority of deaths — 99.9% — do not trigger estate taxes today.

The average federal income tax rate of the richest 400 Americans was just 20 percent in 2009

Taxing investment income at a much lower rate than salaries and wages are taxed loses $1.3 trillion over 10 years.

1,470 households reported income of more than $1 million in 2009 but paid zero federal income taxes

30 percent of income inequality is due to unfair taxes and budget cuts to services and benefits.

The largest contributor to increasing income inequality has been changes in income from capital gains and dividends.

It’s time for the wealthiest Americans and big corporations to pay their fair share of taxes

When they take unfair advantage of the many loopholes

Instead of cutting education funding for our children, we should ask millionaires to pay a tax rate at least as high their secretary’s.

we should ask the wealthy to give up a few tax loophole

The federal income tax is designed to be progressive — tax rates increase in steps as income rises.

Today the system has badly eroded — many multi-millionaires and billionaires pay a lower tax rate than average American families

The extremely rich aren’t only earning and owning more — many are also passing wealth to their heirs tax free, creating a new American aristocracy with vast fortunes.

Tax income from investments like income from work. Billionaires like Warren Buffett pay a lower tax rate than millions of Americans because federal taxes on investment income

To reduce this inequity, we should raise tax rates on capital gains and dividends

Cap tax deductions at 28% for the wealthiest Americans.

The rich are able to get much bigger tax breaks for the same tax deductions taken by the middle class.

Strengthen the estate tax.

Others take advantage of the fact that the exemption levels for the estate tax are very high — $5.3 million per individual ($10.6 million per couple)

Another way to ensure that large inheritances are taxed is to close the income tax loophole that lets wealthy people avoid capital gains taxes

Let me count the ways Leftists want money that doesn't belong to them. If you want to know what "income redistribution" is...look what the Left thinks that people who earn a dollar more than someone else should do with their money, and who they should turn it over to?

They should NOT be allowed to keep what they earn, save, or invest. No,no,no,no,no!!!!!!!

They're not paying enough right now, and they need to give what they're not paying taxes on now over the the Government to decide how it should be spent.

Then we'll all be happy.

Hey I got a business degree from WVU so go ahead and belittle my education

Great! Congratulations Bulya, WVU is a great school.

Now let's see what you've learned.

Let's say for the sake of this argument I pay only 10% of my earnings of a Million dollars in taxes, and you pay 20% of your earnings on 60,000 dollars in taxes. Despite me paying a lower rate than you, which one of us still pays more of their income in total taxes?

In other words, is 10% of a Million still more than 20% of 60,000 in total taxes paid?

When you come up with the answer, you may realize how sophomoric, ill informed, and illogical the post you added to this thread about tax rates, taxes in total, who pays, who doesn't, who should pay, and who pays the most was.

Hope that WVU education also included some basic math my friend, because you appear to have lots of trouble doing some simple counting using addition, subtraction and common percentages.

Great! Congratulations Bulya, WVU is a great school.

Now let's see what you've learned.

Let's say for the sake of this argument I pay only 10% of my earnings of a Million dollars in taxes, and you pay 20% of your earnings on 60,000 dollars in taxes. Despite me paying a lower rate than you, which one of us still pays more of their income in total taxes?

In other words, is 10% of a Million still more than 20% of 60,000 in total taxes paid?

When you come up with the answer, you may realize how sophomoric, ill informed, and illogical the post you added to this thread about tax rates, taxes in total, who pays, who doesn't, who should pay, and who pays the most was.

Hope that WVU education also included some basic math my friend, because you appear to have lots of trouble doing some simple counting using addition, subtraction and common percentages.

It's called a "progressive" tax system but all the loop holes on earned income and lower rates on unearned income ALL favor the wealthy. Who the holds most of the money in the stock market? It sure as hell is Mitt Romney and Warren Buffet not Joe the Plumber and Nancy the Nurse who end up paying a rate higher than those guys who work the ******* system. Term limits for those 534 Idiots(minus Bernie) on Capitol Hill may get some fresh blood and ideas and some legislation and tax reform that favors the working man not the Top 5%.

As for your stupid ******* math equation 2 is greater than 1 is that good enough for you and my degree from WVU. Can you define "progressive tax rates" Mr. Mensa because our tax system doesn't follow what it is supposed to do.

Keep spewing your ******** and the mouth breathers on this board will eat it up but those of us with a clue know you are full of **** and a delusional idiot.

Can you define "progressive tax rates"

Yes I can Bulya. It's called income redistribution, and it doesn't work!

When you figure that out you will stop believing that it does.

What's "progressive" about taking away what belongs to someone else and giving it away to someone who didn't earn it?

No matter how you try to defend it, if I earn more money than you, I'm paying more in taxes than you and there is just no way for you to get around that simple Math with terms like "progressive" and "fair share" and the rest of the Left's Socialist redistribution nomenclature.

10% of a Million will always be more than 20% of 60,000...just as 10% of 60,000 is always going to be less than10% of 90,000.

You and the Left can't stand the fact that folks who earn more both pay more AND deserve to keep more of what they've earned.

Who's money is it Bulya?

Want some of it?

Earn it!

Stop demanding Leviathan's big paw to confiscate it from folks who don't owe you or me a damn thing.

And they are also taking the investment risks and using money for startup capital etc. Without those writeoffs, they don't put in as much and the whole system crumbles down.It's called a "progressive" tax system but all the loop holes on earned income and lower rates on unearned income ALL favor the wealthy. Who the holds most of the money in the stock market? It sure as hell is Mitt Romney and Warren Buffet not Joe the Plumber and Nancy the Nurse who end up paying a rate higher than those guys who work the ****ing system.

This is fact and you will learn the dolt you are conversing with is a waste of time. You will find him and several others on this board will go on and on with their BS and it is amazing that anyone with a clue can see it is crap but these mouth breathers honestly are brainwashed with their rationalization of half truths and unproven theories.Keep spewing your ******** and the mouth breathers on this board will eat it up but those of us with a clue know you are full of **** and a delusional idiot.

Ouch.

Says the host of an unpopular show on a network almost no one watches. Next thing you know Hannity will say Democrats have failed America.

It's called a "progressive" tax system but all the loop holes on earned income and lower rates on unearned income ALL favor the wealthy. Who the holds most of the money in the stock market? It sure as hell is Mitt Romney and Warren Buffet not Joe the Plumber and Nancy the Nurse who end up paying a rate higher than those guys who work the ****ing system. Term limits for those 534 Idiots(minus Bernie) on Capitol Hill may get some fresh blood and ideas and some legislation and tax reform that favors the working man not the Top 5%.

As for your stupid ****ing math equation 2 is greater than 1 is that good enough for you and my degree from WVU. Can you define "progressive tax rates" Mr. Mensa because our tax system doesn't follow what it is supposed to do.

Keep spewing your ******** and the mouth breathers on this board will eat it up but those of us with a clue know you are full of **** and a delusional idiot.

Are you a fresh college graduate?

Does Nancy the Nurse really pay more than Sam the Stock Market? Can you prove that claim? If you're going to accuse someone of spewing ********, and insult people with terms like mouth breathers, can you back up your own claims?