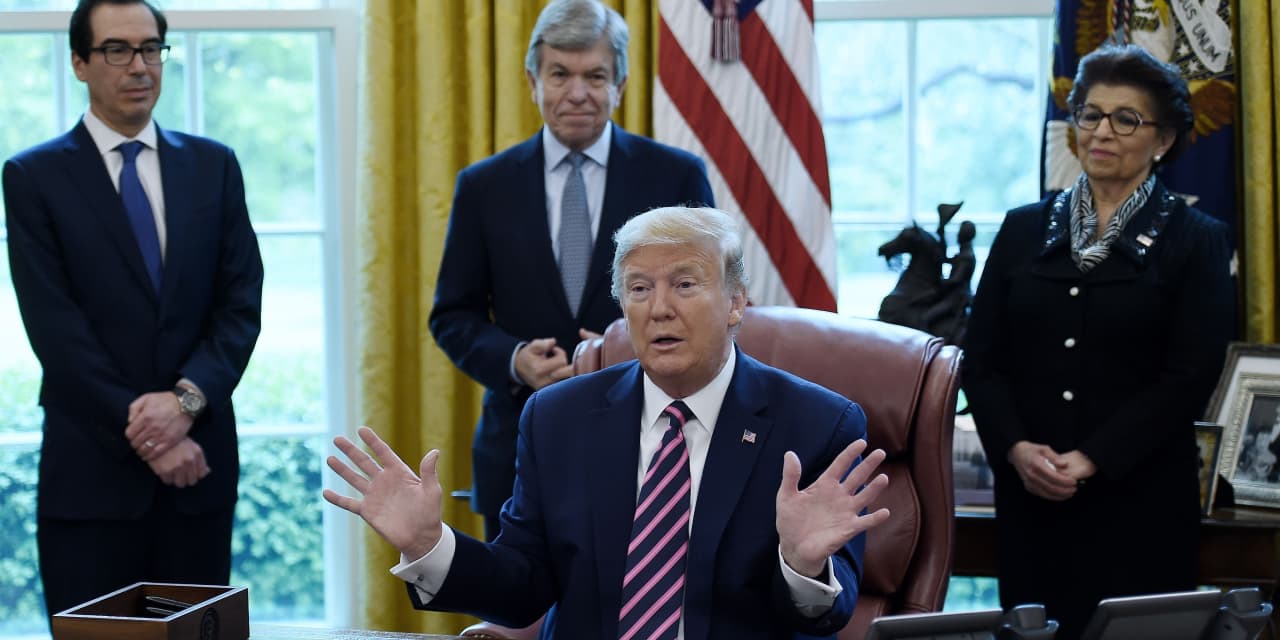

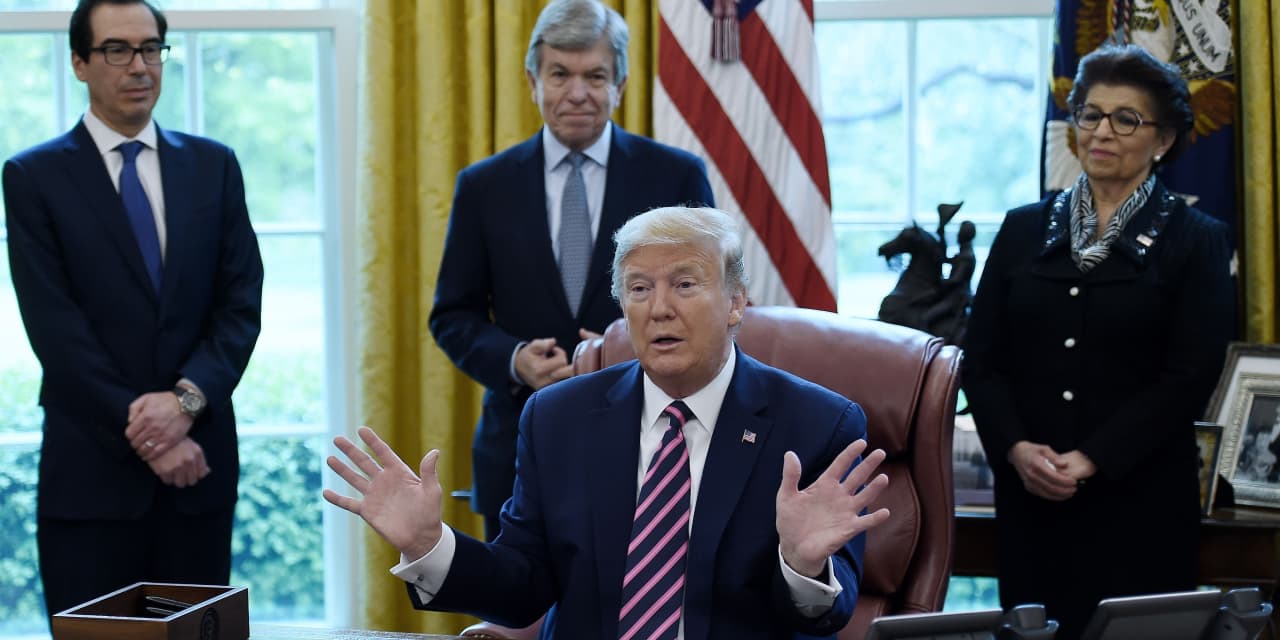

This pretty much explains it.

- Thread starter troypwr

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Whose debt has been written off?Depends -- are we going to cease writing off everyone's debt? PPP, banks, etc? Or are we just picking on students?

Whose debt has been written off?

Kanye West, Tom Brady, Jared Kushner, Reese Witherspoon, other celebs had millions in PPP loans forgiven

Businesses associated with Khloe Kardashian, Jay-Z and Paul Pelosi also were let off the hook in paying back loans meant to help small businesses struggling during the COVID-19 pandemic.

www.mercurynews.com

www.mercurynews.com

But wasn’t forgiveness part of the deal with those loans?

Kanye West, Tom Brady, Jared Kushner, Reese Witherspoon, other celebs had millions in PPP loans forgiven

Businesses associated with Khloe Kardashian, Jay-Z and Paul Pelosi also were let off the hook in paying back loans meant to help small businesses struggling during the COVID-19 pandemic.www.mercurynews.com

The "deal" was murky from the start and the rules kept changing, but forgiveness was based on certain requirements. PPP was intended for small businesses to keep people on the payroll, yet there was very little done on the enforcement side to verify that was the case before 'forgiving" billions in "loans:"But wasn’t forgiveness part of the deal with those loans?

Government officials acknowledge that the program was rife with fraud and did not weed out undeserving applicants. But there was a way to remedy those early errors: Deny forgiveness. That could have thwarted scam artists and forced businesses that prospered to repay the money.

Yet nearly three years after the rollout of PPP, the vast majority of loans have been forgiven.

...

In the frenzied early days of COVID, as PPP was created in great haste to keep businesses from potentially collapsing, the loans were simple to get: Companies simply had to pledge that the economic threat of the pandemic made the funding necessary. But what it would take later to qualify for forgiveness was hazy.

"It was entirely unclear at the beginning," said Eric Lichatin, a commercial loan officer at Centreville Bank in Rhode Island, which was inundated by calls from customers wanting PPP loans. "The SBA really rushed to get this program out there, which I think they should be commended for ... but a lot of the details were very unclear to businesses and banks."

As the program evolved, its rules became increasingly complicated, and even experts struggled to make sense of them. At one point, the SBA published a list of frequently asked questions on loan forgiveness that was 11 pages long. One consulting firm issued a client advisory with the headline "Fast and furious: The rules for the PPP ... continue to emerge at a brisk pace, often updating previous guidance."

Up to three-quarters of the $800 billion in disbursed PPP funds flowed to business owners instead of workers, study finds

The benefits of the landmark small-business relief program designed at the height of the pandemic mostly went to business owners rather than its employees, a...

Put another way, between 23% to 34% of PPP dollars went directly to workers who otherwise would have lost jobs, the study found. The program also was highly regressive, with three-quarters of PPP funds accruing to the top quintile of households.

The bottom line is many of the same politicians grandstanding about student loan forgiveness -- which is comparatively minor -- didn't give a damn about government handouts when it came to enriching their donors and, in some cases, themselves.

The "deal" was murky from the start and the rules kept changing, but forgiveness was based on certain requirements. PPP was intended for small businesses to keep people on the payroll, yet there was very little done on the enforcement side to verify that was the case before 'forgiving" billions in "loans:"

Government officials acknowledge that the program was rife with fraud and did not weed out undeserving applicants. But there was a way to remedy those early errors: Deny forgiveness. That could have thwarted scam artists and forced businesses that prospered to repay the money.

Yet nearly three years after the rollout of PPP, the vast majority of loans have been forgiven.

...

In the frenzied early days of COVID, as PPP was created in great haste to keep businesses from potentially collapsing, the loans were simple to get: Companies simply had to pledge that the economic threat of the pandemic made the funding necessary. But what it would take later to qualify for forgiveness was hazy.

"It was entirely unclear at the beginning," said Eric Lichatin, a commercial loan officer at Centreville Bank in Rhode Island, which was inundated by calls from customers wanting PPP loans. "The SBA really rushed to get this program out there, which I think they should be commended for ... but a lot of the details were very unclear to businesses and banks."

As the program evolved, its rules became increasingly complicated, and even experts struggled to make sense of them. At one point, the SBA published a list of frequently asked questions on loan forgiveness that was 11 pages long. One consulting firm issued a client advisory with the headline "Fast and furious: The rules for the PPP ... continue to emerge at a brisk pace, often updating previous guidance."

Up to three-quarters of the $800 billion in disbursed PPP funds flowed to business owners instead of workers, study finds

The benefits of the landmark small-business relief program designed at the height of the pandemic mostly went to business owners rather than its employees, a...www.marketwatch.com

Put another way, between 23% to 34% of PPP dollars went directly to workers who otherwise would have lost jobs, the study found. The program also was highly regressive, with three-quarters of PPP funds accruing to the top quintile of households.

The bottom line is many of the same politicians grandstanding about student loan forgiveness -- which is comparatively minor -- didn't give a damn about government handouts when it came to enriching their donors and, in some cases, themselves.

I guess I would be ok if Congress forgave the loans or part of them, as was done with the PPP loans. I am not OK with the President singlehandedly forgiving the loans by executive order. To me that won’t or shouldn’t fly constitutionally, as you stated in your answers to the other queries I made.

It’s the MESSAGE… NOT the Messengers.

You liberal democrats, face the impossibility, of comprehending, the message.

You liberal democrats, face the impossibility, of comprehending, the message.