Tell me again. How’s the BBB reducing the debt?We ARE getting spending cuts...that's why the nuts in your party were bombing Telsa dealerships, and voting against every penny that only reduces the increasing amounts of deficits we're spending in future years. What were mindless Dems bitching about in these spending bills if there are no cuts?

Don't tell me they were lying!

Here’s what’s in the GOP’s ‘big, beautiful bill’

- The legislation includes significant cuts to Biden-era tax credits for climate-friendly energy sources.

- It also seeks to eliminate Biden-era regulations that are expected to reduce the share of new gas-powered cars sold in the U.S.

- Medicaid and health care reforms are key pieces of a significant portion of the bill crafted by the House Energy and Commerce Committee, which was tasked with finding more than $800 billion in savings

- Republicans are pushing for well more than $1 trillion in cuts to federal spending to ride alongside the tax piece.

Trump has morphed into W on steroids, when we needed Ross Perot

- Thread starter TarHeelEer

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump isn’t the republican party. The established republicans hate him as much as the left. If tha5 wasn’t clear during his first term, I don’t kniw what else to tell you.Remind me, who has the majority in both houses of Congress right now? If he wanted to cut spending, reduce the debt, then he would have had the votes to do that. Correct? Truman had "The buck stops here" on his desk.

It's not reducing the debt...it's slowing down how fast we were headed over a fiscal cliff, and your worthless party has no better alternative particularly when it comes to allowing Americans who pay for all this government largesse to keep more of what they've earned!Tell me again. How’s the BBB reducing the debt?

Why does your loser party oppose even that?

I know the folks at NPR, PBS and Planned Parenthood aren't happy about their cuts!Tell me again. How’s the BBB reducing the debt?

White House sends $9.4 billion in DOGE cuts to Capitol Hill

excerpt:

Among the spending cuts are $1.1 billion earmarked for the Corporation for Public Broadcasting, which runs PBS and NPR, and $8.3 billion for USAID and the African Development Foundation.

By reducing your testosterone.Tell me again. How’s the BBB reducing the debt?

Metrosexual Dems have testosterone? :stuck_out_tongue_winking_eye:By reducing your testosterone.

He knows that. He's just a piece of ****.Trump isn’t the republican party. The established republicans hate him as much as the left. If tha5 wasn’t clear during his first term, I don’t kniw what else to tell you.

I voted for Ross Perot...

2. Full extension and expansion of the Trump Tax Cuts (this is what CBO is “scoring” — not spending, TAX CUTS. The ones we campaigned on and pledged!)

3. The largest welfare reform in history, CUTTING almost $2 trillion in spending (net)

Item 1 alone (border security + deportation) makes this the most important legislation for the conservative project in the history of the nation.

2. Full extension and expansion of the Trump Tax Cuts (this is what CBO is “scoring” — not spending, TAX CUTS. The ones we campaigned on and pledged!)

3. The largest welfare reform in history, CUTTING almost $2 trillion in spending (net)

Item 1 alone (border security + deportation) makes this the most important legislation for the conservative project in the history of the nation.

Last edited:

Is it supposed to?Tell me again. How’s the BBB reducing the debt?

I know it has a lot of funding for immigration issues and provides tax cuts, but by looking at the basics of it, it doesn't appear it is designed to cut spending.

If we have to invest more now to fix the problems then dial the spending back in the following years, I am all for it. That said, I am not confident our politicians in Washington will reduce the spending in future years but Trump is not the typical Washington politician so I remain cautiously optimistic until then.

This....Is it supposed to?

I know it has a lot of funding for immigration issues and provides tax cuts, but by looking at the basics of it, it doesn't appear it is designed to cut spending.

If we have to invest more now to fix the problems then dial the spending back in the following years, I am all for it. That said, I am not confident our politicians in Washington will reduce the spending in future years but Trump is not the typical Washington politician so I remain cautiously optimistic until then.

Can I finish? If anybody has a better idea, I'm all earsNot stopping any wars, piling on the spending and debt, expanding the surveillance state with Palantir. He couldn't be a more exact opposite of what was required of the moment. I can't wait for No Child Left Behind Part 2.

Econ 101........if you SPEND more than you BRING IN, then you will go broke.Is it supposed to?

I know it has a lot of funding for immigration issues and provides tax cuts, but by looking at the basics of it, it doesn't appear it is designed to cut spending.

If we have to invest more now to fix the problems then dial the spending back in the following years, I am all for it. That said, I am not confident our politicians in Washington will reduce the spending in future years but Trump is not the typical Washington politician so I remain cautiously optimistic until then.

You keep saying this without evidence that he lifted a finger. The CBO scores the bill as a $2.2 trillion deficit in FY 2026 and a $2.8 trillion deficit in FY 2027.However we didn't get into this mess overnight, and not even Trump despite his boasting, can get us out of it overnight.

Yeah. Cut spending. Cut anything.Can I finish? If anybody has a better idea, I'm all ears

That's a lie.It's not reducing the debt...it's slowing down how fast we were headed over a fiscal cliff

US Deficit in Trillions by year

2020 $3.1

2021 $2.7

2022 $1.3

2023 $1.6

2024 $1.8

2025 $1.9 - Half Trump's with CR passed in February

2026 $2.2 - All Trump's

2027 $2.8

I did too. Trump is no Perot.I voted for Ross Perot...

Yes! Schumer would either have to get on board with each appropriation bill, or a Democratic shutdown would occur, where Trump would decide which federal employees are critical to operating during the shutdown and which are not.

Can you tell me which of those deficits CUT more spending than this current bill? (just as it's proposed, since we really don't know how much will finally be eliminated from the operating deficits)That's a lie.

US Deficit in Trillions by year

2020 $3.1

2021 $2.7

2022 $1.3

2023 $1.6

2024 $1.8

2025 $1.9 - Half Trump's with CR passed in February

2026 $2.2 - All Trump's

2027 $2.8

*26 and 27 are projections, '25 deficit is not completed yet.

Also, do you know what were the CBO projections from each of those years vs how these deficits actually ended?

(not a got cha question, I honestly don't know, but typically CBO's projections are way off)

Relying on CBO budget projections and their "static" scoring is like depending on Democrats to be honest. Tell me what happened to the additional revenues generated to the treasury after the 2017 tax cuts? Did we save the extra money, or spend it?You keep saying this without evidence that he lifted a finger. The CBO scores the bill as a $2.2 trillion deficit in FY 2026 and a $2.8 trillion deficit in FY 2027.

Deficits don't occur because we have too little revenue. They happen because Congress (and the President) spend more than we take in. Yes, Trump is not immune from that, however his budget cut proposals back in 2017, 2018 and 2019 were never passed into Law. Matter of fact his proposed "cuts" were typically pronounced dead on arrival by recalcitrant Democrats.

US Deficit in Trillions by year(not a got cha question, I honestly don't know, but typically CBO's projections are way off)

CBO Proj. Actual

2020 $3.3 $3.1

2021 $2.3 $2.7

2022 $1.0 $1.3

2023 $1.4 $1.6

2024 $1.9 $1.8

2025 $1.9 $1.9 - Half Trump's with CR passed in February

2026 $2.2 - All Trump's

2027 $2.8

They aren't far off.

Exactly this! We MUST get the economy growing in order to produce more revenue. Only growth coupled with spending restraint will begin to reduce these deficits. You can't increase taxes, AND spending. You cut taxes, and spending.Is it supposed to?

I know it has a lot of funding for immigration issues and provides tax cuts, but by looking at the basics of it, it doesn't appear it is designed to cut spending.

If we have to invest more now to fix the problems then dial the spending back in the following years, I am all for it. That said, I am not confident our politicians in Washington will reduce the spending in future years but Trump is not the typical Washington politician so I remain cautiously optimistic until then.

Growth plus spending cuts then entitlement reforms is how this must be done. It's 1-2-3 in that exact order.

Thanks. OK, so we're looking at a projected deficit this year ('25) of roughly 2 trillion correct? What's the CBO projection on additional revenue due to economic expansion from the tax cuts? Assuming we produce more revenue from these largest tax cuts in American history...and assuming we can continue to force more spending restraint through DOGE recommendations, eliminating agencies, recissions, sequestration, and defunding some programs....will CBO's 2 trillion dollar deficit prediction for '25 hold up?US Deficit in Trillions by year

CBO Proj. Actual

2020 $3.3 $3.1

2021 $2.3 $2.7

2022 $1.0 $1.3

2023 $1.4 $1.6

2024 $1.9 $1.8

2025 $1.9 $1.9 - Half Trump's with CR passed in February

2026 $2.2 - All Trump's

2027 $2.8

They aren't far off.

We can't know that right now, but without the tax cuts and more growth we know we won't even be close.

Again, I agree we need to cut even more...but we have to start somewhere both growing the economy to produce more revenue and still looking for more areas we can cut spending. This bill doesn't do everything, but it's a start on doing something.

Exactly this! We MUST get the economy growing in order to produce more revenue. Only growth coupled with spending restraint will begin to reduce these deficits. You can't increase taxes, AND spending. You cut taxes, and spending.

Growth plus spending cuts then entitlement reforms is how this must be done. It's 1-2-3 in that exact order.

Proving indeed you can put out a fire by throwing more gas on it.

Incorrect.

"Of course, honestly accounted, extending current tax rates has zero deficit impact which is why the bill, because of its spending cuts, reduces the deficit."

That's an outright lie by Miller. The tax cuts expire this year. They set them to expire and weren't permanent, because, guess what, they cost too much. Throw onto it we're capping SALT tax costing hundreds of billions more. Throw onto it no tax on tips. The tax cuts most certainly will negatively impact the deficit. As I've always stated, taxes need to go up as well, not just spending cuts.

We're beyond borrowing against our children's future. We are now shooting craps in Vegas to see if we can make our mortgage payment this month.

I don't have time right now to look it up, but I believe Trump's original budget deficit proposals for those years he was in the WH were below those final numbers. None of those budgets he submitted to Congress were ever passed. So it's not fair to say he "never lifted a finger". The evidence you have of that is the fact Democrats at least pronounced each of those budgets "dead on arrival" before one vote was even taken on them!You keep saying this without evidence that he lifted a finger. The CBO scores the bill as a $2.2 trillion deficit in FY 2026 and a $2.8 trillion deficit in FY 2027.

(if I get some time today, I'll try to find Trump's budget cut proposals for those years)

Last edited:

Why didn't you answer my question about what happened to the additional revenues generated from Trump's original tax cuts in 2017? Yes we still ran deficits in that and subsequent years, but did revenues go down or did spending go up?Incorrect.

"Of course, honestly accounted, extending current tax rates has zero deficit impact which is why the bill, because of its spending cuts, reduces the deficit."

That's an outright lie by Miller. The tax cuts expire this year. They set them to expire and weren't permanent, because, guess what, they cost too much. Throw onto it we're capping SALT tax costing hundreds of billions more. Throw onto it no tax on tips. The tax cuts most certainly will negatively impact the deficit. As I've always stated, taxes need to go up as well, not just spending cuts.

We're beyond borrowing against our children's future. We are now shooting craps in Vegas to see if we can make our mortgage payment this month.

You're arguing with the wrong person about cutting spending. You want to destroy the economy? Don't pass this bill.Proving indeed you can put out a fire by throwing more gas on it.

One big LIE being promoted is that this bill doesn't cut spending. That is not true. Matter of fact, it's the LARGEST SPENDING CUT IN AMERICAN HISTORY!

It's fair to criticize the deficits contained in this bill, it's unfair to say it doesn't cut spending. Folks, we have a spending problem, not a revenue problem. This bill still spends too much, but it also cuts more than we ever have, which should tell you something about how much we're really spending!

FACT: One, Big, Beautiful Bill Cuts Spending, Fuels Growth

excerpt:

From Stephen Miller...White House deputy Chief of staff

“The Big Beautiful Bill is NOT an annual budget bill and does not fund the departments of government. It does not finance our agencies or federal programs. Instead, it includes the single largest welfare reform in American history. Along with the largest tax cut and reform in American history. The most aggressive energy exploration in American history. And the strongest border bill in American history. All while reducing the deficit.”

It's fair to criticize the deficits contained in this bill, it's unfair to say it doesn't cut spending. Folks, we have a spending problem, not a revenue problem. This bill still spends too much, but it also cuts more than we ever have, which should tell you something about how much we're really spending!

FACT: One, Big, Beautiful Bill Cuts Spending, Fuels Growth

excerpt:

From Stephen Miller...White House deputy Chief of staff

“The Big Beautiful Bill is NOT an annual budget bill and does not fund the departments of government. It does not finance our agencies or federal programs. Instead, it includes the single largest welfare reform in American history. Along with the largest tax cut and reform in American history. The most aggressive energy exploration in American history. And the strongest border bill in American history. All while reducing the deficit.”

- “The bill saves more than 1.6 TRILLION in mandatory spending, including the largest-ever welfare reform.

- CBO says maintaining *current* rates adds to the deficit, but by definition leaving these income tax rates unchanged cannot add one penny to the deficit.

- “In making its projections, the CBO [Congressional Budget Office] has refused to account for — or ‘score’ as they say in CBO lingo — any of the new revenues from the Trump reciprocal tariffs.

- One Big Beautiful Bill Act ranges from a modest $300 billion increase in the debt under the 2.2 percent growth assumption to as much as a $2 trillion surplus under the 2.7 percent growth assumption.”

Why didn't you answer my question about what happened to the additional revenues generated from Trump's original tax cuts in 2017? Yes we still ran deficits in that and subsequent years, but did revenues go down or did spending go up?

Revenues did not increase.

House Republicans unveil $900B in spending cuts for Trump’s ‘big, beautiful’ bill

excerpt:

The committee’s main job was figuring out what to do about Medicaid, which had a roughly $618 billion federal budget in fiscal year 2024

The Republican proposal calls for entitlement reform by:

excerpt:

The committee’s main job was figuring out what to do about Medicaid, which had a roughly $618 billion federal budget in fiscal year 2024

The Republican proposal calls for entitlement reform by:

- A mandated 80-hour-per-month work requirement on able-bodied adults ages 19 – 64 enrolled in the program. Volunteer work and school would count toward the requirement.

- States that enrolled in the Affordable Care Act expansion of Medicaid will see federal reimbursement rates drop from 90 to 80% if illegal immigrants are part of the program.

- Medicaid beneficiaries with incomes over the federal poverty line ($15,650) have to pay up to $35 per medical service.

- Requires eligibility checks on expanded Medicaid enrollees every six months. The Biden administration did them annually.

- State Medicaid programs can’t reimburse healthcare providers, such as hospitals, more than Medicare does.

- States are banned from adding or increasing provider taxes to help finance their portion of Medicaid costs.

- Ban on Medicaid and Children’s Health Insurance Program (CHIP) funding for gender affirming care.

- Restrictions on large abortion providers from getting Medicaid funding.

- Bars “middlemen” pharmacy benefit managers from charging higher prices to Medicaid than they actually pay for drugs.

- Authorizes the federal government to auction wireless spectrum to rake in an estimated $88 billion in revenue.

- Gives Medicare physicians an inflationary pay increase.

- Requires more transparency for pharmacy benefit managers (“middlemen” price negotiators) in Medicare Part D, the component of Medicare that helps retirees pay for prescription drugs.

- Diminishes Medicare’s ability to negotiate drug prices directly under the Inflation Reduction Act.

- Delays the Biden administration’s nursing home staffing standard until 2035. That rule requires nurses to spend 3.48 hours tending to each resident per day.

- Ends the Biden-era electric vehicle mandate for two-thirds of new car sales to be EVS by 2032, which Guthrie believes can save as much as $105 billion.

- Set up a fast-track system for permitting natural gas if applicants pay either 1% of a project’s costs or $10 million, whichever amount is fewer.

Go Figure: Federal Revenues Hit All-Time Highs Under Trump Tax CutsRevenues did not increase.

excerpt:

Critics of the Trump tax cuts said they would blow a hole in the deficit. Yet individual income taxes climbed 6% in the just-ended fiscal year 2018, as the economy grew faster and created more jobs than expected. tax collections for FY 2018 totaled $1.7 trillion. That's up $14 billion from fiscal 2017, and an all-time high. And that's despite the fact that individual income tax rates got a significant cut this year as part of President Donald Trump's tax reform plan.

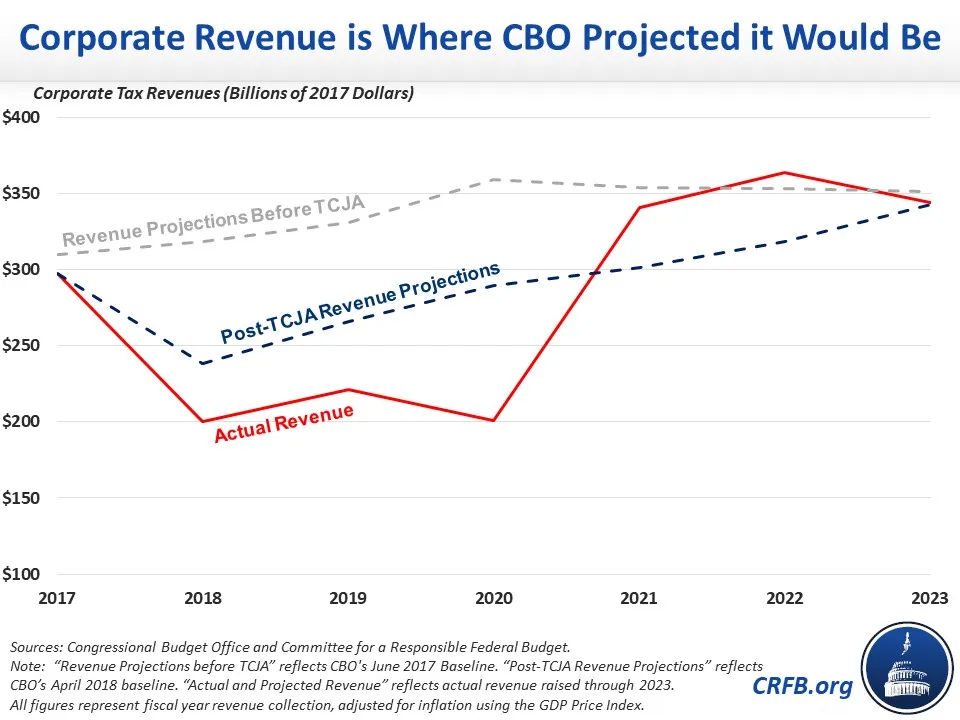

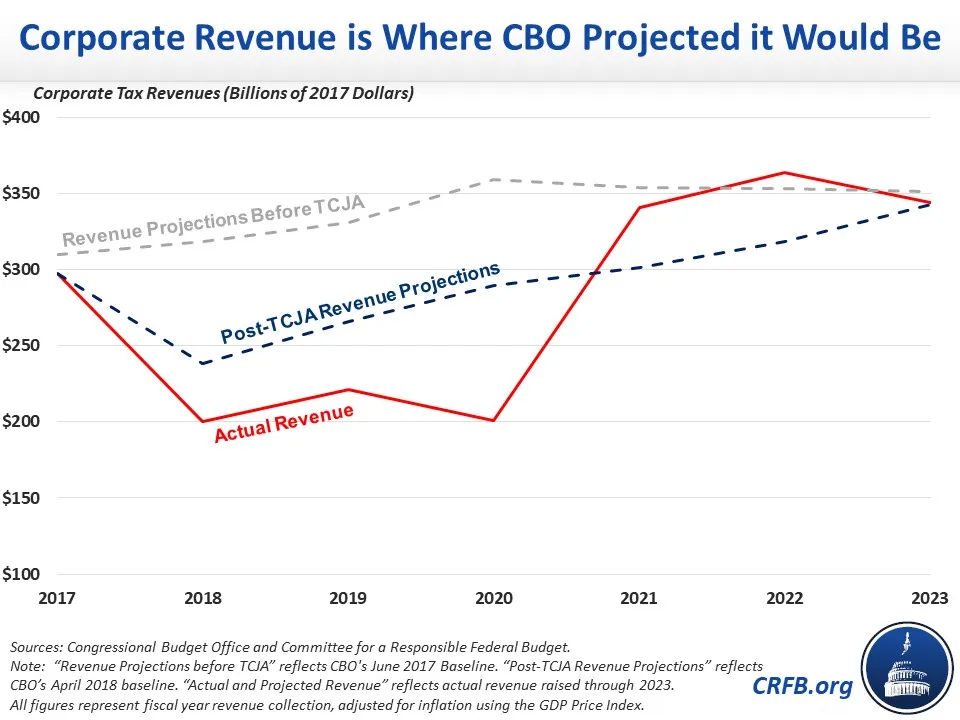

Your words are a rosy picture of what the graph communicates. While it was an all-time high at the time, it was projected to be higher before the tax cuts. The tax cuts did not increase revenue. In fact, they decreased.Go Figure: Federal Revenues Hit All-Time Highs Under Trump Tax Cuts

excerpt:

Critics of the Trump tax cuts said they would blow a hole in the deficit. Yet individual income taxes climbed 6% in the just-ended fiscal year 2018, as the economy grew faster and created more jobs than expected. tax collections for FY 2018 totaled $1.7 trillion. That's up $14 billion from fiscal 2017, and an all-time high. And that's despite the fact that individual income tax rates got a significant cut this year as part of President Donald Trump's tax reform plan.

You refuse to admit we collected more revenue than the "projections" after Trump proposed those tax cuts. Don't you remember....everyone was predicting the loss of revenue would "blow a hole in the deficit"?Your words are a rosy picture of what the graph communicates. While it was an all-time high at the time, it was projected to be higher before the tax cuts. The tax cuts did not increase revenue. In fact, they decreased.

Wrong.

We had record revenues coming into the Treasury...all time highs which were NOT predicted by CBO. We spent every penny of that extra money and then some, thus we were still running deficits. A lot of it BTW was from entitlements!

So again, we agree to disagree. These tax cuts currently proposed go beyond those 2017 cuts. More revenues will come into the treasury as they consistently have done whenever we cut taxes. Economic growth from these tax cuts will produce even more revenue, and then we have to find the political will to restrain our spending.

Econ 402........if you don't invest in your entity, it collapses.Econ 101........if you SPEND more than you BRING IN, then you will go broke.

You're just as wrong as those who stated those things. Revenue was lower than projected before the tax cuts, period. Just look at the graph, if you can read it. I'm wondering at this point.You refuse to admit we collected more revenue than the "projections" after Trump proposed those tax cuts. Don't you remember....everyone was predicting the loss of revenue would "blow a hole in the deficit"?

Wrong.

Projected debt load at the beginning of 2027 is expected to be $41 trillion. Servicing the interest will be anywhere from $1.2 trillion to $2 trillion, depending on how many people buy bonds. I expect it to be in the $1.6 trillion range.We had record revenues coming into the Treasury...all time highs which were NOT predicted by CBO. We spent every penny of that extra money and then some, thus we were still running deficits. A lot of it BTW was from entitlements!

So again, we agree to disagree. These tax cuts currently proposed go beyond those 2017 cuts. More revenues will come into the treasury as they consistently have done whenever we cut taxes. Economic growth from these tax cuts will produce even more revenue, and then we have to find the political will to restrain our spending.

Math doesn't care about your agenda, your politics, your feelz, or your desire to have lower taxes. There has to be pain. We can't grow our way out of this. We can't hide our heads in the sand and make it go away. The sooner we take on the pain, the better we will be longterm. If we continue to do nothing, or worse, increase the load with more tax cuts, our stagflation death spiral will start earlier than 2035, when SS defaults.

I'm reading that Trump wants an interest rate cut. OMG. He doesn't understand even minor stagflation.

High school econ - if you don't pay your debts, they stop giving you more money.Econ 402........if you don't invest in your entity, it collapses.

I didn't say anything about growing the economy. I believe that is one of the primary goals of the Bill.Exactly this! We MUST get the economy growing in order to produce more revenue. Only growth coupled with spending restraint will begin to reduce these deficits. You can't increase taxes, AND spending. You cut taxes, and spending.

Growth plus spending cuts then entitlement reforms is how this must be done. It's 1-2-3 in that exact order.

Thanks to that cancer Biden (pun intended) we have to spend a ton to deport the illegal leeches for security issues and we need to ramp up law enforcement to the levels they were before the racist BLM riots to get our streets under control. Those should be relatively short-term expenditures, but likely won't be.

The problem with the deficit is much of the spending that caused it was wasted, disappeared, stolen by our government officials, or went up Hunter's nose and the US got nothing out of it. The spending can be OK if it is invested in the country instead of enriching the politicians and their donors.

LOL. I don't know anyone who pays/paid taxes on their actual tips. The vast majority of tips are cash and go un-reported. The government never generated any real income taxes from them.That's an outright lie by Miller. The tax cuts expire this year. They set them to expire and weren't permanent, because, guess what, they cost too much. Throw onto it we're capping SALT tax costing hundreds of billions more. Throw onto it no tax on tips. The tax cuts most certainly will negatively impact the deficit. As I've always stated, taxes need to go up as well, not just spending cuts.

It was a talking point by Trump because he knew it made no difference to the government's bottom line while making him popular with the working class. You don't know what you are talking about.