I can't help you cannot the dots.....you are a close mined liberal zealot. If I told you that you were a good person....you would disagree. Your brain is filled with your usual CEO pay **** and had no room for any other ideas. And your defense of the worlds biggest provider of abortions is hilarious.Help me connect these dots I'm a clown and you are for single payer? Did I miss something? Love single payer insurance companies are out. Doctors and nurses should be paid as much as they can get I never said otherwise.

Trump praises Australia's universal health care after Obamacare repeal

- Thread starter moe

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A perfect scenario in protecting people with "pre-existing" conditions would allow insurers to write those policies and take on that risk by designing plans to spread that risk out over their policyholder's portfolios. Much the same way it is done now.

However the difference would be allowing competition for price structure and coverage benefits, then allowing those insurers competing for those high risk dollars to offset their risk and costs and losses (since these are high risk insureds) through tax abatements or reductions.

For instance, let's say a health insurer decides to write 35% of its coverage portfolio into high risk pools. Let's say they also form a consortium with other insurers to spread that risk across several pools. Then, they compete against other insurers or risk pools for that business and for those premium dollars.

When they file their corporate tax returns, they would get either a percentage reduction in the taxes they would otherwise owe for accepting that risk, or essentially write off a portion of their tax bill or eliminate it if their risk portfolios exceed 50% of their income.

Any earnings they manage to secure by either spreading their risk, or developing more cost effective procedures to lower their costs insuring sick high risk patients would accrue to their benefit. But they would get the tax advantages of offering affordable high risk policies to folks with pre existing conditions, and by removing those folks from the general risk pool they would be able to offer lower cost policies to non pre-existing policyholders and be able to sell more of them profitably.

People who complain about facing higher costs because of existing illnesses would have low cost options available from specific insurers who would be willing to accept those risks, manage them, and turn them into profitable operations by spreading the risk pools and having their potential costs offset by lower or reduced taxes which improves their bottom line earnings statements.

They would save the Government (taxpayers) policyholders (premium payers) and the market which would not be distorted by high costs being absorbed by the non sick to cover the chronically sick.

Those folks would be in a risk pool specifically designed and managed to treat those high risk cases, and tax incentives are the reward to the company or companies willing to accept that risk.

The Left would still complain about Insurance companies not paying their "fare share" of taxes, but if they are willing to accept the risk of insuring and caring for folks with pre-exisiting conditions and can find a way to do so profitably, the tax savings should accrue to both them and the taxpayers who would otherwise be paying to treat those folks under much more expensive circumstances.

However the difference would be allowing competition for price structure and coverage benefits, then allowing those insurers competing for those high risk dollars to offset their risk and costs and losses (since these are high risk insureds) through tax abatements or reductions.

For instance, let's say a health insurer decides to write 35% of its coverage portfolio into high risk pools. Let's say they also form a consortium with other insurers to spread that risk across several pools. Then, they compete against other insurers or risk pools for that business and for those premium dollars.

When they file their corporate tax returns, they would get either a percentage reduction in the taxes they would otherwise owe for accepting that risk, or essentially write off a portion of their tax bill or eliminate it if their risk portfolios exceed 50% of their income.

Any earnings they manage to secure by either spreading their risk, or developing more cost effective procedures to lower their costs insuring sick high risk patients would accrue to their benefit. But they would get the tax advantages of offering affordable high risk policies to folks with pre existing conditions, and by removing those folks from the general risk pool they would be able to offer lower cost policies to non pre-existing policyholders and be able to sell more of them profitably.

People who complain about facing higher costs because of existing illnesses would have low cost options available from specific insurers who would be willing to accept those risks, manage them, and turn them into profitable operations by spreading the risk pools and having their potential costs offset by lower or reduced taxes which improves their bottom line earnings statements.

They would save the Government (taxpayers) policyholders (premium payers) and the market which would not be distorted by high costs being absorbed by the non sick to cover the chronically sick.

Those folks would be in a risk pool specifically designed and managed to treat those high risk cases, and tax incentives are the reward to the company or companies willing to accept that risk.

The Left would still complain about Insurance companies not paying their "fare share" of taxes, but if they are willing to accept the risk of insuring and caring for folks with pre-exisiting conditions and can find a way to do so profitably, the tax savings should accrue to both them and the taxpayers who would otherwise be paying to treat those folks under much more expensive circumstances.

Last edited:

LMAO.....Please tell me you don't really believe that.I bought a new car not too long ago. Got free oil changes and checkups for 2 years.

LMAO.....Please tell me you don't really believe that.

Of course he does. Leftists and Liberals have no idea how an economy functions. He thinks "free" means "no cost". He's clueless on who actually paid for those oil changes (probably him in the form of a higher vehicle maintenance policy) or in the price he paid to finance his purchase, or the price he paid for the vehicle itself.

Bottom line is his oil changes weren't "free", and the fact he thinks they were tells you all you need to know about his economic literacy.

Are These Fake News? These and many more outlets arrive at the same 38 Mil dollar figure. The National review broadens the contributions to include many arms of the Democratic Party. At 325,000 abortions annually, I couldn't do the math on tax dollars (500 Mil) per abortion, even taking into account the minutia of other services, without feeling ill. Are political contributions even allowed by nonprofits?LOL! Hillary's biggest contributors for the 2016 election were:

Paloma Partners $21 Million

Priztger Group $16 Million

Renaissance Technologies $14 Million

Saban Capital Group $12 Million

Newsweb Corp $11 Million

Soros Capital $10 Million

I could not find Planned Parenthood on the donation list if they did anything they were WAY below $1 Million which is where the list started.

As a side note overturn Citizen's United and it will fix part of this problem. Corporations ARE NOT people contrary to the late Anton Scalia's idiot belief.

http://usherald.com/planned-parenthood-dropped-massive-38-million-hillarys-losing-campaign/

http://dailysignal.com/2016/11/03/planned-parenthood-arms-spend-over-38-million-to-elect-democrats/

http://www.lifenews.com/2016/11/15/...-million-on-hillary-clintons-losing-campaign/

http://www.nationalreview.com/article/446801/hillary-clinton-planned-parenthoods-appalling-champion

The bottom line is there are many choices among insurers to buy the exact coverage homeowner's need, and competition drives those prices down while maintaining quality policies at affordable prices despite the mandates to protect lien holders in most cases.

LMAO tell that to State Regulators in here in Florida the Insurance companies piss and moan for f*cking increases EVERY damn year! There is true competition in only a handful of goods and services. If you just accept the fact that Big Insurance, Big Pharma, Big Oil, Big Banks and Wall Street run this country and control the bulk of the 535 Idiots in DC then you'll know it is all a charade. It is the same in every state on a smaller scale. Take the money OUT of Politics and term limits for ALL is the first step to right the ship. The argument about social issues is just a distraction propagated by those in charge to keep us from fighting the real fight.

Are These Fake News? These and many more outlets arrive at the same 38 Mil dollar figure. The National review broadens the contributions to include many arms of the Democratic Party. At 325,000 abortions annually, I couldn't do the math on tax dollars (500 Mil) per abortion, even taking into account the minutia of other services, without feeling ill. Are political contributions even allowed by nonprofits?

http://usherald.com/planned-parenthood-dropped-massive-38-million-hillarys-losing-campaign/

http://dailysignal.com/2016/11/03/planned-parenthood-arms-spend-over-38-million-to-elect-democrats/

http://www.lifenews.com/2016/11/15/...-million-on-hillary-clintons-losing-campaign/

http://www.nationalreview.com/article/446801/hillary-clinton-planned-parenthoods-appalling-champion

Obviously you are one of those right win nuts like I see standing on the sidewalk in front of high schools holding Abortion pictures on signs trying to scare the kids.This will be my last response to you and the other mouth breathers here you live your ******* life and I'll live mine and stay the **** out of my business and I'll stay the **** out of yours. Capish?

Obviously you are one of those right win nuts like I see standing on the sidewalk in front of high schools holding Abortion pictures on signs trying to scare the kids.This will be my last response to you and the other mouth breathers here you live your ****ing life and I'll live mine and stay the **** out of my business and I'll stay the **** out of yours. Capish?

Then stop demanding people who make more than you give you and the Left their hard earned money to fund your desires of social welfare.

Pay for your own compassion, live your life as you wish and leave what others choose to do with their money up to them.

You're making my arguments for getting Government out of free markets.LMAO tell that to State Regulators in here in Florida the Insurance companies piss and moan for f*cking increases EVERY damn year! There is true competition in only a handful of goods and services. If you just accept the fact that Big Insurance, Big Pharma, Big Oil, Big Banks and Wall Street run this country and control the bulk of the 535 Idiots in DC then you'll know it is all a charade. It is the same in every state on a smaller scale. Take the money OUT of Politics and term limits for ALL is the first step to right the ship. The argument about social issues is just a distraction propagated by those in charge to keep us from fighting the real fight.

I'll say anything I want. Do you understand, Adolph?Obviously you are one of those right win nuts like I see standing on the sidewalk in front of high schools holding Abortion pictures on signs trying to scare the kids.This will be my last response to you and the other mouth breathers here you live your ****ing life and I'll live mine and stay the **** out of my business and I'll stay the **** out of yours. Capish?

Agreed....Take the money OUT of Politics .

Barack Obama has agreed to a $400,000 fee for speaking to a prominent Wall Street firm.

Hillary Clinton received over $200,000 apiece for each of her speaking engagements at Goldman Sachs.

I posted some articles in rebuttal to your rebuttal. You didn't refute the articles, but instead said I stand in front of High Schools with signs. I have never done such a thing. Do you think you are too good to have civil discourse? Too smart? Too enlightened? Perhaps you would consider sharing your glowing brilliance with this mouth breather.Obviously you are one of those right win nuts like I see standing on the sidewalk in front of high schools holding Abortion pictures on signs trying to scare the kids.This will be my last response to you and the other mouth breathers here you live your ****ing life and I'll live mine and stay the **** out of my business and I'll stay the **** out of yours. Capish?

I bet he stands in front of High Schools wearing his pink "*****" hat.I posted some articles in rebuttal to your rebuttal. You didn't refute the articles, but instead said I stand in front of High Schools with signs. I have never done such a thing. Do you think you are too good to have civil discourse? Too smart? Too enlightened? Perhaps you would consider sharing your glowing brilliance with this mouth breather.

That's right up there with, "They lost money on the car. I practically stole it!"LMAO.....Please tell me you don't really believe that.

People really are stupid my friend.LMAO.....Please tell me you don't really believe that.

I bet you got your *** kicked a lot.Obviously you are one of those right win nuts like I see standing on the sidewalk in front of high schools holding Abortion pictures on signs trying to scare the kids.This will be my last response to you and the other mouth breathers here you live your ****ing life and I'll live mine and stay the **** out of my business and I'll stay the **** out of yours. Capish?

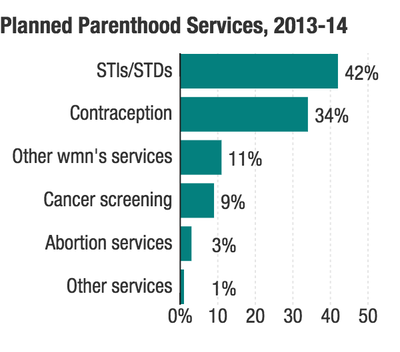

So Bulya why did you quote these statistics without naming a source and just a few posts before this say you accept nothing posted on the internet much less this message board? I previously asked you a specific question about the number of times Planned Parenthood recommends keeping unwanted children vs recommendations for termination of unwanted pregnancies?I was wrong it is 3% for abortion services not 1%. I made this up myself so you know it is accurate.

This doesn't even begin to answer that specific question I asked you.

It's OK if you don't want to answer that question, but there is an answer and it's almost NEVER.

Now, if you want to debate on whether the majority of their activity is providing abortions or simply "women's health care" fine.

Let's provide credible statistics proving abortions are only a small portion of their services. That chart you posted can't be factual because the radical protests to keep Federal funding of their activity are almost never about keeping access to STD treatments, or contraception services, or Cancer screenings.

It's almost always about "protecting a Woman's right to choose" which as I've mentioned in most cases means the choice to kill her unwanted child by terminating the unwanted pregnancy.

Here, read for yourself: (this article is from the New York post refuting the phony 3% abortion claim)

http://nypost.com/2015/08/03/planned-parenthoods-pathetic-3-percent-lie/

Obviously you are one of those right win nuts like I see standing on the sidewalk in front of high schools holding Abortion pictures on signs trying to scare the kids.This will be my last response to you and the other mouth breathers here you live your ****ing life and I'll live mine and stay the **** out of my business and I'll stay the **** out of yours. Capish?

Bulya, you stated earlier in this thread that abortion services account for only 1-3% of Planned Parenthood's overall service portfolio.

Now if you remember, Trump actually proposed to restore virtually 100% of the funding he was proposing to cut (this was before the current budget CR) in exchange for them eliminating just their abortion services funding.

They refused.

Now why would they give up 100% funding for all of those other wonderful "health services" they provide for Women, just to keep funding for only 3% of the services they offer?

Seems to me if Federal funding for most of what they do is as important as they claim, giving up just a small percentage of what they do is an easy trade off to maintain 97% funding for the rest of what they claim it is they actually do.

Explain?

Last edited:

Show some common sense for once.

You've been asked to respond to several questions in this thread which you so far have failed to do.

If you're so replete with common sense, why don't you answer questions when you are asked to explain yours? (common sense)

Man I think Trump grabbed everyone of his apologists on here by the *****!

Usually those most fixated on something never experience it.