EU trade deal

- Thread starter baltimorened

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Has this been announced from the EU side? (Genuinely asking)Devil is in the details, but US and EU have agreed to a trade deal. Good for all of us.

The details show that US consumers will now pay a 15% tax on products imported from EU, up from the traditional average of about 2.5%. On the other hand, opening their markets to our energy and weapons systems was a positive, credit where due.Devil is in the details, but US and EU have agreed to a trade deal. Good for all of us.

That is factually incorrect.The details show that US consumers will now pay a 15% tax on products imported from EU, up from the traditional average of about 2.5%. On the other hand, opening their markets to our energy and weapons systems was a positive, credit where due.

The 15% is a tariff on EU goods at the port of entry, not a direct tax levied on Americans.

The laughing emoji... the go-to response when you don’t understand basic economics but still want to signal your allegiance to leftist talking points. When facts get too inconvenient, just slap on an emoji and pretend it’s a mic drop.

If something that was previously sold for $100 is likely to now cost $115, is there a significant difference? Other than semantics?That is factually incorrect.

The 15% is a tariff on EU goods at the port of entry, not a direct tax levied on Americans.

Yes, there’s a significant difference. A tariff is placed on importers, not U.S. consumers. Whether the full cost gets passed on depends on market factors... competition, supplier margins, demand elasticity. It’s not semantics... it’s Econ 101. Tariffs can raise prices, but they don’t automatically do so across the board.If something that was previously sold for $100 is likely to now cost $115, is there a significant difference? Other than semantics?

Last edited:

Who pays for the tariffs, the foreign sellers, or the buyer of foreign goods when they come into the country?Yes, there’s a significant difference. A tariff is placed on foreign sellers, not U.S. consumers. Whether the full cost gets passed on depends on market factors... competition, supplier margins, demand elasticity. It’s not semantics... it’s Econ 101. Tariffs can raise prices, but they don’t automatically do so across the board.

Devil is in the details, but US and EU have agreed to a trade deal. Good for all of us.

Trump is the Man

OK barking ranting hyenas

Start your mouthy engines and do the full TDS

If you watch Fox it was announced with the EU negotiator sitting by TrumpHas this been announced from the EU side? (Genuinely asking)

I apolgize, I mispoke... doing multiple things at once. Tariffs are paid by the importer... usually a U.S. business... not the foreign seller. That cost can be passed on to U.S. consumers through higher prices, but it’s not automatic. It depends on the product, competition, and supply chain.Who pays for the tariffs, the foreign sellers, or the buyer of foreign goods when they come into the country?

The details show that US consumers will now pay a 15% tax on products imported from EU, up from the traditional average of about 2.5%. On the other hand, opening their markets to our energy and weapons systems was a positive, credit where due.

I ask myself every day why are you on TI with mere mortals such as me when you need to be on Mt Olympus as there is NOT A SINGLE SUBJECT YOU ARE LACKING IN PROVIDING THE BEST AND WISEST ANSWER

YOUR GENIUS HAS NO LIMITS

CARRY ON DA VINCI

Thank you, really wasn’t sure as other deals were announced that ended up not being done. Glad it’s done.Trump is the Man

OK barking ranting hyenas

Start your mouthy engines and do the full TDS

If you watch Fox it was announced with the EU negotiator sitting by Trump

Right, there is certainly a chance the foreign sellers lower their prices to keep their business as well. There is definitely nuance, but saying it is essentially a tax that the American people pay is also not a wild statement. Either the price is paid by the consumer, the price is paid by the US soil importer, or the foreign sellers lower their chooses to absorb some of the cost.I apolgize, I mispoke... doing multiple things at once. Tariffs are paid by the importer... usually a U.S. business... not the foreign seller. That cost can be passed on to U.S. consumers through higher prices, but it’s not automatic. It depends on the product, competition, and supply chain.

It’s not a “wild statement,” but it’s also not factually correct. And let’s be honest… the person who posted the comment was being intellectually dishonest on purpose.Right, there is certainly a chance the foreign sellers lower their prices to keep their business as well. There is definitely nuance, but saying it is essentially a tax that the American people pay is also not a wild statement. Either the price is paid by the consumer, the price is paid by the US soil importer, or the foreign sellers lower their chooses to absorb some of the cost.

Thank you, really wasn’t sure as other deals were announced that ended up not being done. Glad it’s done.

Watching a Fox News rerun right now

All the 27 countries have to sign on

The lady was authorized to make the deal

There will be some adjustments but pretty much the mother of all trade deals UNTIL

CANADA MEXICO CHINA make their deals

particularly Canada with hydrocarbons

I mean, it’s the politics board of a football message board, so it’s going to have hyperbole. There a lot more statements much farther from correct than that. But correct it isn’t a direct tax on the peopleIt’s not a “wild statement,” but it’s also not factually correct. And let’s be honest… the person who posted the comment was being intellectually dishonest on purpose.

Saying tariffs tax the people is definitely functionally true however. The US makes money and prices are raised (like you noted, not necessarily 100% one for one). I think the argument for tariffs has to lean on hoping it encourages companies to purchase from onshore providers of the products. (I actually support tariffs in the case of national security).

What always worries me is that say two products are sold here. One cost 95 from a foreign source, one is 100 from US. What I would expect to happen is if tariffs raise the price of the foreign to 115, I’d expect the US one to raise their price to 107.5 or something. Because they can do so and still beat their competitor on price.

yes by the head of the EU..sitting right next to Trump during a what I think was a press conferenceHas this been announced from the EU side? (Genuinely asking)

genuine question, were there tariffs before?If something that was previously sold for $100 is likely to now cost $115, is there a significant difference? Other than semantics?

Had already been answered but thank you as well.yes by the head of the EU..sitting right next to Trump during a what I think was a press conference

In what context is this question being asked?genuine question, were there tariffs before?

what's been happening is seemingly sellers eating part of the cost, and importers paying part. So far there hasn't been a significant increase other than in auto parts.Who pays for the tariffs, the foreign sellers, or the buyer of foreign goods when they come into the country?

well agreed tariff now is 15%...if they were 10% before, we only have a 5% increase: 15% before, then no change.In what context is this question being asked?

No doubt that has happened some. I think the volatility of the tariffs actually helps with that in the short term (try to eat the costs in the short term, hoping the tariffs are lowered or paused again prior to permanently raising prices of your products). But they have raised prices on some good just like they did during the China trade war in his first term.what's been happening is seemingly sellers eating part of the cost, and importers paying part. So far there hasn't been a significant increase other than in auto parts.

I honestly don’t know enough to say this confidently, but my understanding was there wasn’t any across the board tariff previously, so 0%. But I think I may have seen someone say an average tariff of 2.45% but can’t remember the exact parameters that was about tbhwell agreed tariff now is 15%...if they were 10% before, we only have a 5% increase: 15% before, then no change.

So as long as the benevolent businesses eat a 15% increase in cost then the best case scenario is that the cost of imported goods from the EU stays the same?I apolgize, I mispoke... doing multiple things at once. Tariffs are paid by the importer... usually a U.S. business... not the foreign seller. That cost can be passed on to U.S. consumers through higher prices, but it’s not automatic. It depends on the product, competition, and supply chain.

The ability for Trump supporters to convince themselves that tariffs don’t raise prices is crazy

You might be thinking about my post at the top of this thread. I researched it before I gave that percentage but after looking it up again, I came up with an even lower number.I honestly don’t know enough to say this confidently, but my understanding was there wasn’t any across the board tariff previously, so 0%. But I think I may have seen someone say an average tariff of 2.45% but can’t remember the exact parameters that was about tbh

"Before the trade war, the average US tariff rate on imports from the EU was 1.47 percent, while on EU imports from the US it was 1.35 percent. Based on 2023 trade volumes, full implementation of Trump’s tariffs (Figure 1) would raise the average tariff rate on imports from the EU to 15.2 percent."

The economic impact of Trump’s tariffs on Europe: an initial assessment

It is likely that Trump’s tariffs will be a limited hit to Europe, though some regions and industries could suffer and may need protective measures

Last edited:

I'm not taking a position one way or another.... what you said makes logical sense, and I would think the same thing. But so far the data is not showing that. In one recent month (can't remember if it was may, June, July) the opposite happened - prices on domestic goods increased more than on imported ones.So as long as the benevolent businesses eat a 15% increase in cost then the best case scenario is that the cost of imported goods from the EU stays the same?

The ability for Trump supporters to convince themselves that tariffs don’t raise prices is crazy

IMO, it's too soon to see what will actually happen with these tariffs. It appears as if Trump is getting some good deals in selling US goods abroad, and getting investments in the US. But, he's still keeping tariffs. So, from my perspective, those who say prices will increase may be just as wrong as those who say they won't.

Economists have been a little befuddled as well. Most thought same as you - prices will go up. They're reconsidering now and still trying to figure out what they haven't.. Interersting times.

Yes, there’s a significant difference. A tariff is placed on importers, not U.S. consumers. Whether the full cost gets passed on depends on market factors... competition, supplier margins, demand elasticity. It’s not semantics... it’s Econ 101. Tariffs can raise prices, but they don’t automatically do so across the board.

Tariffs on U.S. imports tend to make those imports more expensive for the ultimate consumers (American consumers). That is just a fact. Yes, sometime the cost of the tariff is not passed on in the form of higher prices, but if IS passed on more often than not. Trump's efforts to jawbone American firms that import products into eating the cost of his tariffs is just hilarious. Kind of like him denying that he ever knew Jeff Epstein. It's not gonna work.I apolgize, I mispoke... doing multiple things at once. Tariffs are paid by the importer... usually a U.S. business... not the foreign seller. That cost can be passed on to U.S. consumers through higher prices, but it’s not automatic. It depends on the product, competition, and supply chain.

I don't know about this because it seems they have determined why they haven't gone up as much as expected - it's due to businesses front-loading their inventory in anticipation of increased costs before tariffs were implemented. This allowed businesses to manage rising prices by utilizing existing inventories bought at lower, pre-tariff costs, though this strategy only postpones, rather than eliminates, the eventual impact of tariffs.Economists have been a little befuddled as well. Most thought same as you - prices will go up. They're reconsidering now and still trying to figure out what they haven't.. Interersting times.

yea, from what I read, they considered that aspect in their discussions. We've got a ways to go before we know absolutely what the impact of these tariffs will be. That's why I avoid definitive statements, because with some saying costs will go up and others saying they will not, one of them has to be wrong.I don't know about this because it seems they have determined why they haven't gone up as much as expected - it's due to businesses front-loading their inventory in anticipation of increased costs before tariffs were implemented. This allowed businesses to manage rising prices by utilizing existing inventories bought at lower, pre-tariff costs, though this strategy only postpones, rather than eliminates, the eventual impact of tariffs.

I take solace in knowing that if Trump is anything, he is flexible. If things go south on inflation because of tariffs, he'll just blame Powell or Schumer (or maybe both) because there's an excellent chance one or both of them will do something dumb that will enable a target to be put on their backs. But, with tariffs, Trump given and Trump can take away. It would be easier to lower tariffs than what it was to generate them (I hope)

President Trump just unlocked one of the biggest economies in the world. The European Union is going to open its 20 Trillion dollar market and completely accept our auto and industrial standards for the first time ever. In addition, it will purchase $750 BILLION in energy from us and invest $600 BILLION in America.

Our Tariff will be set at 15% across the board.

Today is a historic day for U.S. trade and will strengthen our relationship with the European Union for decades to come.

President Trump just unlocked one of the biggest economies in the world. The European Union is going to open its 20 Trillion dollar market and completely accept our auto and industrial standards for the first time ever. In addition, it will purchase $750 BILLION in energy from us and invest $600 BILLION in America.

Our Tariff will be set at 15% across the board.

Today is a historic day for U.S. trade and will strengthen our relationship with the European Union for decades to come.

“The European Union is going to open its 20 Trillion dollar market and completely accept our auto and industrial standards for the first time ever.”

What does that part refer to? Not dogging at all, just legitimately don’t know. Like, what has changed I mean.

Not sure of specifics but it infers they had some obstacles in place for protection of EU manufacturers. They like to do VAT taxes and other stuff over there.“The European Union is going to open its 20 Trillion dollar market and completely accept our auto and industrial standards for the first time ever.”

What does that part refer to? Not dogging at all, just legitimately don’t know. Like, what has changed I mean.

Please show proof that DJT has denied knowing Epstein. Keep on with the narratives though. You aren't going to like the outcome.Tariffs on U.S. imports tend to make those imports more expensive for the ultimate consumers (American consumers). That is just a fact. Yes, sometime the cost of the tariff is not passed on in the form of higher prices, but if IS passed on more often than not. Trump's efforts to jawbone American firms that import products into eating the cost of his tariffs is just hilarious. Kind of like him denying that he ever knew Jeff Epstein. It's not gonna work.

BOOM!!!

BREAKING: Some Europeans are currently FUMING over the European Union deal with President Trump.

BREAKING: Some Europeans are currently FUMING over the European Union deal with President Trump.

"Not one concession from the American side," said the former PM of Belgium, Guy Verhofstadt. "The EU - US deal is scandalous… a disaster."

THAT'S WHAT I LIKE TO HEAR!

Trump: "The EU is going to purchase from the US $750 BILLION worth of energy...Agree to invest $600 billion. Agree to open up their countries at zero tariff. They are agreeing to purchase a vast amount of military equipment. We are agreeing that the tariff straight across for automobiles and everything else will be a straight across tariff of 15%."

Reporters in the room at the time of the deal were shocked too. One asked: "WHAT are the US concessions? WHAT is the US giving up in the deal, if ANYTHING?

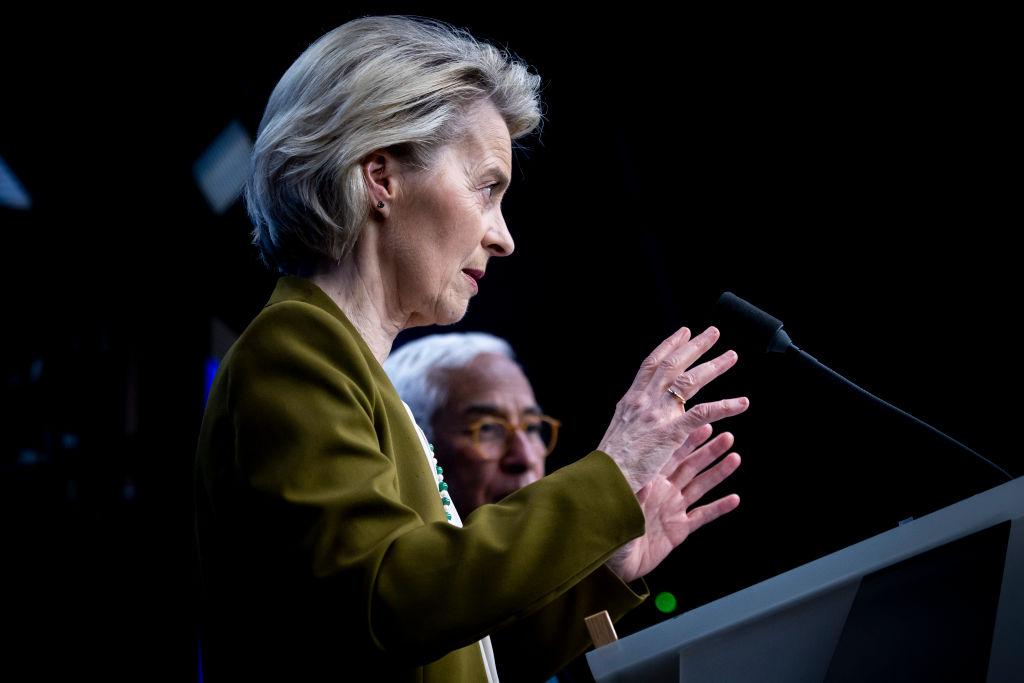

The President of the European Commission - who Trump made the deal with - replied that the entire goal was to resolve the imbalance with America - *precisely* what Trump said was the problem.

It's pretty nice to have a master negotiator in charge.

"Not one concession from the American side," said the former PM of Belgium, Guy Verhofstadt. "The EU - US deal is scandalous… a disaster."

THAT'S WHAT I LIKE TO HEAR!

Trump: "The EU is going to purchase from the US $750 BILLION worth of energy...Agree to invest $600 billion. Agree to open up their countries at zero tariff. They are agreeing to purchase a vast amount of military equipment. We are agreeing that the tariff straight across for automobiles and everything else will be a straight across tariff of 15%."

Reporters in the room at the time of the deal were shocked too. One asked: "WHAT are the US concessions? WHAT is the US giving up in the deal, if ANYTHING?

The President of the European Commission - who Trump made the deal with - replied that the entire goal was to resolve the imbalance with America - *precisely* what Trump said was the problem.

It's pretty nice to have a master negotiator in charge.

not sure it's accurate at "every penny", but it's pretty likely that some part will be.

Thanks @Weapon_X for the intellectual post. The rest of the roaches came out when the lights turned off.

Glad to the see GREAT USA start to become a world leader again!!

Glad to the see GREAT USA start to become a world leader again!!

Please show proof that DJT has denied knowing Epstein. Keep on with the narratives though. You aren't going to like the outcome.

I am thoroughly confused

DJT admitted knowing Epstein decades ago and was photographed with him

Epstein was at Trump parties years ago