Truly an exciting day! Been waiting for this since Oct 2022. These opportunities don't come around too often. Buy, buy, buy.I have some buy orders in. Good thing I have cash on the sideline. Feels like I missed my chance on fixed income.

OT: Stock and Investment Thread

- Thread starter RU05

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Actually, buy low and sell high is the wrong mindset, since the market goes up 77% of the time. Most money is made via buy high and sell higher. Tons of TA data proves this.For me, it's harder to find opportunities when everything is going up. I don't tend to jump on momentum. It's against my psychology which distills down to the most basic "buy low sell high" mantra. There are more potential opportunities when things are coming down but you have to have cash on the sideline as you mentioned. I always do whether the market is going to the moon or sinking to the Titanic. Having it is my psychological safety net.

This is a good point too which I didn't think about. Wonder how much leverage is used in the carry trade as well.

From the article:

“August volatility spikes can be very dangerous because liquidity tends to be low in the month,” he added. “August is a popular vacation time in North America and Europe, so even if things start to stabilize, I’m not sure investors are going to be keen to put on trades quickly.”

That will never be me in my own trading especially as it relates to buying single stocks.Actually, buy low and sell high is the wrong mindset, since the market goes up 77% of the time. Most money is made via buy high and sell higher. Tons of TA data proves this.

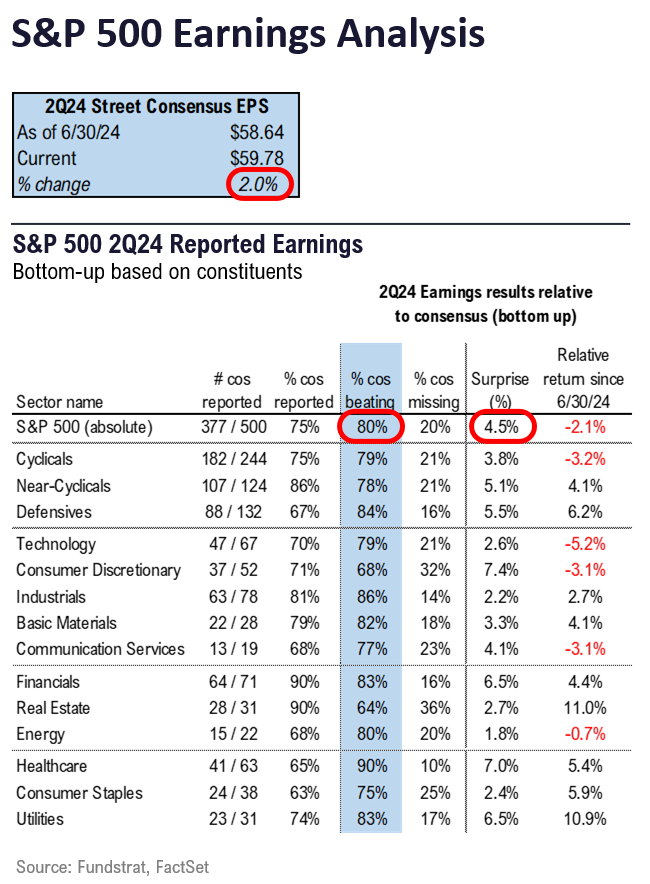

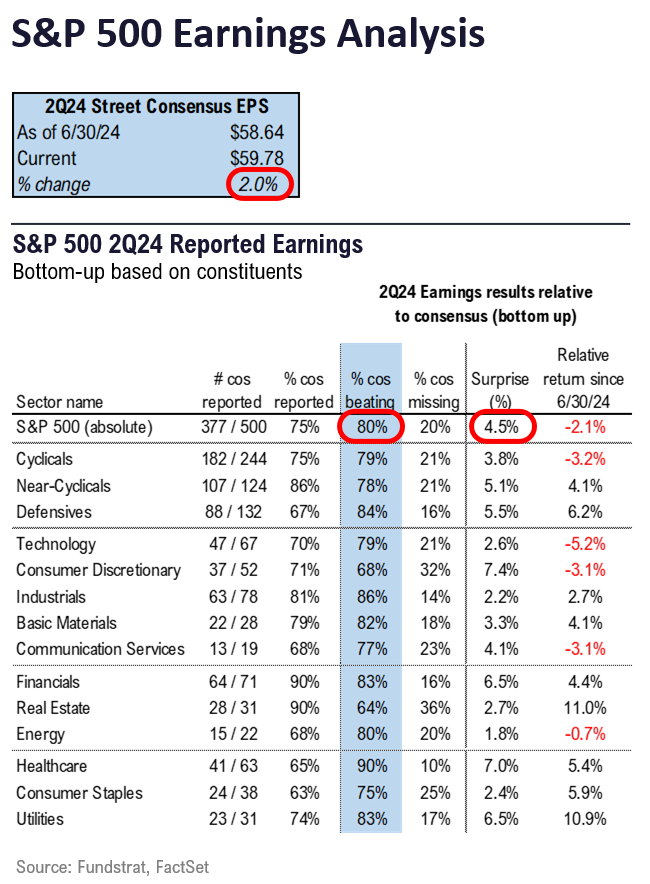

Outstanding earnings season so far (S&P 500):

- Of the 377 companies that have reported so far (75% of the S&P 500):

- Overall, 80% are beating estimates, and those that “beat” are beating by a median of 6%.

- Of the 20% missing, those are missing by a median of -5%.

- On the top line, overall results are beating estimates by a median of 6% and missing by a median of -4%, and 58% of those reporting are beating estimates.

It's good to know what you are comfortable with, but obviously, the data speaks for itself. Regardless, I do admit to getting excited at buying when the market is artificially down.That will never be me in my own trading especially as it relates to buying single stocks.

Strong statement by Goolsbee, first of many Fed speakers this week:

Chicago Fed President Goolsbee says if economy deteriorates, Fed will ‘fix it’

Chicago Fed President Goolsbee says if economy deteriorates, Fed will ‘fix it’

GE broke through a long term 160 resistance much easier than expected a while back. It's been stubbornly holding that level too since. Looks like it will finally break below that support with this downturn. A move into the 140s, maybe even 130s would interest me to dip back in a little.

MSFT looks like it's just about at the 200DMA....actually broke below it at the open. NVDA, GOOGL and META not too far away from their 200DMAs.

Just like the other green to mixed in the staples and utilities at the open.

MSFT looks like it's just about at the 200DMA....actually broke below it at the open. NVDA, GOOGL and META not too far away from their 200DMAs.

Just like the other green to mixed in the staples and utilities at the open.

lol you spend so much time posting and barley working. Penny stocks is what you mean in Buy, Buy, Buy lol. Only on this site can the underemployed be so rich $$$$$ you big dummy when your here multiple hours a day you can’t possibly be be balling $$$. That only works in the World Wide Web where no receipts need to be shown. Ask Cali and Bac to the drawing board.Truly an exciting day! Been waiting for this since Oct 2022. These opportunities don't come around too often. Buy, buy, buy.

Last edited:

I'm eyeing NVDA calls. for a home run play. All signs point to a massive earnings report, but that is 3 weeks away. META capex, AMD, TSM, etc.GE broke through a long term 160 resistance much easier than expected a while back. It's been stubbornly holding that level too since. Looks like it will finally break below that support with this downturn. A move into the 140s, maybe even 130s would interest me to dip back in a little.

MSFT looks like it's just about at the 200DMA....actually broke below it at the open. NVDA, GOOGL and META not too far away from their 200DMAs.

Just like the other green to mixed in the staples and utilities at the open.

Would love to pick-up some GE and add to my GEV position. Let's see how the morning develops!

Because 50+ million Americans own it and find value with it, especially BTC. Any other questions?Why do we need crypto again?

WMT only 3-4% off its highs despite this recent downturn. It's retail but essentially a staple. Was there this past weekend for the first time in a long time because they had something I couldn't find elsewhere. It was a weekend but man it was crazy busy, even more than I expected.

The US economy is doing quite well, including the consumer. WMT, COST, and others are the backbone of many families. As I mentioned above, the earnings season has been great so far.WMT only 3-4% off its highs despite this recent downturn. It's retail but essentially a staple. Was there this past weekend for the first time in a long time because they had something I couldn't find elsewhere. It was a weekend but man it was crazy busy, even more than I expected.

I've had issues as well, although ToS has been working fine.

I bought some stuff this morning. Zeta,fbtc nvda and some others and im still in the red, but there were some crazy trades to be had.

Ton of **** was down double digits, some of which are now in the green

Ton of **** was down double digits, some of which are now in the green

Interesting. Any idea how SVIX works? Probably a good play!Just bought some svix. See how that plays out.

Bought more BTC and ETH early this morning. Added to FS Insights stock list at opening which covers most big names. Need to see which individual stocks I can buy or add to.I bought some stuff this morning. Zeta,fbtc nvda and some others and im still in the red, but there were some crazy trades to be had.

Ton of **** was down double digits, some of which are now in the green

It will be very interesting to see the BTC ETF flow report today.Bought more BTC and ETH early this morning. Added to FS Insights stock list at opening which covers most big names. Need to see which individual stocks I can buy or add to.

Not really. Down 30% today though.Interesting. Any idea how SVIX works? Probably a good play!

Up and to the right in general.

Maybe have to pay some fees?

Only thing you got this morning was a coffee and a roll. Your BS can be seen from how you conduct yourself.Bought more BTC and ETH early this morning. Added to FS Insights stock list at opening which covers most big names. Need to see which individual stocks I can buy or add to.

Absolutely, the crypto market turned around right at market open, so it may be positive.It will be very interesting to see the BTC ETF flow report today.

I'll check it out. Maybe they have options for SVIX? LOL. Special 2pm webinar with TL and team. He's standing firm and saying the rebound can be extreme since it won't take much for the market to realize there is no recession coming and the Fed can cut a ton.Not really. Down 30% today though.

Up and to the right in general.

Maybe have to pay some fees?

So 50+mm people have FOMO. Got it.Because 50+ million Americans own it and find value with it, especially BTC. Any other questions?

Most of those have been holding BTC for years and years. Isn't FOMO a short-term trade?So 50+mm people have FOMO. Got it.

Truly an exciting day! Been waiting for this since Oct 2022. These opportunities don't come around too often. Buy, buy, buy.

You said two weeks ago that you were close to 100% equities. Now it’s an exciting day.

That is correct. I don't own bonds except for that one mutual fund. Always exciting to add to positions at temporary discounts.You said two weeks ago that you were close to 100% equities. Now it’s an exciting day.

Just bought some svix. See how that plays out.

Shorting the Vix … what could go wrong?

So what did you add, and at what price?That is correct. I don't own bonds except for that one mutual fund. Always exciting to add to positions at temporary discounts.

See above for some highlights. Maybe more around close or after hours.So what did you add, and at what price?

He is full of ****. He post like 70% of all the messages in this thread and it’s 764 pages long. This guy never loses market goes up he wins market goes down he wins too. Successful people do not have the time to be posting hourly multiple times. They are busy working and being successful. He is another Cali and Bac. I can’t wait to go back to work tomorrow. Time off can be a curse too lol. You see things that are BS too much.You said two weeks ago that you were close to 100% equities. Now it’s an exciting day.

Very long way to go with this case. Also, they rarely have much impact on the company.

Got hit on limit orders this morning. 400 NVDA @ 98.00 and 200 QQQ @ 430.

Was wondering if NVDA might approach closer to the 200DMA in the mid 80s area or even possibly pierce it.. Went as low as 90 this morning but no 8 handle. It's about 30% off its highs now but mid 80s would put it at 40%. I think it went down as much as 67% during the tech crash a few years ago.Got hit on limit orders this morning. 400 NVDA @ 98.00 and 200 QQQ @ 430.

I think they should be okay with the Blackwell delay and I still like the company.

Another note:

AMD only green on my tech watchlist. Not sure why.