OT: Stock and Investment Thread

- Thread starter RU05

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Besides BTC and ETH, I'm holding SOL and a few other Solana plays (which are taking a dip probably due to XRP's pump).XRP carrying my crypto account this last week.

Finally!

Intel CEO steps down as chipmaker falters, lays off staff

Intel CEO steps down as chipmaker falters, lays off staff

Looks like it's trying to break through that 24-25 and change area I mentioned is resistance. Very good news. Of course who the replacement is important but the first step is recognizing part of the problem. Jensen and Lisa have any more relatives? lolFinally!

Intel CEO steps down as chipmaker falters, lays off staff

Jensen Huang Jr? Intel would be at $50 in a week! I'm still holding this POS so I'm hoping this is the start of a rally.Looks like it's trying to break through that 24-25 and change area I mentioned is resistance. Very good news. Of course who the replacement is important but the first step is recognizing part of the problem. Jensen and Lisa have any more relatives? lol

It’s still bottoming (that’s not usually a V but a process) in my opinion and has a ways to go to come out of it. I mentioned awhile back that 19-20 and change area looked like a good spot to possibly step in and it’s held that area and bounced to this current resistance. I couldn’t say that it will break this area convincingly any time soon but the news is hopeful at least. The replacement and the roadmap are the next key pieces that need to be defined to move meaningfully higher.Jensen Huang Jr? Intel would be at $50 in a week! I'm still holding this POS so I'm hoping this is the start of a rally.

This was always going to be a slog similar to GE in some ways. That at least had a jewel, now 2 with the surprising rise of Vernova…INTC has solid pieces and is in the guts of enterprise on some level but nothing of the quality of aerospace at GE so still TBD.

I got in during the last big dip, so $25-26 (IIRC). And then round tripped the last rally. It does have valuable parts. I listened to a podcast with a chip expert and his thoughts on INTC were very interesting. Tale as old as time.....why invest in new tech (GPUs) that would eat your cash cow (CPUs)? Oops.It’s still bottoming (that’s not usually a V but a process) in my opinion and has a ways to go to come out of it. I mentioned awhile back that 19-20 and change area looked like a good spot to possibly step in and it’s held that area and bounced to this current resistance. I couldn’t say that it will break this area convincingly any time soon but the news is hopeful at least. The replacement and the roadmap are the next key pieces that need to be defined to move meaningfully higher.

This was always going to be a slog similar to GE in some ways. That at least had a jewel, now 2 with the surprising rise of Vernova…INTC has solid pieces and is in the guts of enterprise on some level but nothing of the quality of aerospace at GE so still TBD.

It was all about what NVDA was doing vs INTC. I will try to find it again.

Sold half my shares of DEFTF at 2.75. Nice profit with a cost basis of .87. I'd buy back in if it dips significantly.

And my account balances!ATHs for the S&P 500 and Nasdaq.

And that's what matters most! Mo Money, Less Problems.And my account balances!

Sounds like yes.....but still pending Friday's jobs report and CPI next week.Another nice day. Is interest rate going to be lowered again in December?

People on inside know Gelsinger wasn't the problem - Intel was hung to dry . Intel's problem was that their hardware was stuck in a rut while AMD, Apple and TSMC made some innovative and popular hardware. Intel - owned the enterprise market - got big and lazy (and corrupt some will say). As things slid, the marketing/finance people took the wheel - almost always a bad sign. Intel tried selling sizzle instead of steak. They couldn't make chips smaller/faster/cooler but tried to look faster while being hot and power hungry (deadly in enterprise server farms)

The chips act was meant to help Intel make chips in US. However DC made so many DEI hoops to jump through Intel couldn't keep going fast enough and gov held money back. TSMC tried setting-up in US and was also suffocated. Knowing how many people in DC are on the take (CCP) I'm not even sure they wanted chip success. Now Intel has a (temp?) girl boss from marketing and finance. Same old path to sizzle but it wont work now.

“We are disappointed by how long and how slow the dispensing of funds has been,” said Gelsinger in an interview with Bloomberg.

Intel CEO Expresses Disappointment as Delays Persist

Intel’s CHIPS Act grant reduced as production delays and losses mount

This is the meat of the problem:

"Commentators have noted that CHIPS and Science Act money has been sluggish. What they haven’t noticed is that it’s because the CHIPS Act is so loaded with DEI pork that it can’t move...Because equity is so critical, the makers of humanity’s most complex technology must rely on local labor and apprentices from all those underrepresented groups, as TSMC discovered to its dismay..."

DEI killed the CHIPS Act

The chips act was meant to help Intel make chips in US. However DC made so many DEI hoops to jump through Intel couldn't keep going fast enough and gov held money back. TSMC tried setting-up in US and was also suffocated. Knowing how many people in DC are on the take (CCP) I'm not even sure they wanted chip success. Now Intel has a (temp?) girl boss from marketing and finance. Same old path to sizzle but it wont work now.

“We are disappointed by how long and how slow the dispensing of funds has been,” said Gelsinger in an interview with Bloomberg.

Intel CEO Expresses Disappointment as Delays Persist

Intel’s CHIPS Act grant reduced as production delays and losses mount

This is the meat of the problem:

"Commentators have noted that CHIPS and Science Act money has been sluggish. What they haven’t noticed is that it’s because the CHIPS Act is so loaded with DEI pork that it can’t move...Because equity is so critical, the makers of humanity’s most complex technology must rely on local labor and apprentices from all those underrepresented groups, as TSMC discovered to its dismay..."

DEI killed the CHIPS Act

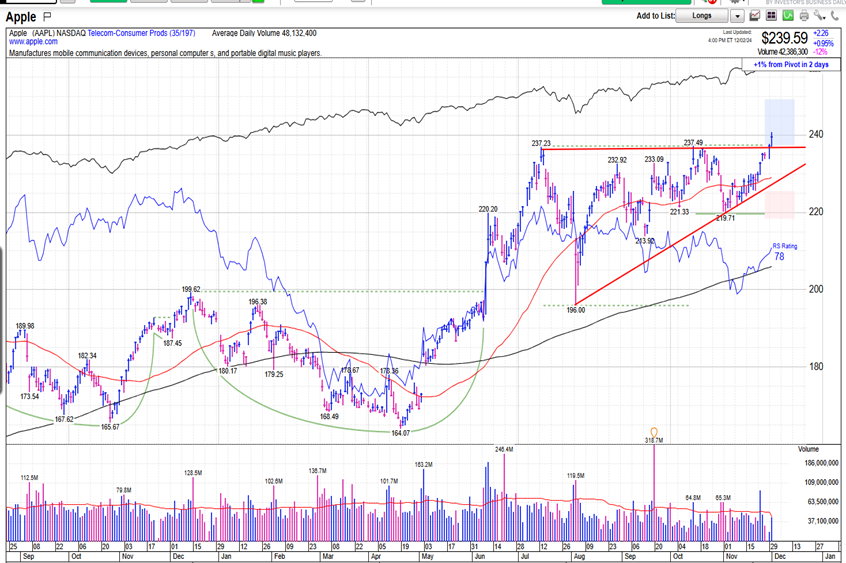

I don’t get the recent Apple move based on what seems like an AI flop (at least for now) although I’m guessing funds rebalancing helps move it higher.

Sold some MSFT yesterday and moved that money to SPOT. Seems to me SPOT has a clear path to domination with less competition than video streaming and just look at what Netflix has done.

Telcoms (VZ, T) in one of my favorite category of stocks (dividend payers) having somewhat of a revival lately.

Historically, massive value traps that provided mediocre total returns. That said, probably holding onto INTC for a GE-style break-up play. Maybe shareholders get lucky.Telcoms (VZ, T) in one of my favorite category of stocks (dividend payers) having somewhat of a revival lately.

SPOT is a great company with a promising future. Would love to see a modest pullback to get in.I don’t get the recent Apple move based on what seems like an AI flop (at least for now) although I’m guessing funds rebalancing helps move it higher.

Sold some MSFT yesterday and moved that money to SPOT. Seems to me SPOT has a clear path to domination with less competition than video streaming and just look at what Netflix has done.

If you like dividends (as I do), check out NHS, a closed end fund with rock solid distributions monthly at a 12-13% for over 20 years. I don't worry about the NAV which has ranged from 6-16 since 2003 since I have no need to sell it.Telcoms (VZ, T) in one of my favorite category of stocks (dividend payers) having somewhat of a revival lately.

I’ve been waiting since $300 but dragged my feet. SPOT and COST were two I needed to buy instead of so much MSFT earlier this year.SPOT is a great company with a promising future. Would love to see a modest pullback to get in.

Been in COST since $710'ish. I bought a mini-pullback but it was still expensive. Happy I did. LOL! Most money is made by buying high and selling higher. Some companies are worth it.I’ve been waiting since $300 but dragged my feet. SPOT and COST were two I needed to buy instead of so much MSFT earlier this year.

It needs to if it wants to get into the Dow. Regardless, a stock price around $1000 is a drag and needs to be adjusted.Any chance COST splits soon?

Telecoms are the only companies in history that sell the equivalent of gold in the palm of your hand - connectivity - yet between regulation and horrible executive leadership they gave away the farm to companies (network parasites) like Apple and Google. Value traps for sure but def worse places to put money.Historically, massive value traps that provided mediocre total returns. That said, probably holding onto INTC for a GE-style break-up play. Maybe shareholders get lucky.

Fedramp authorization meaning USG buys more.Any news on PLTR causing this spike today?

Just tapped out of PLTR (for now). Bought at $18.5 and sold at $71. This small position became very large. Happy to jump back in once it calms down. Thanks to @rurahrah000 for his insights and guidance on the company! I thought about selling a bunch of times during the run up.....happy I didn't until now.Fedramp authorization meaning USG buys more.

CRM = amazing company and a big AI winner over the next few years.CRM up $21 after closing after earning. Another great day.

Why did you sell PLTR?Just tapped out of PLTR (for now). Bought at $18.5 and sold at $71. This small position became very large. Happy to jump back in once it calms down. Thanks to @rurahrah000 for his insights and guidance on the company! I thought about selling a bunch of times during the run up.....happy I didn't until now.

Future will be picking the right AI software companies.CRM = amazing company and a big AI winner over the next few years.

Any thoughts on this?Future will be picking the right AI software companies.

Just the price going too far too fast. Betting on a pullback.Why did you sell PLTR?

17% at the open.Marvell also rocking it after hours! Up 11%. Great day for earnings.

Feel you sold just as it broke through resistance. Up over $3 now.Sold half my shares of DEFTF at 2.75. Nice profit with a cost basis of .87. I'd buy back in if it dips significantly.

Edit: Although I know you are up big in this position and I also wouldn't want an OTC to be too big of a position in my portfolio.

Last edited:

Got a large MRVL position via one of my top growth funds. Great company!17% at the open.