OT: Stock and Investment Thread

- Thread starter RU05

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Interesting person to be speaking up about oil…

He’s not wrong. If a plan isn’t developed, and fast, these sanctions will hurt our economy almost as bad as Russia. Our economy is not geared for 100 buck a barrel oil for more than short shocks. Goldman is forecasting $180 a barrel by year end if no contingency is in place.

Drill baby drill !!!!!!!!!!!!!!!!!!He’s not wrong. If a plan isn’t developed, and fast, these sanctions will hurt our economy almost as bad as Russia. Our economy is not geared for 100 buck a barrel oil for more than short shocks. Goldman is forecasting $180 a barrel by year end if no contingency is in place.

Someone on CNBC said something along the lines of retail traders make up 35% of the trades but 70% of the price action.As a rule of thumb IMO institutional money is what drives things, there may be a rare exception here and there like the meme stocks. If retail and institutions are on opposite sides institutional money is going to rule the day. Easy money helped everyone both institutions and retail. Now with easy money starting to whittle away institutions are selling and retail money isn't enough to "buy the dip" to stem the tide and by and large IMO retail money is never enough with few exceptions.

I say have at it.Is there a thread OT on macro and microeconomic discussion? Want to dig in more on the broader economic effect of sanctions on the global economy and commodity market but don't want to clog up this thread which is more securities trading.

I have a couple euro ev part makers, BWA and APTV, which have certainly taken a hit, my two biggest losers on Friday actually.Haven't had meaningful international exposure in a very long time. And no plans to start now!

But I'm hanging in as I don't think this lasts forever. Fingers crossed, but I think the outcome could be favorable to EU companies.

Last edited:

Here's an article on Bloomberg. It's kind of what I'm saying. Easy money makes it all go up, no stock picking or valuation/fundamental assessments needed and institutions and retail largely on the same side. Now easy money is starting to go away and inflation on the rise and then those things matter again. If the 2 groups are on opposite sides...the institutional wave of money is too much for retail money.Someone on CNBC said something along the lines of retail traders make up 35% of the trades but 70% of the price action.

From the article:

Institutional investors are striking back in stocks, upending the brief and kooky reign of the retail day trader.

So says veteran market-structure analyst Larry Tabb, citing a panoply of evidence including volume on legacy venues like the New York Stock Exchange as well as the quickly swelling value of shares changing hands each day in equities. Data from Morgan Stanley found big-money investment houses bringing increasing pressure to bear on the futures market, while prime brokerage data showed hedge-fund selling drove the selloff in speculative tech at the turn of the year.

The change is both a cause and consequence of big shifts in the market’s volatility backdrop, with concerns about Federal Reserve policy forcing a reordering of institutional portfolios. According to Tabb, it’s a landscape that is likely to prove less and less conducive to the day-trading heroes whose derring-do was a big influence on prices in the post-pandemic era.

“If volatility stays high, retail lags. And if I was to be a betting man, I would be saying volatility will remain high for probably throughout this year,” said Tabb, head of market structure research at Bloomberg Intelligence. “Outside of another meme stock phenomenon, it would seem that institutions are going to wind up driving flows.”

A market driven by these institutions is one where old-school metrics like earnings announcements, valuation and guidance matter more than populist drivers like Reddit postings and name checks on TikTok, Tabb says. For better or worse, when big-money funds rule the roost, companies in bankruptcy proceedings are unlikely to find enthusiastic buyers, as Hertz Global Holdings Inc. did in 2020.

The share of overall trading represented by do-it-yourselfers has come down a lot. After spiking to 24% in the first quarter of 2021, it’s now around 18%, Tabb and other BI analysts estimate. What’s more, a phenomenon where the value of daily trading is rising faster than the absolute number of shares changing hands shows deeper-pocketed investors are dominating flows.

“The diversion is due to a transition to higher-priced securities and likely a result of a slowdown in retail trading participation and a shift to institutional,” BI wrote in a report last month. “Retail investors have historically favored lower-priced securities and active trading in small-cap stocks.”

Not that retail traders aren’t still buying like crazy. They sent a net $41 billion into stocks last month, according to estimates from Morgan Stanley’s trading desk. Increasingly, though, they’re running into worried institutions forced into action by the Fed.

In fact, money managers whose investment decisions are based on macroeconomic and market trends unwound $43 billion of equity positions in January -- enough to offset all the retail inflows, Morgan Stanley data showed.

That’s “emblematic of the institutional pressure on the market,” Morgan Stanley’s Christopher Metli and others wrote in a recent report. “While retail likely contributed to some of the market moves, it’s likely that institutional flows are becoming an even bigger driver.”

To Max Gokhman, the chief investment officer at AlphaTrAI Inc., the retail crowd’s influence has always been exaggerated. “It’s not that they had a magic touch,” he said. “It’s that market dynamics created this amazing market rally and they just greased the wheels a little bit.”

Even though overall retail activity last month was at a 13-month high, the group’s share of total market volume still fell to the lowest level since March 2020, according to Morgan Stanley. That happened as institutions were unwinding holdings fast enough that their selling appeared to have overwhelmed buying from the retail crowd.

Though their optimism remains high, retail traders’ portfolios haven’t been faring well lately. Morgan Stanley estimates based on exchange and public price-feed data showed individual investors have seen their trades losing 12% this year.

“I would expect retail investors to struggle a bit with making the buying decision in the middle of a brutal market, compared to program trading or institutions,” said Mike Bailey, director of research at FBB Capital Partners. “Psychologically, the retail trade likely faces a higher bar for buying the dip, rather than going with the flow and buying on the way up.”

bloomberg.com/news/articles/2022-02-05/adults-back-in-charge-of-stock-market-as-fed-awakens-big-money

Last edited:

For those looking for dividend stock ideas.

Interesting choices in that the charts are so divergent. LMT has been ripping of late(due in part to Ukraine). CC has tanked(I assume also due to Ukraine), while NVT looks like it's at a bit of a crossroads, very solid upward trend since the covid dip, but is it rolling over?

CC brings significant options yield potential as well.

Bloomberg reporting the holistic commodities market saw the biggest one week gain since records started in 1960.

A number of European nations are now putting full export bans on wheat production. I’m struggling to see how this isn’t going to snowball.

Deutsche Bank reporting they will not be able to staff IT infrastructure since 25% of it was Russian and Ukrainian labor. Company now moving into business continuity mode.

A number of European nations are now putting full export bans on wheat production. I’m struggling to see how this isn’t going to snowball.

Deutsche Bank reporting they will not be able to staff IT infrastructure since 25% of it was Russian and Ukrainian labor. Company now moving into business continuity mode.

Short term pain for long term gain. Amazing to see the power of western nations without firing a single shot. The Russian economy is in full collapse. Even if UKR falls, the days of Russia as a power are over. China is taking notes. They are even more dependent on western nations.Bloomberg reporting the holistic commodities market saw the biggest one week gain since records started in 1960.

A number of European nations are now putting full export bans on wheat production. I’m struggling to see how this isn’t going to snowball.

Deutsche Bank reporting they will not be able to staff IT infrastructure since 25% of it was Russian and Ukrainian labor. Company now moving into business continuity mode.

I’m thinking that I just grabbed a few long positions when I bought the dip late last week.Bloomberg reporting the holistic commodities market saw the biggest one week gain since records started in 1960.

A number of European nations are now putting full export bans on wheat production. I’m struggling to see how this isn’t going to snowball.

Deutsche Bank reporting they will not be able to staff IT infrastructure since 25% of it was Russian and Ukrainian labor. Company now moving into business continuity mode.

The thing is there needs to be a contingency plan among the west to weather the short term pain. So far it seems like it’s more “we’re all in together” nonsense. That’s not a contingency plan.Short term pain for long term gain. Amazing to see the power of western nations without firing a single shot. The Russian economy is in full collapse. Even if UKR falls, the days of Russia as a power are over. China is taking notes. They are even more dependent on western nations.

Also have to love how we’re now trying to broker a deal with the Maduro regime. Remember when he was next on the chopping block for regime change?

This…sanctions are great but where is the short and long term game plan?The thing is there needs to be a contingency plan among the west to weather the short term pain. So far it seems like it’s more “we’re all in together” nonsense. That’s not a contingency plan

GSG has done remarkably well of late.Bloomberg reporting the holistic commodities market saw the biggest one week gain since records started in 1960.

A number of European nations are now putting full export bans on wheat production. I’m struggling to see how this isn’t going to snowball.

Deutsche Bank reporting they will not be able to staff IT infrastructure since 25% of it was Russian and Ukrainian labor. Company now moving into business continuity mode.

Yes indeed, up 25% in the last month alone.GSG has done remarkably well of late.

Perfect timing! My equity awards are granted at EOB tomorrow. Locked and loaded on buying this artificial dip. Tomorrow is going to be fun. Can't wait any longer, Goldman is calling the entire market oversold and ready for strong near-term returns.Oil up a big 10% tonight, equity futures not looking good

Shopping list (fun brokerage account):

TQQQ

UPRO

SOXL (starting this position)

Entire E-Trade account (our main brokerage account, so most last week's bonuses will be parked here):

VONE

IWF

IGM

VIG

VTV

SOXX

VO

VB

Also may add to some of our long hold stocks:

FB

GOOGL

MSFT

AMZN

NVDA

Have to analyze some of the others, maybe a few more.

Seems like a lot of Russian aircrafts are being shot down:

Saw a report one of their “top” pilots from the Syria campaign was shot down over Ukraine. Guy must have been toppin’ 250, 275 easy. Guy’s gut would have given out under a high G combat maneuver.Seems like a lot of Russian aircrafts are being shot down:

A lot of propaganda on both sides. Read the story about”the Ghost“. Have to keep the spirit up with some good news.Seems like a lot of Russian aircrafts are being shot down:

Stuff like this and the Russian mercenaries makes me think the reports of high Russian casualties has merit.

Red Six standing by.Saw a report one of their “top” pilots from the Syria campaign was shot down over Ukraine. Guy must have been toppin’ 250, 275 easy. Guy’s gut would have given out under a high G combat maneuver.

Maybe we’ll get lucky and the Russian military will all get COVID.

Stuff like this and the Russian mercenaries makes me think the reports of high Russian casualties has merit.

3.2% growth is wonderful. Strong performance, but definitely not overheated that would require more Fed intervention. Sign me up!

$7.00 per gallon in parts of CA?! Amazes me that oil/gas skyrockets right when the driving season is about to start. If this happened during a COVID lockdown it would not have had such a major impact. I guess I’m glad I bailed on the Ford Raptor with its 15 mpg!

Well, CA does a lot of stupid stuff to gas production and availability, so $7 gas is on them. Buy TSLA!$7.00 per gallon in parts of CA?! Amazes me that oil/gas skyrockets right when the driving season is about to start. If this happened during a COVID lockdown it would not have had such a major impact. I guess I’m glad I bailed on the Ford Raptor with its 15 mpg!

Been buying for the past 30 mins. Finally jumped in SOXL. Deposited 50% of our new bonus cash into E-Trade. Started deploying the new funds across the board. Our allocations are good, so just buying as usual.Brought some AMZN at 2,815 but will trade when it gets over 3,000. Still just waiting for capitulation.

Halftime mentioned Tom Lee (a favorite of some here) thinks stocks are in no man's land and that for now stocks haven't found their footing yet.

I agree. Just one unexpected event and the market goes down another notch. If Tom Lee, Mr. Optimist, is caution, you better be caution.Halftime mentioned Tom Lee (a favorite of some here) thinks stocks are in no man's land and that for now stocks haven't found their footing yet.

The stalwart AAPL is still essentially remaining a stalwart. I've been thinking it's going to roll over sooner or later like the rest but so far nope lol. The other day I heard it's viewed kind of like a staple, which on a level I agree with but it shows much more sturdiness than even staples and the like. Staples are little mixed today but mostly down today but AAPL minimally so for now.I agree. Just one unexpected event and the market goes down another notch. If Tom Lee, Mr. Optimist, is caution, you better be caution.

They say when AAPL rolls over that's when there's a good chance you've got a bottom put in but I'm like when the hell is that suppose to happen haha. The notion makes sense but the relative strength has been quite impressive to date.

Heavy buying today! So much fun. Artificial drops are the best.I agree. Just one unexpected event and the market goes down another notch. If Tom Lee, Mr. Optimist, is caution, you better be caution.

Heavy buying today! So much fun. Artificial drops are the best.

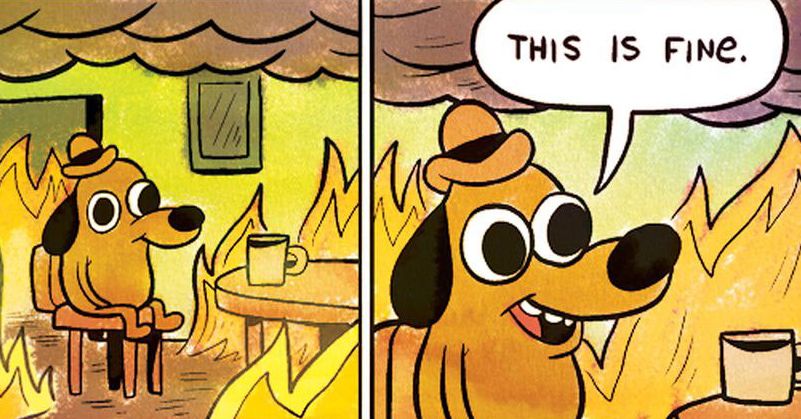

The hotter the fire, they better the time to buy. Lessons of 2020, 2018, 2009, etc.

I waiting for it to roll over. AAPL has been a very slow mover downward. it was only 5 months ago, AAPL was $140, $20 lower than today price. I think one big push will get us closer to $140. When it hit $140, it will be time to buy AAPL, CRM, NVDA, PYPL, and ADBE.The stalwart AAPL is still essentially remaining a stalwart. I've been thinking it's going to roll over sooner or later like the rest but so far nope lol. The other day I heard it's viewed kind of like a staple, which on a level I agree with but it shows much more sturdiness than even staples and the like. Staples are little mixed today but mostly down today but AAPL minimally so for now.

They say when AAPL rolls over that's when there's a good chance you've got a bottom put in but I'm like when the hell is that suppose to happen haha. The notion makes sense but the relative strength has been quite impressive to date.

MSFT was like that until it wasn’t. Cramer mentioned that MSFT is a great stock but the PE is too high a couple of days ago when it started dropping. No one mentioned it was an expensive stock until it fell.

Agree or disagree?

Last edited:

AAPL will be $200+ soon. Be careful and don't miss out. All those stocks you mentioned are very undervalued and huge buys.I waiting for it to roll over. AAPL has been a very slow mover downward. it was only 5 months ago, AAPL was $140, $20 lower than today price. I think one big push will get us closer to $140. When it hit $140, it will be time to buy AAPL, CRM, NVDA, PYPL, and ADBE.

MSFT was like that until it wasn’t. Cramer mentioned that MSFT is a great stock but the PE is too high a couple of days ago when it started dropping. No one mentioned it was an expensive stock until it fell.

Agree or disagree?

MSFT and AAPL theoretically deserve a valuation premium but we're in an environment where nothing deserves any premium really or if it's a premium it's in an environment where everything is be rerated. So a premium on that rerating but not the valuations of the last few years.I waiting for it to roll over. AAPL has been a very slow mover downward. it was only 5 months ago, AAPL was $140, $20 lower than today price. I think one big push will get us closer to $140. When it hit $140, it will be time to buy AAPL, CRM, NVDA, PYPL, and ADBE.

MSFT was like that until it wasn’t. Cramer mentioned that MSFT is a great stock but the PE is too high a couple of days ago when it started dropping. No one mentioned it was an expensive stock until it fell.

Agree or disagree?

Honestly, I don't even know that AAPL deserves as much premium as it gets though. It's growth rate is nice but IIRC it's just mid high single digits. For that growth for a company its size an the amount of cash flow it generates it does deserve some premium but as much as it gets I'm not so sure. But there are a lot of "believers" in the stock and it's safe haven stature so I don't know if it gets reflected so well.