If you have a regular IRA with say half a dozen different funds or equities, how does the broker handle if you want to pull 10-15% of the value to a Roth via conversion? Do they automatically liquidate a pro rata slice of each security or can you specify which one(s) and how much to liquidate?Thanks. My wife is seven years younger than I and I’ll likely die first (not to be morbid, just rational). If that happens she’ll get hit with huge taxes from RMDs so for her, and the kids, I’m trying to correct an imbalance where I have much more in tax deferred accounts than Roth or taxable. First world problem I suppose but planning is prudent.

OT: Stock and Investment Thread

- Thread starter RU05

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

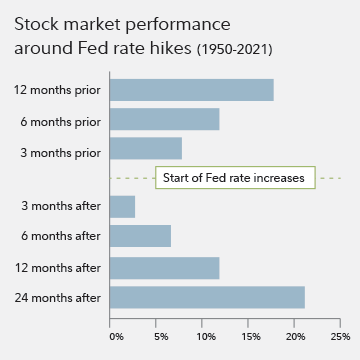

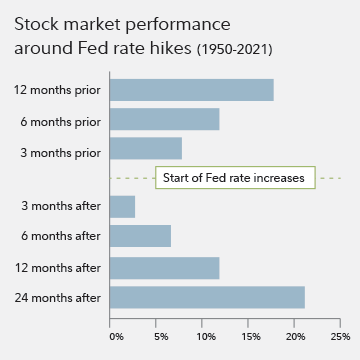

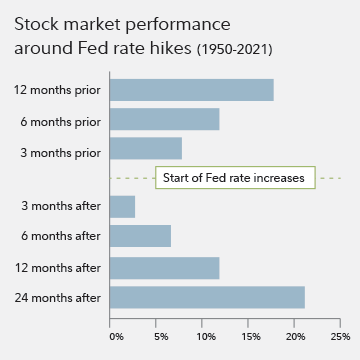

Lots of upswing to come. Plan accordingly.

Source: Fidelity Investments (AART) as of 12/31/21. Stock performance represented by S&P 500.

Source: Fidelity Investments (AART) as of 12/31/21. Stock performance represented by S&P 500.

@T2Kplus20 maybe right that we are nearing a bottom. Just saw an article quoting Peter Schiff.

FYI - I was going to post last night that a few of the CNBC super bears are saying that values look very good (especially with big tech). Is it bear capitulation when they start buying? LOL!@T2Kplus20 maybe right that we are nearing a bottom. Just saw an article quoting Peter Schiff.

As per Morningstar, growth and tech are undervalued compared to defensive and value. The market is out of whack.

Likely a bounce today. Then CPI tomorrow followed by a dip. Pattern going to be like that thru next Fed rate increase then another dip. Still thinking the S&P will likely come to a rest in the 3600 range, hopefully not lower. Put in a few orders this morning:. AAPL, MSFT, AMZN.Lots of upswing to come. Plan accordingly.

Source: Fidelity Investments (AART) as of 12/31/21. Stock performance represented by S&P 500.

If CPI breaks tomorrow (50-50), we will experience a significant rally (think mid/late March). When CPI shows a legit trend break (2 lower months in a row), we will be off to the races. Once again, the base effect start tomorrow/April data and ramps up nicely with the upcoming May data point. Look for core CPI.Likely a bounce today. Then CPI tomorrow followed by a dip. Pattern going to be like that thru next Fed rate increase then another dip. Still thinking the S&P will likely come to a rest in the 3600 range, hopefully not lower. Put in a few orders this morning:. AAPL, MSFT, AMZN.

Good list of orders. 12 months from now you will look back at these prices and wish you bought more.

For those interested in biotech. Cut and paste due to a paywall. Bottom?

________________________________________

A record number of small biotechs are now trading below cash. Is this the bottom yet? | Endpoints News | May 9, 2022

For anyone who’s been following biotech news of late, it should be no surprise that many small- to mid-cap players are struggling. But the scope and depth of their troubles may be harder to grasp.

Jefferies analysts took a stab at quantifying the market downturn and came up with a number: 128 companies are now trading at a market cap smaller than the cash they have on hand, a “historical” number owing to negative clinical events, negative FDA developments and macro economic environments.

The observation adds to other indicators of a daunting bear market, from numerical ones such as plummeting biotech indices to anecdotal evidence of individual companies executing major reorganizations, layoffs, pipeline pivots, or even seeking the dreaded “strategic alternatives.”

Although they predict that 2022 will remain a tough year overall, Michael Yee, Dennis Ding, Andrew Tsai and their team do hope that the second half of the year may bring some respite — particularly if Big Pharma steps up on M&A. As they remarked days ago, the top 15 drugmakers have enough cash to buy out the whole SMID biotech sector, or a whopping 644 companies.

Looking back at the past 15 years, the analysts noted that since 2007, the number of SMID cap biotechs trading below cash has never gone higher than 45. In fact, for the most part, fewer than 20 biotechs each year fell to that predicament.

Sure, SMID cap biotechs these days do have more cash than earlier years “to keep up with a higher burn,” they wrote.

“(H)owever, we note a faster pace of market value contraction in SMID caps (all cap $0-5B) with now over 120 companies trading below cash vs ~45 in YE:21 and on average ~10-20 smids for the past 15 years,” the Jefferies note read.

Perhaps more important, not only is 128 the highest number they’ve seen, at 25% it’s also the “highest percent share of the industry.” That’s up there with the 2008-2009 period, just after the financial tsunami.

One factor, they noted, is the macro environment pushing generalist investors into “defensive, dividend-yielding large-cap” names, leaving little on the table for the lesser-known names. Then there was the stream of bad news — negative readouts — that inevitably trigger falls, and regulatory moves, such as delays and clinical holds, that might suggest a harsher environment.

Still, things could improve if coming clinical updates turn out positive, and they believe IPO activity will pick up again near the end of the year “with more conservative valuations.”

As to whether M&A activity will pick up, they are calling it possible without speculating too much. However, we sense the buyer-seller spread may keep widening until the market finds bottom. Additionally, this doesn’t mean the companies trading below cash are going to be taken out soon – they likely suffered from negative events. As we have repeatedly said, sentiment is unlikely to turn on a few small deals and investors are watching for big ones (at least $5B in our view).

________________________________________

A record number of small biotechs are now trading below cash. Is this the bottom yet? | Endpoints News | May 9, 2022

For anyone who’s been following biotech news of late, it should be no surprise that many small- to mid-cap players are struggling. But the scope and depth of their troubles may be harder to grasp.

Jefferies analysts took a stab at quantifying the market downturn and came up with a number: 128 companies are now trading at a market cap smaller than the cash they have on hand, a “historical” number owing to negative clinical events, negative FDA developments and macro economic environments.

The observation adds to other indicators of a daunting bear market, from numerical ones such as plummeting biotech indices to anecdotal evidence of individual companies executing major reorganizations, layoffs, pipeline pivots, or even seeking the dreaded “strategic alternatives.”

Although they predict that 2022 will remain a tough year overall, Michael Yee, Dennis Ding, Andrew Tsai and their team do hope that the second half of the year may bring some respite — particularly if Big Pharma steps up on M&A. As they remarked days ago, the top 15 drugmakers have enough cash to buy out the whole SMID biotech sector, or a whopping 644 companies.

Looking back at the past 15 years, the analysts noted that since 2007, the number of SMID cap biotechs trading below cash has never gone higher than 45. In fact, for the most part, fewer than 20 biotechs each year fell to that predicament.

Sure, SMID cap biotechs these days do have more cash than earlier years “to keep up with a higher burn,” they wrote.

“(H)owever, we note a faster pace of market value contraction in SMID caps (all cap $0-5B) with now over 120 companies trading below cash vs ~45 in YE:21 and on average ~10-20 smids for the past 15 years,” the Jefferies note read.

Perhaps more important, not only is 128 the highest number they’ve seen, at 25% it’s also the “highest percent share of the industry.” That’s up there with the 2008-2009 period, just after the financial tsunami.

One factor, they noted, is the macro environment pushing generalist investors into “defensive, dividend-yielding large-cap” names, leaving little on the table for the lesser-known names. Then there was the stream of bad news — negative readouts — that inevitably trigger falls, and regulatory moves, such as delays and clinical holds, that might suggest a harsher environment.

Still, things could improve if coming clinical updates turn out positive, and they believe IPO activity will pick up again near the end of the year “with more conservative valuations.”

As to whether M&A activity will pick up, they are calling it possible without speculating too much. However, we sense the buyer-seller spread may keep widening until the market finds bottom. Additionally, this doesn’t mean the companies trading below cash are going to be taken out soon – they likely suffered from negative events. As we have repeatedly said, sentiment is unlikely to turn on a few small deals and investors are watching for big ones (at least $5B in our view).

For those interested in biotech. Cut and paste due to a paywall. Bottom?

________________________________________

A record number of small biotechs are now trading below cash. Is this the bottom yet? | Endpoints News | May 9, 2022

For anyone who’s been following biotech news of late, it should be no surprise that many small- to mid-cap players are struggling. But the scope and depth of their troubles may be harder to grasp.

Jefferies analysts took a stab at quantifying the market downturn and came up with a number: 128 companies are now trading at a market cap smaller than the cash they have on hand, a “historical” number owing to negative clinical events, negative FDA developments and macro economic environments.

The observation adds to other indicators of a daunting bear market, from numerical ones such as plummeting biotech indices to anecdotal evidence of individual companies executing major reorganizations, layoffs, pipeline pivots, or even seeking the dreaded “strategic alternatives.”

Although they predict that 2022 will remain a tough year overall, Michael Yee, Dennis Ding, Andrew Tsai and their team do hope that the second half of the year may bring some respite — particularly if Big Pharma steps up on M&A. As they remarked days ago, the top 15 drugmakers have enough cash to buy out the whole SMID biotech sector, or a whopping 644 companies.

Looking back at the past 15 years, the analysts noted that since 2007, the number of SMID cap biotechs trading below cash has never gone higher than 45. In fact, for the most part, fewer than 20 biotechs each year fell to that predicament.

Sure, SMID cap biotechs these days do have more cash than earlier years “to keep up with a higher burn,” they wrote.

“(H)owever, we note a faster pace of market value contraction in SMID caps (all cap $0-5B) with now over 120 companies trading below cash vs ~45 in YE:21 and on average ~10-20 smids for the past 15 years,” the Jefferies note read.

Perhaps more important, not only is 128 the highest number they’ve seen, at 25% it’s also the “highest percent share of the industry.” That’s up there with the 2008-2009 period, just after the financial tsunami.

One factor, they noted, is the macro environment pushing generalist investors into “defensive, dividend-yielding large-cap” names, leaving little on the table for the lesser-known names. Then there was the stream of bad news — negative readouts — that inevitably trigger falls, and regulatory moves, such as delays and clinical holds, that might suggest a harsher environment.

Still, things could improve if coming clinical updates turn out positive, and they believe IPO activity will pick up again near the end of the year “with more conservative valuations.”

As to whether M&A activity will pick up, they are calling it possible without speculating too much. However, we sense the buyer-seller spread may keep widening until the market finds bottom. Additionally, this doesn’t mean the companies trading below cash are going to be taken out soon – they likely suffered from negative events. As we have repeatedly said, sentiment is unlikely to turn on a few small deals and investors are watching for big ones (at least $5B in our view).

Be careful with these ‘below tangible assets’ / ‘below cash’ plays; more often than not the discount reflects management’s propensity to burn excess value to keep the company solvent.

Good for the company’s employees, I guess. Bad for shareholders who would be better off liquidating the whole thing.

In theory I love these classic “last puff of the cigar” value plays, but found that if there’s not a time constraint to trigger a default, management will burn all available value to try to save the business

The play would be one of the biotech ETFs not any specific stocks (which are WAY too risky and unpredictable). Just sounds like the sub-sector is hitting the floor.Be careful with these ‘below tangible assets’ / ‘below cash’ plays; more often than not the discount reflects management’s propensity to burn excess value to keep the company solvent.

Good for the company’s employees, I guess. Bad for shareholders who would be better off liquidating the whole thing.

Added or increased my balance in the same stocks but added NVDA and TSLA when it was under 800. Expect further decline in NVDA and ADBE to add more. Added quite a few 4.5-7% dividend stocks. O, BTI, VZ, BEN, LEG, VFC most aristocratic increasing their dividends every year.Likely a bounce today. Then CPI tomorrow followed by a dip. Pattern going to be like that thru next Fed rate increase then another dip. Still thinking the S&P will likely come to a rest in the 3600 range, hopefully not lower. Put in a few orders this morning:. AAPL, MSFT, AMZN.

Still expect further decline but buying as it goes down.

What would you expect from an idiot?Watching Cecilia Rouse from the White House council of economic advisors previewing the Biden speech on inflation today. Don't expect to hear anything new from Biden. Same old excuses and same plan (ie no plan) for inflation reduction.

Not true. You can "transfer in kind" whatever funds or stocks from a regular IRA to a Roth IRA. You still have to pay taxes on the total amount but no liquidation is necessary.Can only convert cash. So, you have to liquidate what you want

You can "transfer in kind" whatever funds or stocks from a regular IRA to a Roth IRA. You still have to pay taxes on the total amount but no liquidation is necessary.If you have a regular IRA with say half a dozen different funds or equities, how does the broker handle if you want to pull 10-15% of the value to a Roth via conversion? Do they automatically liquidate a pro rata slice of each security or can you specify which one(s) and how much to liquidate?

FYI: Hedge fund manager David Tepper believes “the sell-off could be concluding,” the founder of Appaloosa Management told Jim Cramer on Tuesday.

-----

“I was talking to my friend Dave Tepper, who’s been short,” Cramer said on “Squawk Box,” before the opening bell, following another day of broad declines on Wall Street.

Tepper also told Cramer that he feels that “the forced sellers have equaled bottom, and that it really is a great time to be able to take a shot.”

Reflecting on his Tuesday morning chat with Tepper, Cramer said: “This is a major change for him. I speak with Dave quite a lot, and I know he’s been very, very negative, so this is a big trading cover. And if it goes down more, he wants to go long.”

“He is a trader, but I think it’s worth noting that he’s a great trader,” Cramer said, alluding to some of Tepper’s timely moves throughout the years, perhaps most notably his call about the Federal Reserve in 2010 that sparked the so-called “Tepper rally.”

-----

“I was talking to my friend Dave Tepper, who’s been short,” Cramer said on “Squawk Box,” before the opening bell, following another day of broad declines on Wall Street.

Tepper also told Cramer that he feels that “the forced sellers have equaled bottom, and that it really is a great time to be able to take a shot.”

Reflecting on his Tuesday morning chat with Tepper, Cramer said: “This is a major change for him. I speak with Dave quite a lot, and I know he’s been very, very negative, so this is a big trading cover. And if it goes down more, he wants to go long.”

“He is a trader, but I think it’s worth noting that he’s a great trader,” Cramer said, alluding to some of Tepper’s timely moves throughout the years, perhaps most notably his call about the Federal Reserve in 2010 that sparked the so-called “Tepper rally.”

Last edited:

"Funny" dividend stock story: I have a neighbor on the mountain here that has $1 million in LUMN, what used to be CenturyLink. He was guided to it via a friend/broker in Naples, FL. Done for the 9.7% dividend, producing $100k in income. Yikes....Added or increased my balance in the same stocks but added NVDA and TSLA when it was under 800. Expect further decline in NVDA and ADBE to add more. Added quite a few 4.5-7% dividend stocks. O, BTI, VZ, BEN, LEG, VFC most aristocratic increasing their dividends every year.

Still expect further decline but buying as it goes down.

He didn't cause it nor can he fix it. This is a complex dynamic, a shared responsibility in the causation and the solution.What would you expect from an idiot?

OK good to know, but can you specify which of the specific funds or equities or does it have to be pro rata?You can "transfer in kind" whatever funds or stocks from a regular IRA to a Roth IRA. You still have to pay taxes on the total amount but no liquidation is necessary.

FYI: Hedge fund manager David Tepper believes “the sell-off could be concluding,” the founder of Appaloosa Management told Jim Cramer on Tuesday.

-----

“I was talking to my friend Dave Tepper, who’s been short,” Cramer said on “Squawk Box,” before the opening bell, following another day of broad declines on Wall Street.

Tepper also told Cramer that he feels that “the forced sellers have equaled bottom, and that it really is a great time to be able to take a shot.”

Reflecting on his Tuesday morning chat with Tepper, Cramer said: “This is a major change for him. I speak with Dave quite a lot, and I know he’s been very, very negative, so this is a big trading cover. And if it goes down more, he wants to go long.”

“He is a trader, but I think it’s worth noting that he’s a great trader,” Cramer said, alluding to some of Tepper’s timely moves throughout the years, perhaps most notably his call about the Federal Reserve in 2010 that sparked the so-called “Tepper rally.”

I’m a “just keep buying” kind of guy, I don’t really try to time it, other than holding some cash to deploy for big drops.

That said, if we’re riffing on calling bottoms, I wonder if we’ve been too trained to smell quick bottoms and fierce rallies after 10+ years of very accommodating monetary policy.

After the market peak in March of 2000, the S&P’s didn’t really find a bottom until April of 2001 (and was sniffing a fresh bottoms leading up to 9/11 — but I throw out market performance after that as a separate trend).

Then from a cycle peak in March of 2007, we didn’t find a bottom for 18 months.

There’s that Buffett quote “when the tide goes out you find out who is swimming naked.” Post-crash the tide has never really gone out. There are trader tantrums, but companies still find liquidity and there isn’t economic fallout to prolong the downturn.

This may be a case where we actually see some fallout with cash burning companies running out of liquidity to stay afloat, and a prolonged recession with sustained market downcycle as a result.

Agree, there no V in this market. Last time was the monetary policy.I’m a “just keep buying” kind of guy, I don’t really try to time it, other than holding some cash to deploy for big drops.

That said, if we’re riffing on calling bottoms, I wonder if we’ve been too trained to smell quick bottoms and fierce rallies after 10+ years of very accommodating monetary policy.

After the market peak in March of 2000, the S&P’s didn’t really find a bottom until April of 2001 (and was sniffing a fresh bottoms leading up to 9/11 — but I throw out market performance after that as a separate trend).

Then from a cycle peak in March of 2007, we didn’t find a bottom for 18 months.

There’s that Buffett quote “when the tide goes out you find out who is swimming naked.” Post-crash the tide has never really gone out. There are trader tantrums, but companies still find liquidity and there isn’t economic fallout to prolong the downturn.

This may be a case where we actually see some fallout with cash burning companies running out of liquidity to stay afloat, and a prolonged recession with sustained market downcycle as a result.

SOFI about to pull a "hold my beer." Halted due to early earnings leakHere we go again.

UPST down over 60% today only. From $400 high to $30. Positive earning and revenue but lower estimate.

$4.87 down 18.5%, frequently discussed on this board. I’m going to buy before it disappears.SOFI about to pull a "hold my beer." Halted due to early earnings leak

Does it have value to another company at this level? Maybe a takeover target?$4.87 down 18.5%, frequently discussed on this board. I’m going to buy before it disappears.

Not sure about this yet. With super-max fear and emotion baked into the market, any good news may generate a violent rally like in 2020. Once inflation breaks, the Feds can signal less tightening, and then.....KABOOM!Agree, there no V in this market. Last time was the monetary policy.

PYPL? Or a traditional big bank looking for a better customer experience.Does it have value to another company at this level? Maybe a takeover target?

Still halted, probably going to get it at an even better price$4.87 down 18.5%, frequently discussed on this board. I’m going to buy before it disappears.

Why halted? If earnings leaked, tough S for the company. People are going to react to it after hours anyway.Still halted, probably going to get it at an even better price

Its been halted for over an hour, allegedly because of the earnings leak.Why halted? If earnings leaked, tough S for the company. People are going to react to it after hours any

you are correct. my mistake. deleted the post to not cause more confusionNot true. You can "transfer in kind" whatever funds or stocks from a regular IRA to a Roth IRA. You still have to pay taxes on the total amount but no liquidation is necessary.

Last edited:

You can specify which exact funds/stocks to transfer and all or a portion of any of them as you wishOK good to know, but can you specify which of the specific funds or equities or does it have to be pro rata?

Can you specify whichyou are correct. my mistake. deleted the post to not cause more confusion

Thank you! I just retired this year and am considering starting a series of Roth conversions either in 2023 or 2024 depending on market conditions. This will allow me to construct a more workable plan.You can specify which exact funds/stocks to transfer and all or a portion of any of them as you wish

Right now, I'm torn on how to think about Roth conversions. I believe they make a lot of sense at least to fill up the 12% tax bracket. On the other hand, once they occur they force up current expenses in the form of taxes due which creates a bit more risk of portfolio failure in the event of severely underperforming markets over the next 10-15 years.

The ARKK hits keep coming. Unity Software, which was down to $48 as of today from $200 last November, is down a whopping 35% in after hours trading (to $31 a share). Ms. Wood couldn’t have picked a worse portfolio (outside of TSLA). In fact, her stock picks are historically bad, as her ETF is down to where it was over 4 years ago; all during a time that TSLA, her largest holding, was up over a 1,000%.

Anyone stay with the fund?The ARKK hits keep coming. Unity Software, which was down to $48 as of today from $200 last November, is down a whopping 35% in after hours trading (to $31 a share). Ms. Wood couldn’t have picked a worse portfolio (outside of TSLA). In fact, her stock picks are historically bad, as her ETF is down to where it was over 4 years ago; all during a time that TSLA, her largest holding, was up over a 1,000%.

I expected a 10% drop but a 5-6% drop will signal the capitulation and time to buy.

There are going to be books written about this.....and I mean the entire story. I'm not going to solely crush CW. A large band of shorters are essentially doing a WSB operation. They are using ARK's daily list of transactions to direct their short activities. Doesn't seem kosher.The ARKK hits keep coming. Unity Software, which was down to $48 as of today from $200 last November, is down a whopping 35% in after hours trading (to $31 a share). Ms. Wood couldn’t have picked a worse portfolio (outside of TSLA). In fact, her stock picks are historically bad, as her ETF is down to where it was over 4 years ago; all during a time that TSLA, her largest holding, was up over a 1,000%.

I seem to recall certain folks on this thread hailing CW as a genius. In the meantime, everyone with money in the market during the bull run put up huge numbers. But looking specifically at CW’s positions = total nuclear meltdown other than Tesla. Remember the valuation debates…? Her fund will not be able to recover with the current investment mix. So she buys GM LOL!There are going to be books written about this.....and I mean the entire story. I'm not going to solely crush CW. A large band of shorters are essentially doing a WSB operation. They are using ARK's daily list of transactions to direct their short activities. Doesn't seem kosher.