SBF is toast. Holmes got 11 years and Theranos was only worth $9B. Amazing how nobody that I am aware of got any serious time arising out of the financial crisis.

OT: Stock and Investment Thread

- Thread starter RU05

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

To his defense, she dupped everyone around her.

Is the problem with twitter its wokeness?

Or it’s inability to monetize its significant user base?

The $9 a month move was certainly aimed at monetizing those users but may come with the consequence of undermining the trustworthiness of the information posted. Which itself will have a negative consequence.

I'm not sure how then $9 works (all users? Just posters and/or blue checks?) but it could be good since Twitter is full of seedy garbage that nobody would miss. Pubs use cover charges to keep riff raff out.

Twitter has good core potential since its a citizen journalism hub. A bad storm, war, rally, protest, shooting etc - it can all show-up raw on twitter first (Reddit is similar). Lots of journalists rely on Twitter.

The "wokeness" (I use "Maoist" to more accurately describe the toxic trend) is a problem because it constricts the platform. When a foreign born techie with a Klingon name takes charge of Twitter, and proclaims the 1st Amendment "outdated" then the journalistic aspect constricts down to psyops that loses audience. Look at CNN and MSNBC struggling (money from China helps).

I see Musk as a sort of 60s-70s style liberal who still appreciates free speech and understands the Maoist things brings dysfunction. A few years ago he was warning Austin to not become a Texan version of San Franciso. That doesn't mean Musk is Barry Goldwater. He just sees Austin is nice but can tip into the dysfunction ruining so many places

I find Reddit easier to follow than Twitter

I also don’t understand the great angst when there is non-governmental consequences for something someone posts on a social media site. And no I am not easily offended. I just don’t see it as a First Amendment issue.

To me the FirstAmendment protects you from government action for speech in the town square not against private action for speech you make in the middle of a privately owned restaurant on the town square

I also don’t understand the great angst when there is non-governmental consequences for something someone posts on a social media site. And no I am not easily offended. I just don’t see it as a First Amendment issue.

To me the FirstAmendment protects you from government action for speech in the town square not against private action for speech you make in the middle of a privately owned restaurant on the town square

Peace offering to my bear friends (including @RUinPinehurst ):

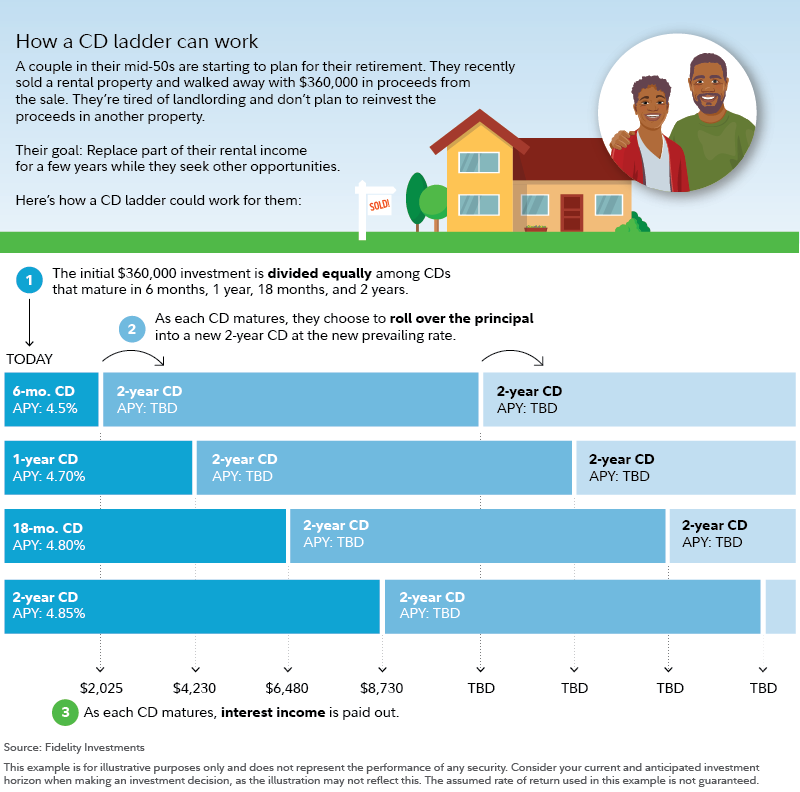

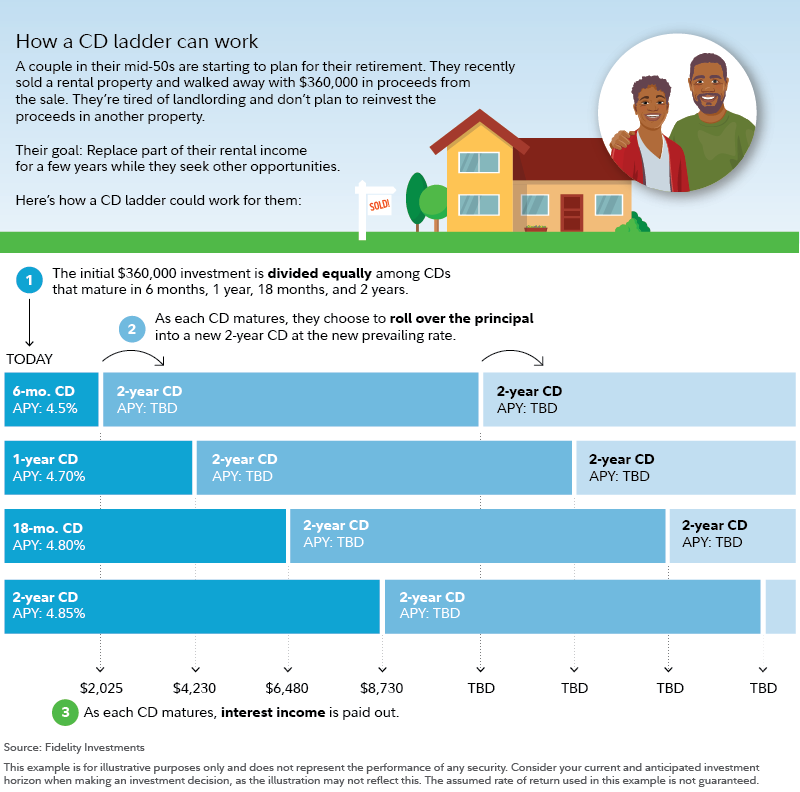

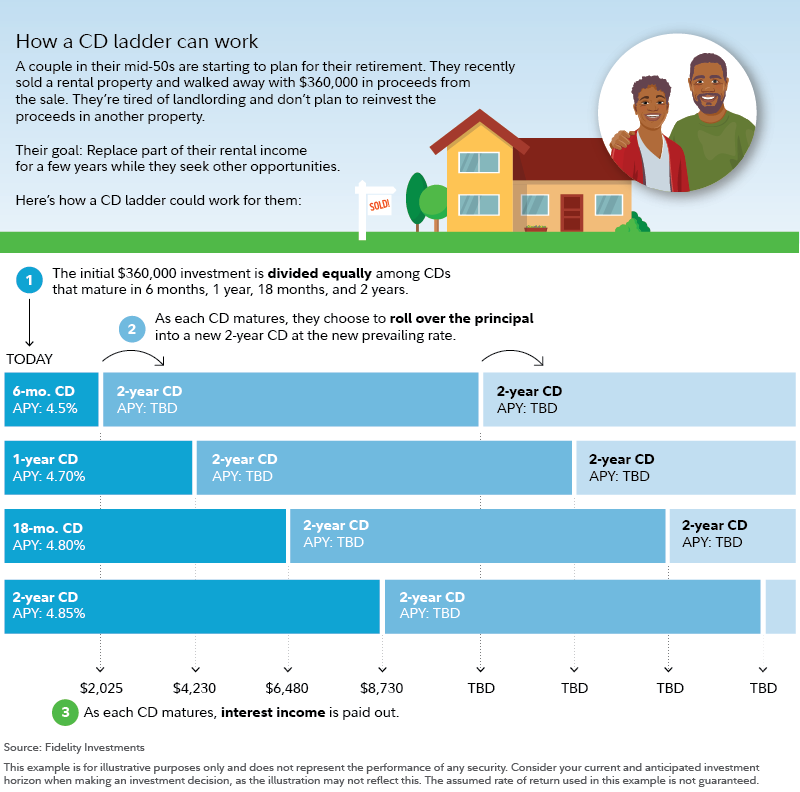

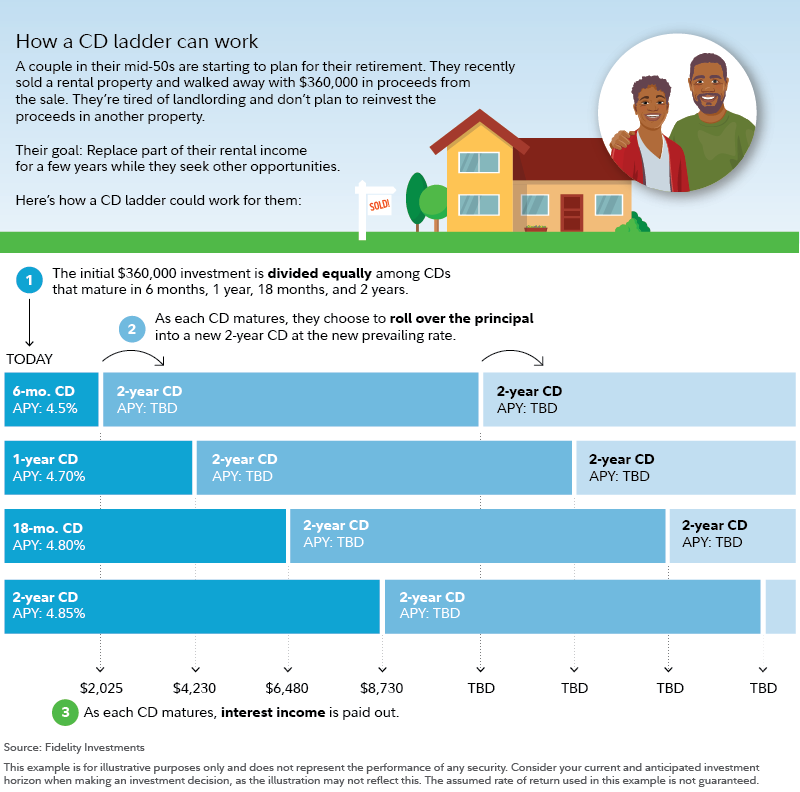

Good article with a link to Fidelity's current offerings.

Good article with a link to Fidelity's current offerings.

Nice. I will share this with my wife since that is what she is comfortable withPeace offering to my bear friends (including @RUinPinehurst ):

Good article with a link to Fidelity's current offerings.

We don't have any CDs right now. Our cash is just chilling in our Capital One and Ally online accounts. Those rates are around 3%. We will move to CDs soon, but I think CDs rates will creep up a little more over the next month or two (via more Fed action). Just being patient.Nice. I will share this with my wife since that is what she is comfortable with

Given what lies ahead, consider it an "extension ladder."Peace offering to my bear friends (including @RUinPinehurst ):

Good article with a link to Fidelity's current offerings.

I don’t eitherWe don't have any CDs right now. Our cash is just chilling in our Capital One and Ally online accounts. Those rates are around 3%. We will move to CDs soon, but I think CDs rates will creep up a little more over the next month or two (via more Fed action). Just being patient.

My wife has a few with money she inherited

My extension ladder is called TQQQ!Given what lies ahead, consider it an "extension ladder."

Thought you were holding out for SJIM?My extension ladder is called TQQQ!

HA! Is that available yet?Thought you were holding out for SJIM?

Not yet. Until then, see @CramerTracker on Musker, I mean Twitter...HA! Is that available yet?

I find Reddit easier to follow than Twitter

I also don’t understand the great angst when there is non-governmental consequences for something someone posts on a social media site. And no I am not easily offended. I just don’t see it as a First Amendment issue.

To me the FirstAmendment protects you from government action for speech in the town square not against private action for speech you make in the middle of a privately owned restaurant on the town square

Normally it would be correct to say a private enterprise can do what it wants (including censoring) but the line between government and private censorship is long gone. They work hand in glove across all platforms and the targets are all the same.

Some people spend a lot of time and money building a business using Facebook/YT/Twit and get their accounts closed because they posted about something a top medical authority claimed. In that case someone's business and health were a focus. It often turns out the censorship comes from government telling a network what to do. Its a shell game where gov agencies have a bean of propaganda they want to circulate and preserve so they give it to Twitter or FB to put under their shells. Lots of legal, financial and constitutional issues have been moved to gray zones. Zuckerberg himself has admitted doing what gov tells him to do

https://nypost.com/2022/10/31/feds-keep-facebook-censorship-portal-despite-dhs-disinfo-board-demise/

Zuckerberg tells Rogan FBI warning prompted Biden laptop story censorship

In an interview with Joe Rogan, Mark Zuckerberg says the story was flagged after an FBI warning.

Last edited:

Doesn’t that contradict allowing businesses to deny service based on their religious beliefsNormally it would be correct to say a private enterprise can do what it wants (including censoring) but the line between government and private censorship is long gone. They work hand in glove across all platforms and the targets are all the same.

Some people spend a lot of time and money building a business using Facebook/YT/Twit and get their accounts closed because they posted about something a top medical authority claimed. In that case someone's business and health were a focus. It often turns out the censorship comes from government telling a network what to do. Its a shell game where gov agencies have a bean of propaganda thet want to circulate and preserve so they give it to Twitter or FB to put under their shells. Lots of legal, financial and constitutional issues have been moved to gray zones Zuckerberg himself has admitted doing what gov tells him to do

Can a social media company deny access because what people post is contradictory to the owner’s (including shareholders) religious beliefs

No, religious beliefs are different and directly protected in the constitution. Also, people can't just label or claim religious beliefs for anything. There is an established and reasonableness test it has to pass. Can I claim the T2K religion prohibits paying taxes? Sadly, no.Doesn’t that contradict allowing businesses to deny service based on their religious beliefs

As for Twitter and censorship. Meh, I lean towards letting them to do what they like.....and allow them to suffer the consequences.

This is where I am at also

As for Twitter and censorship. Meh, I lean towards letting them to do what they like.....and allow them to suffer the consequences.

I do not think being allowed to post on Twitter or FaceBook etc is a 1st amendment issue

As for Twitter and censorship. Meh, I lean towards letting them to do what they like.....and allow them to suffer the consequences.

I do not think being allowed to post on Twitter or FaceBook etc is a 1st amendment issue

The coders remain

"The vast majority of Twitter as it existed just a month ago has disappeared. And yet… Twitter is still there. If anything, it’s a lot better.

Does your company have 16 employees? Then four people are doing half of the actual work. A hundred employees? Then ten people do half.

So, what’s the situation like at Twitter? Well, a month ago Twitter had about 7,500 employees worldwide. Per Price’s Law, that means about half of all the real work at Twitter was carried out by… eighty-six people.

At this moment, Musk is well on his way to finding out how accurate Price’s little maxim is.

Could you really run Twitter with a smaller staff than your typical American high school? Maybe not. Certainly, a bunch of Twitter addict journalists with no relevant expertise think it’s impossible.

But maybe you could. Did you know that Craiglist, which collects close to a billion dollars in revenue per year, has only about 50 staff?

Did you know that when Facebook bought WhatsApp for $19 billion in 2014, it had just 32 engineers for more than 450 million users? One year post-buyout, it was up to nearly a billion users, with just 50 engineers.

But the norm for most of big tech is bloat. Lots and lots of bloat."

"The vast majority of Twitter as it existed just a month ago has disappeared. And yet… Twitter is still there. If anything, it’s a lot better.

Does your company have 16 employees? Then four people are doing half of the actual work. A hundred employees? Then ten people do half.

So, what’s the situation like at Twitter? Well, a month ago Twitter had about 7,500 employees worldwide. Per Price’s Law, that means about half of all the real work at Twitter was carried out by… eighty-six people.

At this moment, Musk is well on his way to finding out how accurate Price’s little maxim is.

Could you really run Twitter with a smaller staff than your typical American high school? Maybe not. Certainly, a bunch of Twitter addict journalists with no relevant expertise think it’s impossible.

But maybe you could. Did you know that Craiglist, which collects close to a billion dollars in revenue per year, has only about 50 staff?

Did you know that when Facebook bought WhatsApp for $19 billion in 2014, it had just 32 engineers for more than 450 million users? One year post-buyout, it was up to nearly a billion users, with just 50 engineers.

But the norm for most of big tech is bloat. Lots and lots of bloat."

Refreshing common sense from a Fed official:

So if a CEO retires and gets his/her golden parachute but then is rehired down the road, does the severance package have to be returned? Will he/she get another severance package when they retire again?

Not sure. I guess it depends on how desperate the board was to bring Iger back. Seems like this was a quick turnaround firing.So if a CEO retires and gets his/her golden parachute but then is rehired down the road, does the severance package have to be returned? Will he/she get another severance package when they retire again?

The upcoming rail strike should be interesting.

Will Biden pull a Truman Show and have the Army seize the railroads?

Will Biden pull a Truman Show and have the Army seize the railroads?

Per Yahoo Finance: "San Francisco Fed President Mary Daly said Monday it’s premature to take another 75-basis point rate hike off the table ahead of the central bank’s December policy meeting.

“It’s premature in my mind to take anything off the table,” Daly said when asked during a media Q&A whether a 75-basis point rate hike is still possible for the next policy meeting if forthcoming inflation reports came in hot. “I’m going into the meeting with the full range of adjustments that we could make on the table and not taking off prematurely.”

Daly reiterated she still sees the need to raise the Fed’s benchmark interest rate to a range of 4.75%-5.25%, but added the caveat that nothing is set in stone. The Fed funds rate is currently set in a range of 3.75%-4%."

“It’s premature in my mind to take anything off the table,” Daly said when asked during a media Q&A whether a 75-basis point rate hike is still possible for the next policy meeting if forthcoming inflation reports came in hot. “I’m going into the meeting with the full range of adjustments that we could make on the table and not taking off prematurely.”

Daly reiterated she still sees the need to raise the Fed’s benchmark interest rate to a range of 4.75%-5.25%, but added the caveat that nothing is set in stone. The Fed funds rate is currently set in a range of 3.75%-4%."

The market is starting to ignore the Fed's comments. This is very good news. The inflation data speaks for itself, regardless of the Fed's whining.Per Yahoo Finance: "San Francisco Fed President Mary Daly said Monday it’s premature to take another 75-basis point rate hike off the table ahead of the central bank’s December policy meeting.

“It’s premature in my mind to take anything off the table,” Daly said when asked during a media Q&A whether a 75-basis point rate hike is still possible for the next policy meeting if forthcoming inflation reports came in hot. “I’m going into the meeting with the full range of adjustments that we could make on the table and not taking off prematurely.”

Daly reiterated she still sees the need to raise the Fed’s benchmark interest rate to a range of 4.75%-5.25%, but added the caveat that nothing is set in stone. The Fed funds rate is currently set in a range of 3.75%-4%."

Remember, the rally will begin a few months PRIOR to the Fed admitting to the pivot. Plan accordingly.

Fed Mester on board with slowing the hikes:

Cleveland Fed President Loretta Mester said Monday that recent data has been encouraging, but that the progress is only a start. However, Mester said she’s on board with smaller interest rate increases than the Fed has been implementing lately.

Cleveland Fed President Loretta Mester said Monday that recent data has been encouraging, but that the progress is only a start. However, Mester said she’s on board with smaller interest rate increases than the Fed has been implementing lately.

From "The Street," Using the so-called Taylor Rule for monetary policy, (the Fed's) Bullard suggested the federal funds rate may have to go beyond 5%, to as high as 7%."Fed Mester on board with slowing the hikes:

Cleveland Fed President Loretta Mester said Monday that recent data has been encouraging, but that the progress is only a start. However, Mester said she’s on board with smaller interest rate increases than the Fed has been implementing lately.

An analyst from Stifel was referenced in that same article as stating the Fed may have to go beyond that, up to 9%.

Lol. OkFrom "The Street," Using the so-called Taylor Rule for monetary policy, (the Fed's) Bullard suggested the federal funds rate may have to go beyond 5%, to as high as 7%."

An analyst from Stifel was referenced in that same article as stating the Fed may have to go beyond that, up to 9%.

LOL! Let’s keep this a serious conversation.From "The Street," Using the so-called Taylor Rule for monetary policy, (the Fed's) Bullard suggested the federal funds rate may have to go beyond 5%, to as high as 7%."

An analyst from Stifel was referenced in that same article as stating the Fed may have to go beyond that, up to 9%.

Take the info how you must. Nonetheless, this comes from one Fed member. I get that we all want the economy to improve and the markets to follow. But "things" are out of whack.LOL! Let’s keep this a serious conversation.

https://www.thestreet.com/markets/rates-bonds/fed-interest-rates-8-9-percent-economist-stifel

9% causes global depression and ww3

That's what everyone said about 5%.

I feel like the Fed will stop raising rates as soon as @T2Kplus20 says uncle. That’ll be my leading indicator.

+19% causes global depression and ww3

Our ultra-bear is acting ridiculous again.

The Fed will say uncle first. Mary Daly complained yesterday that the market is overreacting to the interest rates. Saying the market dropped too much and is acting like rates are already 6-7%. Interesting POV. Multiple Fed members getting weak in the knees. Inflation is buckling.I feel like the Fed will stop raising rates as soon as @T2Kplus20 says uncle. That’ll be my leading indicator.

not sure how severance packages can't be challenged as shareholder value considerations. Always baffled me how no one has sued on that

There have been shareholder derivative suits regarding severance packages but not that often. Also most have been in circumstances where sexual harassment or some other misconduct was involved.

I'm not everyone and I'm not wrongThat's what everyone said about 5%.