Just curious assuming you are willing to share - how old are you?23% for 2023

12% fixed income

13% cash

75% equities

Was very close to hitting my number after 2021. Then was down 21.23% in 2022. Now I can retired again. 2022 did teach me a lesson. Need a 20% buffer.

OT: Stock and Investment Thread

- Thread starter RU05

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Big 50 coming up.Just curious assuming you are willing to share - how old are you?

Using a hybrid formula. Based on my current lifestyle/spending and backing into the number by assuming 4% return.20%+ return years are always a blast! As for retirement, we are not close yet, but can see it in the distance horizon. LOL! So many articles say you need whatever your target is ($X) on the day you retire. However, you don't need all that money on day one. Much of it is going to stay invested for a long, long time. Sure, the days of TQQQ trades will be over, but basic indexes should have significant allocations.

So, do you need a set # or just enough to live on for 4-5 years without tapping into the remaining investments? Advice on retirement seems to be evolving.

And you were buying treasuries last year? I assumed you were 65 or 70.Big 50 coming up.

Still buying T-bills. 75% in equities is fairly aggressive.And you were buying treasuries last year? I assumed you were 65 or 70.

Our strategy is more simple. Save as much as possible, invest mostly in equities, and then see how much we have when we feel like retiring. That will dictate what we do. LOL! Obviously, we track as we go, but honestly, we both have no idea when we will be tire of working. The wife is already a consultant and I can easily pivot to that whenever I want. We have lots of flexibility.Using a hybrid formula. Based on my current lifestyle/spending and backing into the number by assuming 4% return.

I do the sameUsing a hybrid formula. Based on my current lifestyle/spending and backing into the number by assuming 4% return.

I used 5% before but trying to build in buffers after 2022.I do the same

Outside of my play money/crypto moves, I have 3 different financial advisors managing my retirement income and nonqualified investments. I’ve been retired almost 4 years and withdraw 5% annually from the 2 retirement accounts and whatever interest/dividends come in from my nonqualified account. I’m thrilled to say that my principal is exactly the same as it was when I stopped working.

What did you decide to do with SS? Take it early, on-time, or late? The math seems to indicate take it early and invest.Outside of my play money/crypto moves, I have 3 different financial advisors managing my retirement income and nonqualified investments. I’ve been retired almost 4 years and withdraw 5% annually from the 2 retirement accounts and whatever interest/dividends come in from my nonqualified account. I’m thrilled to say that my principal is exactly the same as it was when I stopped working.

You did good buying this. It’s up about 14% since then.Frick. I am such a sucker for expected growth. (E-trade has them at 166m in 2026, which would be more then current market cap).

And I bought some.

Besides my old shares, which I still have, I started buying Ocugen again when it was at .45 including some I bought 2 weeks ago at .37. Now it’s at .65

Yes, finally even my JNJ is now positive and BDX is doing well. A point or two more and BMY is positive and my BRk.r will be positive. I guess people are running to defensive stocks.HC and biotech are blowing up today. Rotation from the Mag 7. PFE is pumping and so is CLRB (perhaps word is getting out on next week's data drop?).

I started collecting SS at 65y 4mths, for the full benefit. Although I didn't need it, I crunched the numbers and it would take until was 83yo to break even if I waited until I was 70. I'm fine paying taxes. In my mind, I'd rather have the money in my pocket instead of it in the govt's hands even if its taxed. Besides, there's no guarantee I'll be around at 83.What did you decide to do with SS? Take it early, on-time, or late? The math seems to indicate take it early and invest.

Exactly the same on my endI used 5% before but trying to build in buffers after 2022.

Does that include potential returns if invested?I started collecting SS at 65y 4mths, for the full benefit. Although I didn't need it, I crunched the numbers and it would take until was 83yo to break even if I waited until I was 70. I'm fine paying taxes. In my mind, I'd rather have the money in my pocket instead of it in the govt's hands even if its taxed. Besides, there's no guarantee I'll be around at 83.

Nasdaq 20,000!!! Bring it:

Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and a host of other tech stocks are likely to help boost the broader Nasdaq to hit 20,000 this year, investment firm Wedbush Securities said on Tuesday.

"While we can see ebbs and flows in the coming months given Fed jawboning/macro factors, we believe tech stocks will be up 25% in 2024 with a NASDAQ 20k level our bull case scenario as the Street is still significantly underestimating how quickly this AI monetization cycle is playing out among enterprises in the field," analyst Dan Ives wrote in an investor note.

Ives listed Apple (AAPL), Microsoft (MSFT), Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Palo Alto Networks (PANW), Palantir (PLTR), Zscaler (ZS), CyberArk (CYBR), Crowdstrike (CYBR) and MongoDB (MDB) as the firm's favorite tech stocks for 2024.

He added recent channel checks at the end of the fourth-quarter showed that AI monetization has started to "positively impact" the broader tech sector, as companies like Nvidia (NVDA), Microsoft, Google, Datadog and Palantir have all demonstrated multiplying use cases in both the enterprise and consumer landscapes.

"Use cases lead to the pot of gold at the end of the rainbow," Ives wrote. "50%+ of all enterprises we have recently surveyed see 20+ use cases for Generative AI and 80%+ of all enterprises see 10+ use cases including data analysis, marketing content creation, document editing/summarization, and many more to improve business operations, increase efficiencies, and create a more cost-effective capital structure with the benefits of using Generative AI becoming increasingly clear."

The checks also showed there was a "strong year-end budget flush hit" for the three big cloud service providers — Microsoft, Google and Amazon (AMZN) — as well as the overall software sector.

Ives added that not only has a new tech bull market begun, but the rest of the tech industry will join the "Magnificent 7" — all of which rallied in 2023 — and should result in a "tidal wave" of M&A in both software and semiconductors.

Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and a host of other tech stocks are likely to help boost the broader Nasdaq to hit 20,000 this year, investment firm Wedbush Securities said on Tuesday.

"While we can see ebbs and flows in the coming months given Fed jawboning/macro factors, we believe tech stocks will be up 25% in 2024 with a NASDAQ 20k level our bull case scenario as the Street is still significantly underestimating how quickly this AI monetization cycle is playing out among enterprises in the field," analyst Dan Ives wrote in an investor note.

Ives listed Apple (AAPL), Microsoft (MSFT), Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Palo Alto Networks (PANW), Palantir (PLTR), Zscaler (ZS), CyberArk (CYBR), Crowdstrike (CYBR) and MongoDB (MDB) as the firm's favorite tech stocks for 2024.

He added recent channel checks at the end of the fourth-quarter showed that AI monetization has started to "positively impact" the broader tech sector, as companies like Nvidia (NVDA), Microsoft, Google, Datadog and Palantir have all demonstrated multiplying use cases in both the enterprise and consumer landscapes.

"Use cases lead to the pot of gold at the end of the rainbow," Ives wrote. "50%+ of all enterprises we have recently surveyed see 20+ use cases for Generative AI and 80%+ of all enterprises see 10+ use cases including data analysis, marketing content creation, document editing/summarization, and many more to improve business operations, increase efficiencies, and create a more cost-effective capital structure with the benefits of using Generative AI becoming increasingly clear."

The checks also showed there was a "strong year-end budget flush hit" for the three big cloud service providers — Microsoft, Google and Amazon (AMZN) — as well as the overall software sector.

Ives added that not only has a new tech bull market begun, but the rest of the tech industry will join the "Magnificent 7" — all of which rallied in 2023 — and should result in a "tidal wave" of M&A in both software and semiconductors.

I only calculated how long it would take to make up for the lost distributions. I had no intentions of investing my SS income. I would either enjoy the proceeds or help my kids out. I’m of the belief that if possible why not share the inheritance with my kids while I’m alive and see the joy it brings them.Does that include potential returns if invested?

Shocking to me that M&A hasn’t gone gang-busters yet but guessing interest rates are the primary factor. I can see it taking off in 2024 for sure.Nasdaq 20,000!!! Bring it:

Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and a host of other tech stocks are likely to help boost the broader Nasdaq to hit 20,000 this year, investment firm Wedbush Securities said on Tuesday.

"While we can see ebbs and flows in the coming months given Fed jawboning/macro factors, we believe tech stocks will be up 25% in 2024 with a NASDAQ 20k level our bull case scenario as the Street is still significantly underestimating how quickly this AI monetization cycle is playing out among enterprises in the field," analyst Dan Ives wrote in an investor note.

Ives listed Apple (AAPL), Microsoft (MSFT), Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Palo Alto Networks (PANW), Palantir (PLTR), Zscaler (ZS), CyberArk (CYBR), Crowdstrike (CYBR) and MongoDB (MDB) as the firm's favorite tech stocks for 2024.

He added recent channel checks at the end of the fourth-quarter showed that AI monetization has started to "positively impact" the broader tech sector, as companies like Nvidia (NVDA), Microsoft, Google, Datadog and Palantir have all demonstrated multiplying use cases in both the enterprise and consumer landscapes.

"Use cases lead to the pot of gold at the end of the rainbow," Ives wrote. "50%+ of all enterprises we have recently surveyed see 20+ use cases for Generative AI and 80%+ of all enterprises see 10+ use cases including data analysis, marketing content creation, document editing/summarization, and many more to improve business operations, increase efficiencies, and create a more cost-effective capital structure with the benefits of using Generative AI becoming increasingly clear."

The checks also showed there was a "strong year-end budget flush hit" for the three big cloud service providers — Microsoft, Google and Amazon (AMZN) — as well as the overall software sector.

Ives added that not only has a new tech bull market begun, but the rest of the tech industry will join the "Magnificent 7" — all of which rallied in 2023 — and should result in a "tidal wave" of M&A in both software and semiconductors.

Hard to bet against the Mag 7 especially when you look at so many different funds and the top holdings are always the usual suspects. I don’t see how the Mag 7 could suffer any significant decline unless there is a major event.

A few stocks I’m eyeing at the moment other than the usual: UBER, RACE, ALGN. I’m looking to build a long-term position in UBER - seems like the moat continues to grow and CX is great. With huge stock market gains in 2023 where will the rich spend their money= Ferraris (RACE)? Re: ALGN, the bankruptcy of smiledirect basically leaves Align as the only game in town?

I would love to get a position going with UBER, if the price comes down a bit. I assume we will see a lot more M&A in 2024 than the past 2 years. Same thing with RACE, needs to come down a bit. Ferrari is essentially a luxury brand company like Lvmh.Shocking to me that M&A hasn’t gone gang-busters yet but guessing interest rates are the primary factor. I can see it taking off in 2024 for sure.

Hard to bet against the Mag 7 especially when you look at so many different funds and the top holdings are always the usual suspects. I don’t see how the Mag 7 could suffer any significant decline unless there is a major event.

A few stocks I’m eyeing at the moment other than the usual: UBER, RACE, ALGN. I’m looking to build a long-term position in UBER - seems like the moat continues to grow and CX is great. With huge stock market gains in 2023 where will the rich spend their money= Ferraris (RACE)? Re: ALGN, the bankruptcy of smiledirect basically leaves Align as the only game in town?

Last edited:

@rurahrah000 - Any thoughts on the best play for a BTC announcement on 1/10? Been looking at calls for various miners.

In other news, started a small position in NTLA today. Better pipeline than CRSP with good big pharma partnership deals in place.

In other news, started a small position in NTLA today. Better pipeline than CRSP with good big pharma partnership deals in place.

@rurahrah000 - Any thoughts on the best play for a BTC announcement on 1/10? Been looking at calls for various miners.

In other news, started a small position in NTLA today. Better pipeline than CRSP with good big pharma partnership deals in place.

I am out of all the miners as of the end of 2023. My guess is that this will be a sell the news type of situation. The only caveat being that if we get a pullback to BTC of more than 15-20%.

If you don’t mind me asking, what’s a “small position” in terms of the number of shares? You have me looking at it now so I’m trying to determine the level of your conviction.In other news, started a small position in NTLA today.

Yeah, I keep going back and forth on if the news will generate a bounce or temporary dip. You are right on assessing what BTC does as we approach 1/10.I am out of all the miners as of the end of 2023. My guess is that this will be a sell the news type of situation. The only caveat being that if we get a pullback to BTC of more than 15-20%.

Most of my comments are focused on moves in my personal/fun account, which is roughly $120k. My small "test the water" positions start at $1k which is what I did with NTLA (35 shares). Higher conviction stocks $3-5k. Half of this account is devoted to a custom stock basket via my FS Insights membership (subset of the S&P 500 meant to outperform).If you don’t mind me asking, what’s a “small position” in terms of the number of shares? You have me looking at it now so I’m trying to determine the level of your conviction.

Obviously, the vast majority of our investments are in funds and ETFs via other accounts, but can have some aggressive holdings like 2x ETFs of broad indexes (relatively small positions to get a little extra juice!).

Hedge funds got whooped by the S&P 500 last year:

I don’t disagree but the sell the news narrative is almost too obvious at this point. I’d think any selling for that would be balanced by these funds having to buy btc. And I’m also guessing the funds don’t care too much about price as they’re collecting based on aum regardless.I am out of all the miners as of the end of 2023. My guess is that this will be a sell the news type of situation. The only caveat being that if we get a pullback to BTC of more than 15-20%.

I thought that was the norm.Hedge funds got whooped by the S&P 500 last year:

QS up big today. 44%

QuantumScape's solid-state cell "significantly exceeded" requirements in a sample test as it completed more than 1,000 charging cycles. "For an electric car with a WLTP range of 500-600 kilometres, this corresponds to a total mileage of more than half a million kilometres," PowerCo said. "At the same time, the cell barely aged and still had 95 percent of its capacity (or discharge energy retention) at the end of the test."

Not that they generate any revenue or anything, but maybe eventually.

QuantumScape's solid-state cell "significantly exceeded" requirements in a sample test as it completed more than 1,000 charging cycles. "For an electric car with a WLTP range of 500-600 kilometres, this corresponds to a total mileage of more than half a million kilometres," PowerCo said. "At the same time, the cell barely aged and still had 95 percent of its capacity (or discharge energy retention) at the end of the test."

Not that they generate any revenue or anything, but maybe eventually.

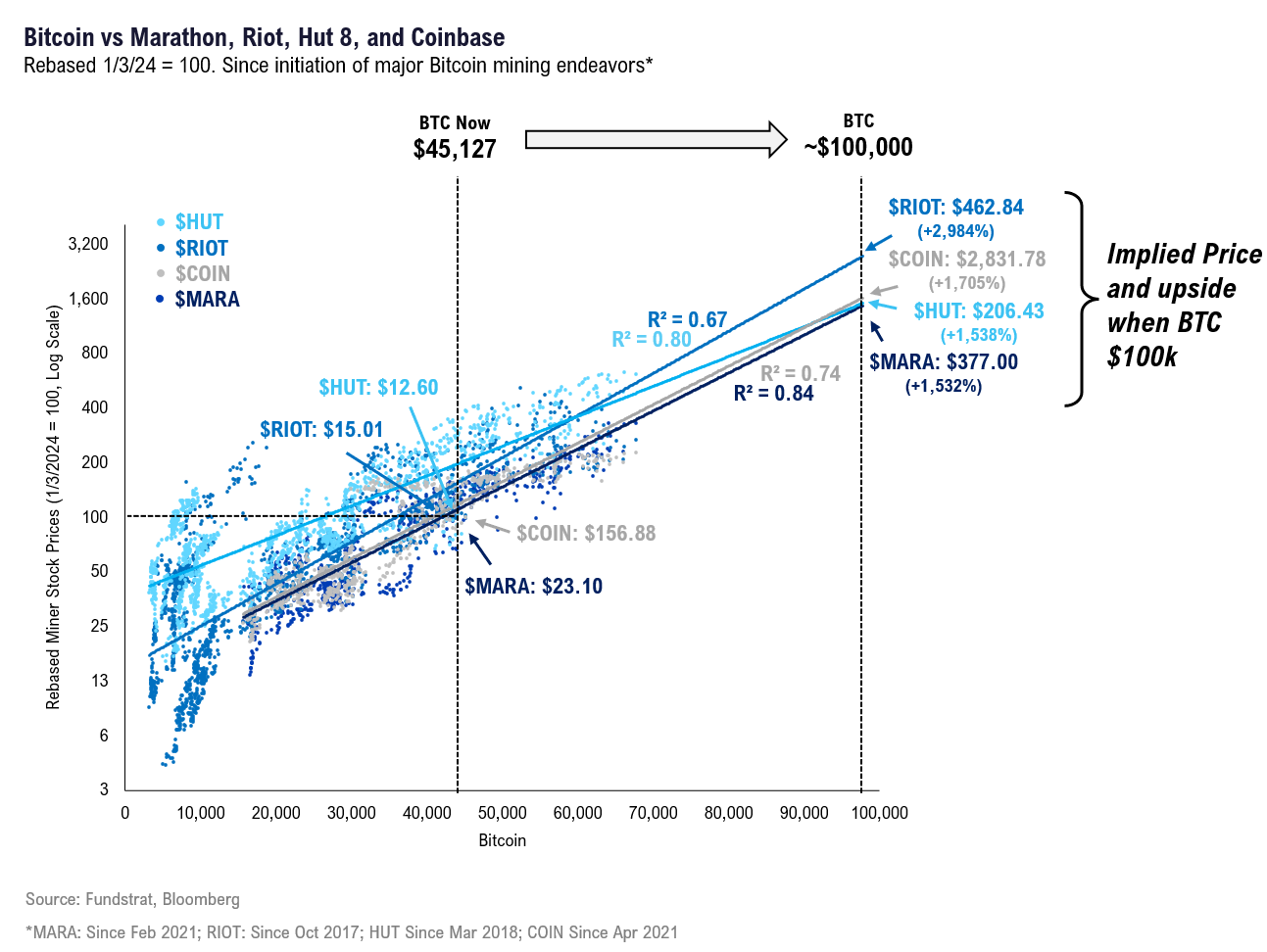

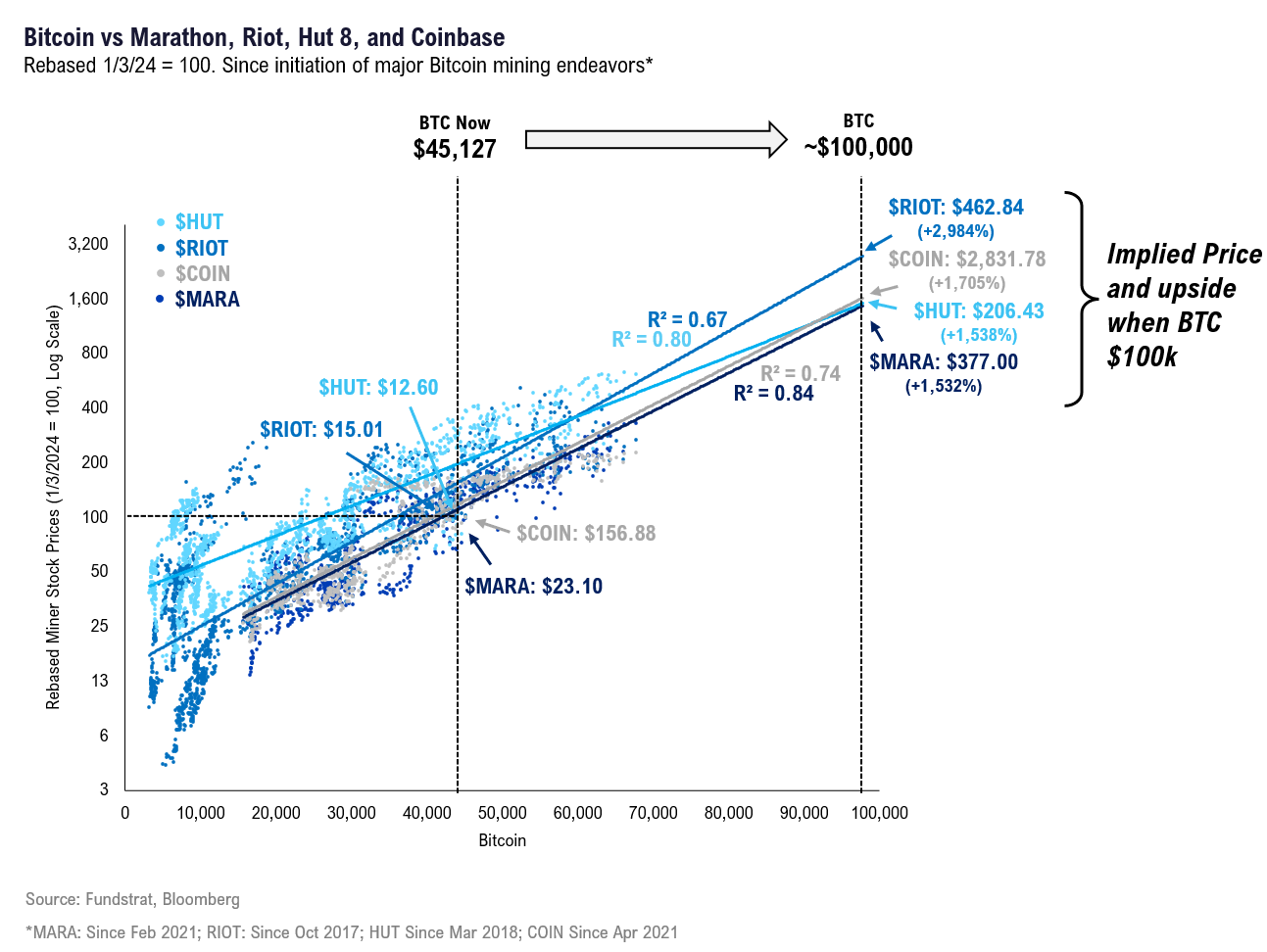

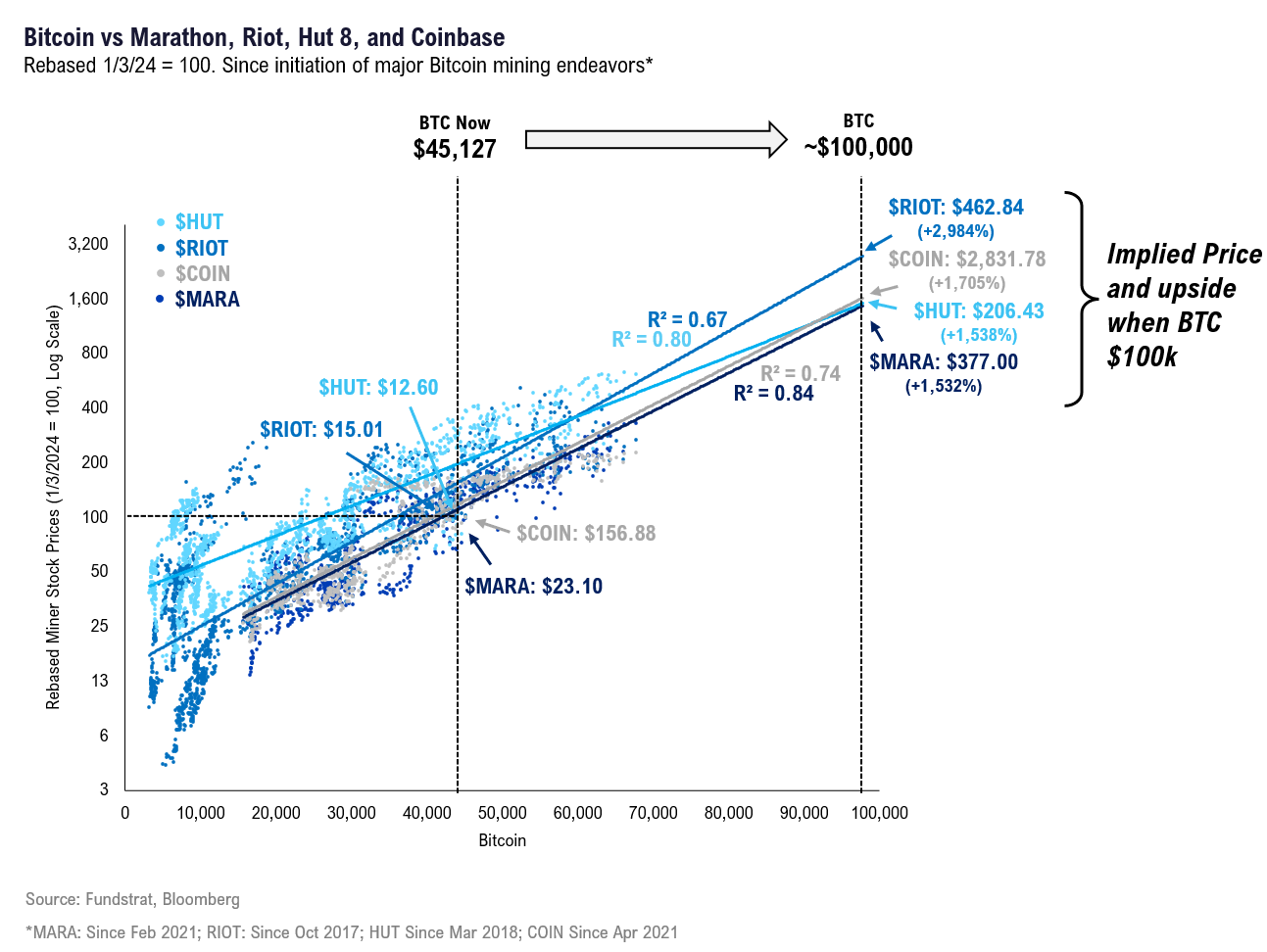

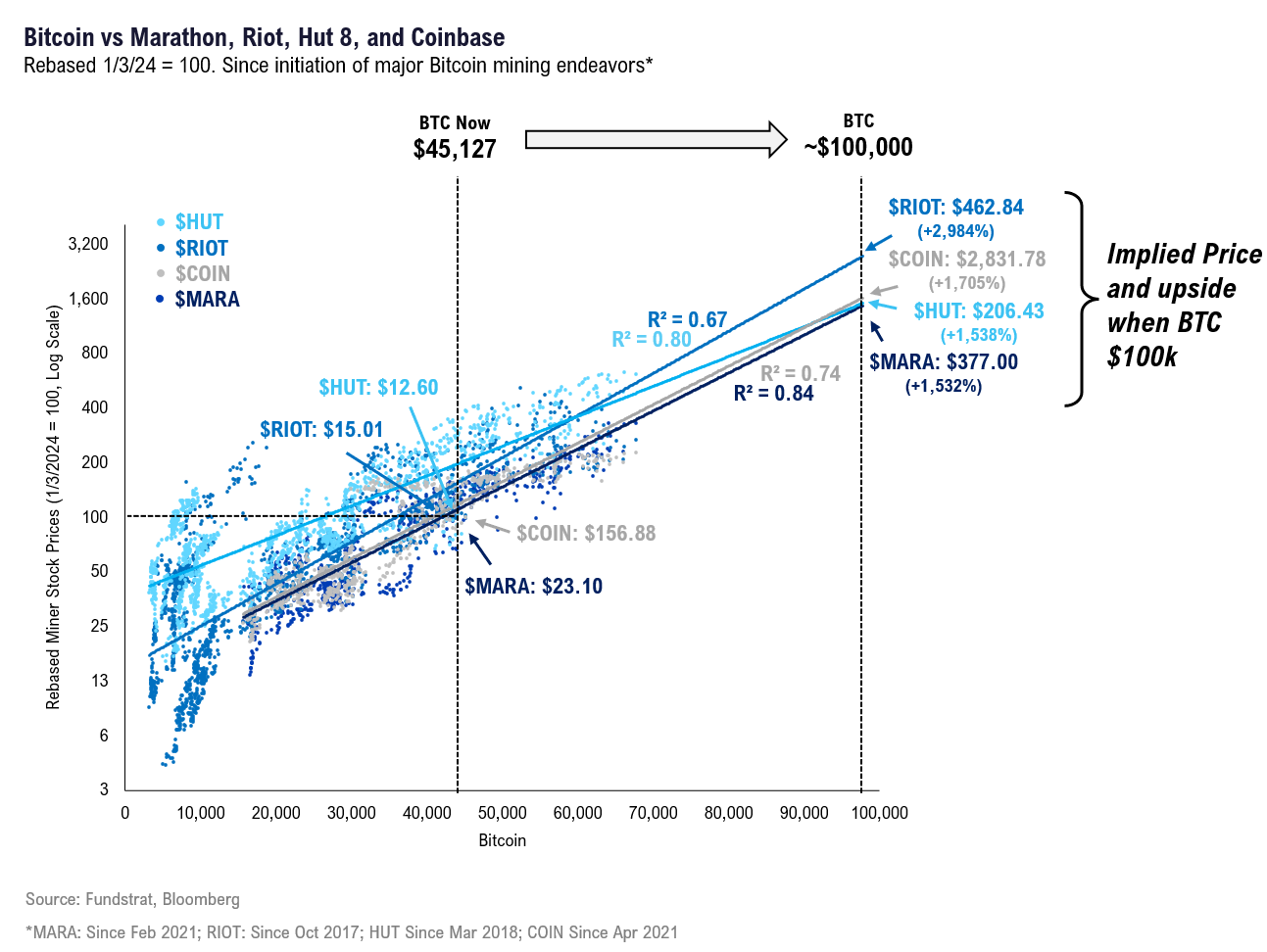

Estimating the inflation of miners and COIN. Wow!

@bob-loblaw

@ScarletNut

@rurahrah000

@Rutgers Chris

And all others.

@bob-loblaw

@ScarletNut

@rurahrah000

@Rutgers Chris

And all others.

Science first, then prototype, then commercial production. Long way to go but definitely good news for their technology. LEAP calls once the stock settles back down? Jan 2026 calls are already posted.QS up big today. 44%

QuantumScape's solid-state cell "significantly exceeded" requirements in a sample test as it completed more than 1,000 charging cycles. "For an electric car with a WLTP range of 500-600 kilometres, this corresponds to a total mileage of more than half a million kilometres," PowerCo said. "At the same time, the cell barely aged and still had 95 percent of its capacity (or discharge energy retention) at the end of the test."

Not that they generate any revenue or anything, but maybe eventually.

Well yeah. I dont know how high it will go. I had a few miners I sold for profit, and had one go bankrupt almost negating it all.Estimating the inflation of miners and COIN. Wow!

@bob-loblaw

@ScarletNut

@rurahrah000

@Rutgers Chris

And all others.

I have a hearty amt of $dghi, a small miner out of Canada and upstate NY. They were one of the few that werent over extended last year. I snagged a good amt when it was a penny stock. Presently up over 300% but if what I think happens, happens in 2024, Im looking at another 5x+.

I can’t predict how high they will go but I strongly believe that sector will have a bull runEstimating the inflation of miners and COIN. Wow!

@bob-loblaw

@ScarletNut

@rurahrah000

@Rutgers Chris

And all others.

Hedge funds got whooped by the S&P 500 last year:

They lagged again, yes. The typical “2 and 20” fee structure makes performance even worse. What a joke. But some people with “a lot” of money think that since their wealth allows them to buy a bigger house, better car, better school for kids, more luxury items, then they MUST be able to get better investment returns if they pay these stupid fees…

+1They lagged again, yes. The typical “2 and 20” fee structure makes performance even worse. What a joke. But some people with “a lot” of money think that since their wealth allows them to buy a bigger house, better car, better school for kids, more luxury items, then they MUST be able to get better investment returns if they pay these stupid fees…

Completely asinine in most cases. Just give your money to Fidelity and ask them to buy low-cost indexes, treasuries, and tax-free munis. Whatever balance works for you.

And, like you do, nothing wrong with having an account you manage yourself. I manage about 20% of our assets with the rest at Vanguard (index and active). But to each his own, I don’t begrudge anyone’s investment strategy or approach.+1

Completely asinine in most cases. Just give your money to Fidelity and ask them to buy low-cost indexes, treasuries, and tax-free munis. Whatever balance works for you.

By the way, how is Vanguard's platform and website? I used to hear negative things about it, way too no-frills. However, I think they recently updated it. I assume it's not for trading, but it still needs to be functional.And, like you do, nothing wrong with having an account you manage yourself. I manage about 20% of our assets with the rest at Vanguard (index and active). But to each his own, I don’t begrudge anyone’s investment strategy or approach.

By the way, how is Vanguard's platform and website? I used to hear negative things about it, way too no-frills. However, I think they recently updated it. I assume it's not for trading, but it still needs to be functional.

I think the general consensus is that it’s probably not quite on par with Fidelity, Schwab, and some others. They recently upgraded the mobile app. I don’t trade much and it meets my needs very well. It’s easy to see performance, a.locarions, transactions, balances in various account, moving money between accounts etc. I suppose I see someone might want another website if they were very frequent traders but I haven’t been on Fidelity since I consolidated accounts to Vanguard.

That’s exactly the same with me. When I retired 14 years ago, my assets or principal never went down even though I didn’t have any cash flow like social security or pension during 13 years. I don’t expect to ever use the principal.Outside of my play money/crypto moves, I have 3 different financial advisors managing my retirement income and nonqualified investments. I’ve been retired almost 4 years and withdraw 5% annually from the 2 retirement accounts and whatever interest/dividends come in from my nonqualified account. I’m thrilled to say that my principal is exactly the same as it was when I stopped working.