OT: Stock and Investment Thread

- Thread starter RU05

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I own JEPI too. Look into NHS, gives off 12-14% on a monthly basis and has been consistent with that distribution for over 15 yearsAt my stage of life I'm into continued growth in my qualified funds but taking dividends in my non-qualified account. I found two investments off of Fox Business (LOL) that I love. JEPI (that was paying 12% and now just under 8% that pays monthly (and has also grown 8+ % on the base) and what I bought more of today.... . SPG Simon Property Group. 4.7% Dividend but had also grown nearly 60% on top of that last 2 years.

As I figured once interest rates started to decline money would flow into higher dividend investments and real estate would start to take off. I tend to stick with things I've seen perform in my portfolio vs. trying to find the shiny new toy.

Oil is at $66 and could go lower if Trump ends sanctions on Russia. However, CVX seems to have held up pretty well.hey what's your thought on CVX (Chevron)? I've made a solid return on it over the past few years but wondering if the push to lower energy costs is going to hurt them. Coin I guess it could flip both ways I suppose and they do return a very nice 4.5% dividend. Took a good hit last 10 days with the Venezuela deal loss but still wondering if it might be a good time to take those profits and reinvest elsewhere?

wow. Holy Cow. Nothing like yours. $100 ish.I've held CVX for over 30 years. What's your basis? Mine is roughly 15, so the annual dividend on my original investment is (very roughly) 40%. And what would you do with the after tax proceeds?

Something with more growth and equal div yield.

It's a great buy and hold but this is my play account so I'm always looking to remix.

I've moved some of my energy invest into more developmental ..pays 3.5% div too.

| 1 year | 3 year | 5 year | 10 year | |

|---|---|---|---|---|

| MLPX Market Value | +42.87% | +26.18% | +17.46% | +6.60% |

Last edited:

I own JEPI too. Look into NHS, gives off 12-14% on a monthly basis and has been consistent with that distribution for over 15 years

| 1 year | 3 year | 5 year | 10 year | � |

|---|---|---|---|---|

| +11.30% | -3.78% | +1.55% | +5.00% |

13.7% div paid monthly..THANKS for that.

I’m surprise Doge isn’t trying to get rid of federal pension. A lot of federal employees will leave without the pension.

Any thought about CNBC Chart-man Carter Braxton forecasting a bear market? I see a few bringing up defensive dividend stocks in the thread.

Any thought about CNBC Chart-man Carter Braxton forecasting a bear market? I see a few bringing up defensive dividend stocks in the thread.

Last edited:

I’m surprise Doge isn’t trying to get rid of federal pension. A lot of federal employees will leave without the pension.

Perhaps because their benefits are vested?

Carter Braxton = LOLI’m surprise Doge isn’t trying to get rid of federal pension. A lot of federal employees will leave without the pension.

Any thought about CNBC Chart-man Carter Braxton forecasting a bear market? I see a few bringing up defensive dividend stocks in the thread.

Just a permabear. He's been wrong for 14 of the past 15 years.

My previous company had a vested pension then they changed it, 15 years later, there no more pension. One of the last companies to keep a pension. They also had a plan to get of the ones that had a pension and hire new non pension employees. I think maybe the old utilities employees still have a pension as well as local Governments. Do banks still have pensions?Perhaps because their benefits are vested?

I’m not a chart guy, so I call Carter Worth, Charter Worthless.Carter Braxton = LOL

Just a permabear. He's been wrong for 14 of the past 15 years.

People and the media perception is that inflation going up. Tariffs don’t affect anything? Cars not going to be affected by tariffs and clothing from China not going to be affected?

Agreed. And even if you were a chart/TA guy, there are so many better ones out there. Mark Newton from Fundstrat is really good.I’m not a chart guy, so I call Carter Worth, Charter Worthless.

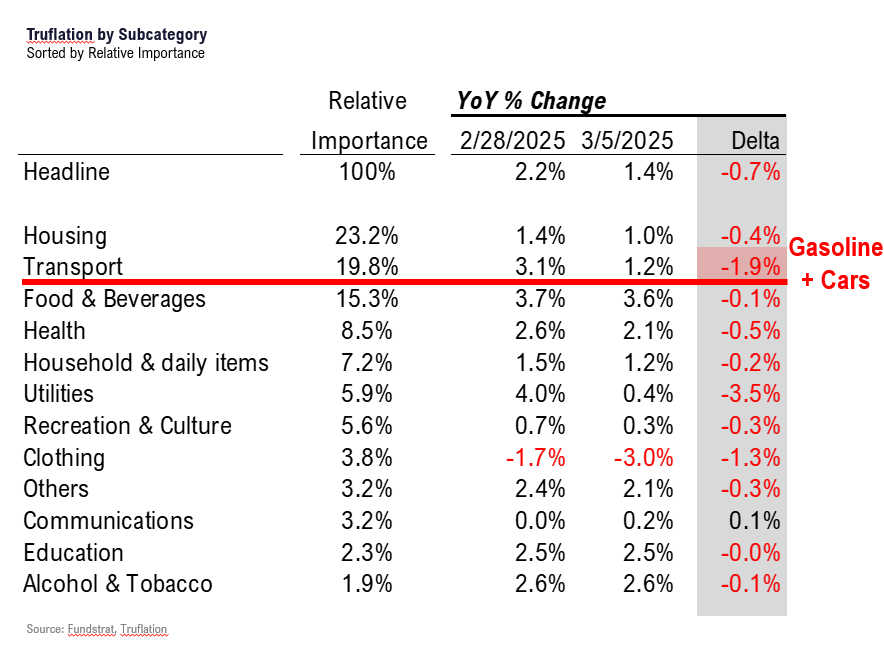

The data doesn't agree with those perceptions (as of now). Oil and energy are tanking which is being reflected in prices right now. As for tariffs? Who knows. Hard to even guess what the tariffs will be over the long run let along the impact of them.People and the media perception is that inflation going up. Tariffs don’t affect anything? Cars not going to be affected by tariffs and clothing from China not going to be affected?

He can remove or add new tariffs any day or time to multiple countries so its impossible to predict.The data doesn't agree with those perceptions (as of now). Oil and energy are tanking which is being reflected in prices right now. As for tariffs? Who knows. Hard to even guess what the tariffs will be over the long run let along the impact of them.

The data is the past, tariffs is the future. The unemployment numbers will be on the side of lowering rates, maybe in Jun and then the big rally for Tom Lee in July.The data doesn't agree with those perceptions (as of now). Oil and energy are tanking which is being reflected in prices right now. As for tariffs? Who knows. Hard to even guess what the tariffs will be over the long run let along the impact of them.

My previous company had a vested pension then they changed it, 15 years later, there no more pension. One of the last companies to keep a pension. They also had a plan to get of the ones that had a pension and hire new non pension employees. I think maybe the old utilities employees still have a pension as well as local Governments. Do banks still have pensions?

Did the employees lose their vested benefits when the plan was terminated? I don't think so. If you mean defined benefit plans when you say "pensions" they are around, but the benefits have been reduced in many cases. What has been added are 401k's and other defined contribution plan. There is also an employer match in many cases.

The employees that stayed no longer added any more vested years. All the companies I worked for had 401k matching and the defined benefit plan( pension). Very few companies have a defined pension plan except government employees.Did the employees lose their vested benefits when the plan was terminated? I don't think so. If you mean defined benefit plans when you say "pensions" they are around, but the benefits have been reduced in many cases. What has been added are 401k's and other defined contribution plan. There is also an employer match in many cases.

I have a few friends in pharma that had them last I spoke to them about it.The employees that stayed no longer added any more vested years. All the companies I worked for had 401k matching and the defined benefit plan( pension). Very few companies have a defined pension plan except government employees.

I worked at a medical devices company. My nephew has a pension at Prudential.I have a few friends in pharma that had them last I spoke to them about it.

I had worked for Pru early in my career. Strong defined benefit pension plus a generous 401K match. And they paid for my MBA.

I'm into the dividends not for defense. But since I'm paying tax on them anyway and I would like income vs. growth at my age. Reduces what I have to take out of my 401k and IRAs...which leaves me room to reclassify them too to Roth to address future RMD impact.I’m surprise Doge isn’t trying to get rid of federal pension. A lot of federal employees will leave without the pension.

Any thought about CNBC Chart-man Carter Braxton forecasting a bear market? I see a few bringing up defensive dividend stocks in the thread.

exactly. It is all part of the stew. Some things will offset including having more money after taxes to pay slightly higher prices if that happens.The data doesn't agree with those perceptions (as of now). Oil and energy are tanking which is being reflected in prices right now. As for tariffs? Who knows. Hard to even guess what the tariffs will be over the long run let along the impact of them.

He’s been there 10-15 years in the internal audit department, specialized accounting, probably stay there as long as he can.I had worked for Pru early in my career. Strong defined benefit pension plus a generous 401K match. And they paid for my MBA.

It's even better when the dividends are "qualified" (vs. ordinary) where you will pay lower taxes.I'm into the dividends not for defense. But since I'm paying tax on them anyway and I would like income vs. growth at my age. Reduces what I have to take out of my 401k and IRAs...which leaves me room to reclassify them too to Roth to address future RMD impact.

Last edited:

yes sir. I got a nice little surprise on my actual return vs. my Tax Tracker when a full 1/3 of my div. came in as Qualified!It's even better when the dividends are "qualified" (vs. ordinary) where you will pay lower taxes.

My dad worked at Dow Chemical for 38 years. Obviously, a great pension. However, I did some temp work there prior to starting my MBA (so 2000). They just announced moving to 401ks and phasing out pensions. The workforce wasn't happy. LOL! I forgot the exact details, but if you had X years of service you could stay in the pension as is, but below that you were pushed into the 401k with a company match. They converted your pension years into a starting balance for the 401k. It turned out to be a pretty good deal, so the hysteria calmed down.He’s been there 10-15 years in the internal audit department, specialized accounting, probably stay there as long as he can.

I worked for 8 years in one of the larger health systems in NJ. I had four different retirement plans in that time. Each change annoyed the employees more. Thankfully I could roll over the last three, but I have about $10k sitting in a defined benefit plan I can’t touch. A complete wasteMy dad worked at Dow Chemical for 38 years. Obviously, a great pension. However, I did some temp work there prior to starting my MBA (so 2000). They just announced moving to 401ks and phasing out pensions. The workforce wasn't happy. LOL! I forgot the exact details, but if you had X years of service you could stay in the pension as is, but below that you were pushed into the 401k with a company match. They converted your pension years into a starting balance for the 401k. It turned out to be a pretty good deal, so the hysteria calmed down.

Yeah, I have a stupid defined benefit plan with the state due to my elected service. About $7-8k sitting in Empower for no reason. It is invested in an S&P 500 index so it must be some weird hybrid thing. I can't move it until I'm 55. Very annoying.I worked for 8 years in one of the larger health systems in NJ. I had four different retirement plans in that time. Each change annoyed the employees more. Thankfully I could roll over the last three, but I have about $10k sitting in a defined benefit plan I can’t touch. A complete waste

ah shut up. You're not even 55 lol! (I wish I were 55 again)Yeah, I have a stupid defined benefit plan with the state due to my elected service. About $7-8k sitting in Empower for no reason. It is invested in an S&P 500 index so it must be some weird hybrid thing. I can't move it until I'm 55. Very annoying.

Added Meta down 15%, NFLX down 15% and AMZN down 18%. Sold some UNH.

+1Added Meta down 15%, NFLX down 15% and AMZN down 18%. Sold some UNH.

Just did a buy round of buying. Added about 10% to my custom stock basket across the board (32 holdings). Double positions of RDDT, SHAK, and HOOD. I sense the bow is about to break on these ridiculous Mexico and Canada tariffs. Bessit and Lutnick are in full damage control mode.

I have a defined benefits plan from work in the ‘80s-early ‘90s, defined contribution plan from mid 90s to retirement, and a SERP whose payout was triggered by a Shareholder Rights Plan when there was a change of control in the company—pretty happy/lucky with the way it all worked out.

Mr. Market is likely processing this whole tariff fiasco as being indicative of a prolonged period of instability or volatility, and this amidst the reality of historically over-valued equities. A reset is likely coming, slowly now, then all at once. The question is: how long will it last? And there maybe viable alternatives, relative havens of safety. Discuss....+1

Just did a buy round of buying. Added about 10% to my custom stock basket across the board (32 holdings). Double positions of RDDT, SHAK, and HOOD. I sense the bow is about to break on these ridiculous Mexico and Canada tariffs. Bessit and Lutnick are in full damage control mode.

Trump administration is not going to pull back on tariffs because of a few down days in the market. They would loose all leverage the next time they use tariffs as a negotiation tool.+1

Just did a buy round of buying. Added about 10% to my custom stock basket across the board (32 holdings). Double positions of RDDT, SHAK, and HOOD. I sense the bow is about to break on these ridiculous Mexico and Canada tariffs. Bessit and Lutnick are in full damage control mode.

But they already did.Trump administration is not going to pull back on tariffs because of a few down days in the market. They would loose all leverage the next time they use tariffs as a negotiation tool.

Only partial and for one month.But they already did.