OT: Stock and Investment Thread

- Thread starter RU05

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mark Newton from Tom Lee's shop is saying oil can touch below $50 and then rip back through the first quarter of 2026. I can add to both SLB and XLE call positions as needed.I wasn't paying attention the last couple days, I'm down 6% like that.

I bought some DVN as well, also down on that, but it is bouncing a little nicer today.

The downside moves didn't break the upward trend, yet at least. Charts still look productive.

I have room to add to SLB so I probably will.

Tom Lee is also citing the energy sector as overweight for 2026. Let's go!!!

Any thoughts on RACE? Pretty nice dip recently. I assume rich people are still going to want rich people things.MRNA again trying or a breakout. $31. Resistance ahead. Needs to fight it's way to the upper $30's..

Surprised RIVN didn't get a bump from F discontinuing the EV lightning.

Maybe the market thinks the Ford hybrid pickup will take those Lightning sales?

Or maybe RIVN's run up this year was in part due to the market seeing the Lightning's days were numbered.

Maybe the market thinks the Ford hybrid pickup will take those Lightning sales?

Or maybe RIVN's run up this year was in part due to the market seeing the Lightning's days were numbered.

The gas engine will power an electric generator, providing a range of 700 miles, which is amazing. Yes, the sales are expected to be made up by the hybrid. EV sales fell off a cliff.Surprised RIVN didn't get a bump from F discontinuing the EV lightning.

Maybe the market thinks the Ford hybrid pickup will take those Lightning sales?

Or maybe RIVN's run up this year was in part due to the market seeing the Lightning's days were numbered.

Chart heading the wrong direction right now.Any thoughts on RACE? Pretty nice dip recently. I assume rich people are still going to want rich people things.

And at 35x P/E I imagine it could keep heading that direction.

Ya, WTI def looks like it's heading lower. Wonder what the rational is for bouncing at $50.Mark Newton from Tom Lee's shop is saying oil can touch below $50 and then rip back through the first quarter of 2026. I can add to both SLB and XLE call positions as needed.

Tom Lee is also citing the energy sector as overweight for 2026. Let's go!!!

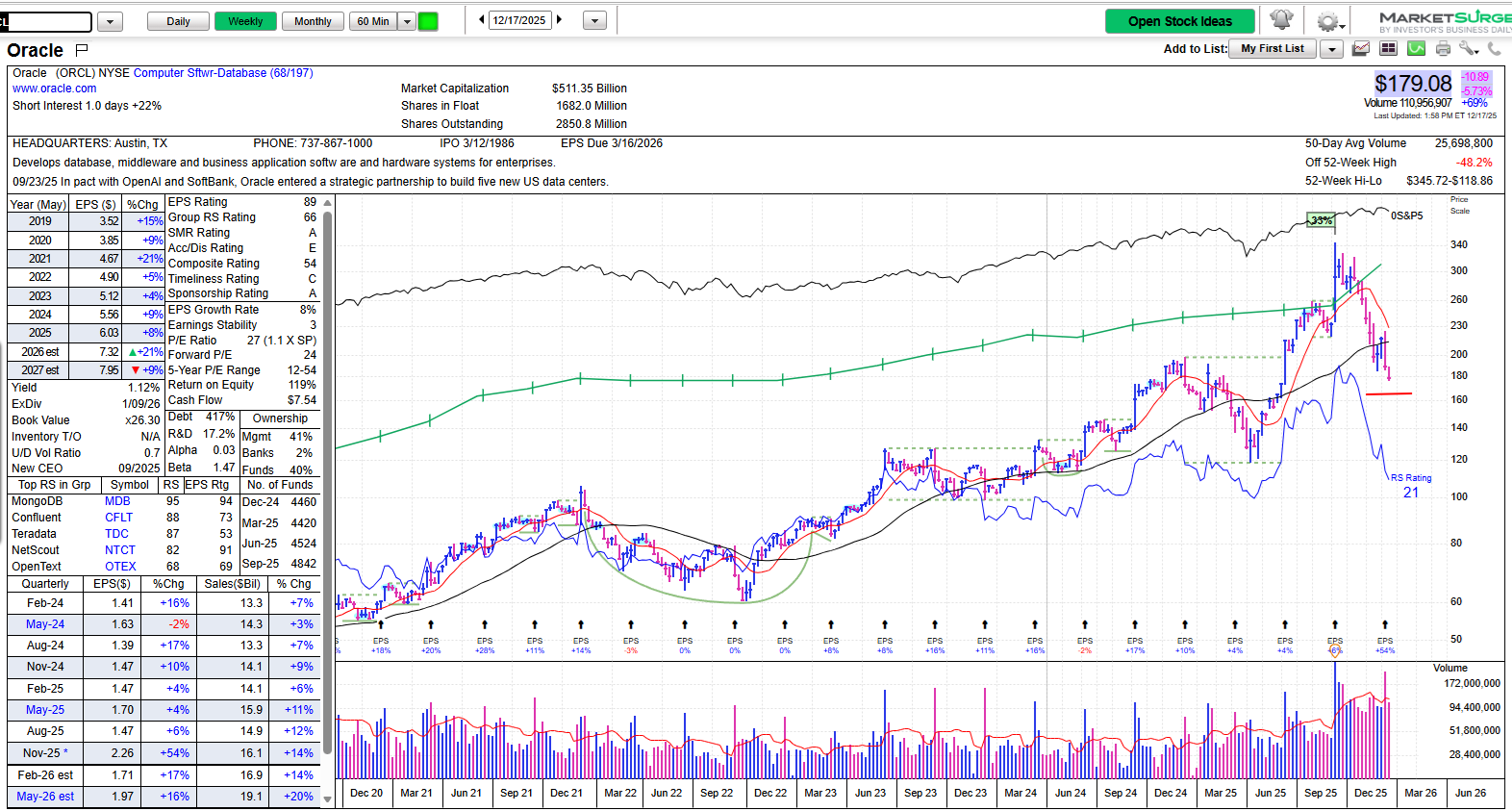

ORCL starting to look like a screaming buy (or add) on all this FUD. Seems like Blackrock will just step in for financing as needed. So.....Blue Owl walking on a $10B deal with ORCL to build a data center.

ORCL down on the news, but I feel like they are being punished for something the market didn't want it to do anyways. Am I reading that right?

I saw $154 as potential support level.ORCL starting to look like a screaming buy (or add) on all this FUD. Seems like Blackrock will just step in for financing as needed. So.....

Ives was still talking it up with Batnick (no Brown) on WAYT.

As the Compound guys often like to point out, this is healthy market behavior. You want worry in there, you want corrections, you want these buying opportunities.

Not to say you can't go straight up ala NVDA and PLTR, but those stocks are rare. (and even these stocks have hit rough roads at times).

No oil producer wants $50 oil.Ya, WTI def looks like it's heading lower. Wonder what the rational is for bouncing at $50.

Interesting TA on ORCL (from Mark Newton/FS Insights):

ORCL -5.43% which remains on UPTICKS (and i plan keeping on UPTICKS which should be released tomorrow) has suffered a very steep drop lately, but has some reasons towards thinking this might find support and turn back higher. The stock is approaching a time-based Fibonacci retracement of its rally from April into September of this year, which proved to be 156 calendar days. Interestingly enough, if this were to bottom this week, it would represent a 61.8% time-based retracement of 156 days. More interesting to some maybe however, is that when putting ORCL's rally on Gann's "Square of 9" chart which i use to convert time to price for targeting resistance and support, it's important that ORCL's peak of $328 lie on the 150 degree angle of Square of 9. The level of 172 looks important as support on this chart, which coincidentally would be exactly half of its peak on Sept. 10, 2025 of $345.72. Thus, ORCL might find support at a 50% absolute price retracement of its intra-day high from 9/10. What's also interesting is that when turning its rally in time into price, we see that 156 calendar days or 156 dollars, when subtracted from the high close of $328.33, also equals $172.33. Elliott-wave patterns on ORCL clearly show this to be in the final stage of a five-wave decline from September. This can be good news, but also bad. Initially, being near the potential end of this decline could signal a coming bounce, and that's what i expect. However, it also likely points to bounces not getting back to new highs right away, but resulting in additional weakness, which i feel might happen between March and October of next year. Thus, for now, it looks like a good risk/reward to buy dips technically at $172-3 this week if reached. Thereafter, a rally might get underway back up to $238 initially or maybe $258 before this stalls and turns lower. Overall, my work suggests this is getting close to a bottom.

ORCL -5.43% which remains on UPTICKS (and i plan keeping on UPTICKS which should be released tomorrow) has suffered a very steep drop lately, but has some reasons towards thinking this might find support and turn back higher. The stock is approaching a time-based Fibonacci retracement of its rally from April into September of this year, which proved to be 156 calendar days. Interestingly enough, if this were to bottom this week, it would represent a 61.8% time-based retracement of 156 days. More interesting to some maybe however, is that when putting ORCL's rally on Gann's "Square of 9" chart which i use to convert time to price for targeting resistance and support, it's important that ORCL's peak of $328 lie on the 150 degree angle of Square of 9. The level of 172 looks important as support on this chart, which coincidentally would be exactly half of its peak on Sept. 10, 2025 of $345.72. Thus, ORCL might find support at a 50% absolute price retracement of its intra-day high from 9/10. What's also interesting is that when turning its rally in time into price, we see that 156 calendar days or 156 dollars, when subtracted from the high close of $328.33, also equals $172.33. Elliott-wave patterns on ORCL clearly show this to be in the final stage of a five-wave decline from September. This can be good news, but also bad. Initially, being near the potential end of this decline could signal a coming bounce, and that's what i expect. However, it also likely points to bounces not getting back to new highs right away, but resulting in additional weakness, which i feel might happen between March and October of next year. Thus, for now, it looks like a good risk/reward to buy dips technically at $172-3 this week if reached. Thereafter, a rally might get underway back up to $238 initially or maybe $258 before this stalls and turns lower. Overall, my work suggests this is getting close to a bottom.

Inflation falls off a cliff:

November consumer prices rose at a 2.7% annual rate, lower than expected, delayed data shows

November consumer prices rose at a 2.7% annual rate, lower than expected, delayed data shows

Check this out, about why oil bouncing at $50'ish.Ya, WTI def looks like it's heading lower. Wonder what the rational is for bouncing at $50.

I would like to encourage all the millionaires in this thread to support Rutgers NIL. You can simply transfer stock to Rutgers and take the write off. Something to think about before the end of the year.