Latest NIL data shows dollars continue to flow in college football

When NIL and the college football season collided for the first time last fall, there were plenty of unknowns.

Some stakeholders truly believed athletes receiving compensation was going to drive apart locker rooms. Others were interested to see what brands would consider a successful return on investment. Plus, what if a star player’s preseason hype did not live up on the field despite signing multiple NIL deals.

The list of lessons learned in Year 1 of NIL is long. To date, there haven’t been reports of a locker room implosion due to the new age of college athletics. The coaching carousel’s impact is another story, though. And some football players who inked lucrative endorsement deals last year did struggle to put up the numbers many expected. Brand behavior has arguably shifted early in Year 2.

More brands are buying into NIL, specifically in college football, according to the latest data from INFLCR, a company that provides brand-building technology to assist institutions’ athletes in maximizing their NIL value.

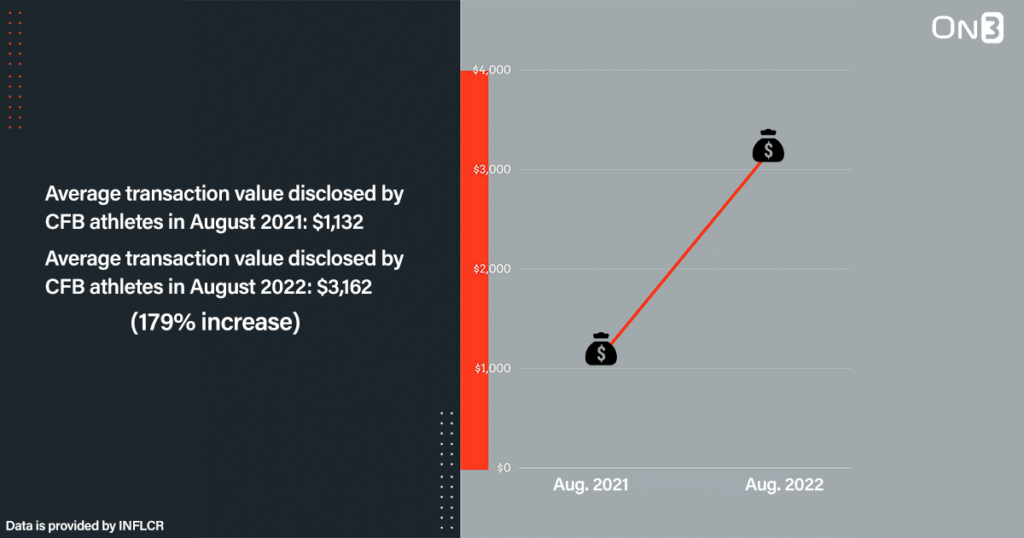

The average transaction involving a college football player has seen a 179% increase in Year 2 of the NIL era, according to INFLCR. Athletes are earning an average of $3,162 this fall compared to $1,132 a year ago. And in the month of August, 55.64% of all NIL transaction value disclosed was from college football endorsements and NIL deals.

More than 40% of all football NIL disclosures INFLCR received came from the company’s local exchange program. These allow institutions to customize and manage NIL reporting.

“Some of the increase that we’ve seen have just been brands getting more comfortable, and businesses getting more comfortable engaging student-athletes for partnership opportunities,” said Kevin Barefoot, who serves as vice president of business development in Teamworks’ collegiate division and works closely with INFLCR. “It was obviously a brand new industry, a new frontier. There were a lot of brands and businesses that were a little bit cautious earlier that are now seeing there’s a ton of opportunity. There’s many good reasons to partner with student-athletes for these for these brand activations.”

Why is NIL compensation in college football shooting up?

There’s a variety of factors that can explain the major deal growth from over the past year. More and more major brands are buying into NIL. Earlier this week, Nike signed five basketball players to NIL deals. It was the largest NIL partnership announcement the sneaker giant has announced to date.

The infrastructure is significantly more developed, too. When deals were being announced last year, NIL collectives were far off from where the landscape stands now. At last check in the On3 NIL collective database, there are more than 170 organizations that support athletes at institutions across the Division I landscape.

All vary on how they operate, with some opting to register as nonprofits and give back to communities and charities. Many have taken up the LLC business model. And there’s also player-driven, membership-based community models, including those powered by the company YOKE, which has launched clubs at more than 45 institutions.

“The majority of dollars flowing through our platform are driven from collectives,” Barefoot added. “The more collectives that you have pop up, the more likelihood that you’re going to see increased opportunities and dollars for student athletes.

“… If I’m a school, I want to ensure that the environment I’m creating is not too noisy, I want to make sure that my fans and supporters and donors and local businesses know where to go and how to interact with my student athletes.”

INFLCR struck a deal with On3 back in July. The partnership will focus on providing the On3 NIL Valuation, as well as educational resources, to all student-athletes at INFLCR partnered schools.

Another big factor in the value of the average deal lies with institutions. Two summers ago, schools were trying to figure out what they could and couldn’t do. That has changed. Commissioners spent the past few months calling for NIL legislation from Capitol Hill because of various state NIL laws.

Have brands been satisfied?

While athletes continue to receive more deals and they are commanding more cash in the open market, there’s always going to be questions of NIL fatigue.

More importantly, are brands excited to strike endorsement contracts? Is the return on investment there? And what does the company consider a strong return?

“One of the ways that you can measure the success of a marketing campaign, with any public figure, whether they’re a college athlete or not, is how much attention that that campaign draws,” Barefoot said. “And so in that regard, my hunch is that many of these local and national brands have been satisfied and excited about the student-athlete partnerships because of that attention. But also, it’s an exciting new space. Brands that want to push the envelope, businesses that want to push the envelope — this is a phenomenal and exciting space for them to play in.

“You can use infinite creativity in how you partner with a student-athlete. Whether it’s a deal based on where they’re from, or maybe their last name or a unique characteristic that they may have. You can use a lot of creativity.”