Important perspective:

Why now might be the time to invest

Down markets may present opportunities for patient investors.

The potential danger of reactive decision-making

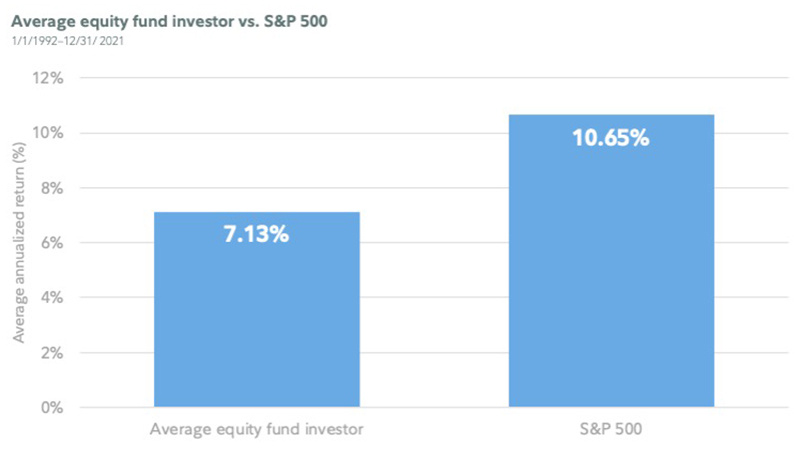

Over the last 30 years, studies have shown that when investors have given up on their long-term strategies and begin reacting to short-term developments in the market, their portfolios have suffered. Reactive behavior on the part of an investor can be a significant drag on performance. For example, since 1992, the average equity fund investor has underperformed the S&P 500 index, largely due to investor attempts to time the market. In 2021, this gap was particularly wide: the average equity fund investor underperformed the S&P 500 by more than 10%.

Part of the reason for this underperformance may be that investors might have an outsized impression of the impact that bear markets, volatility, and recessions may have on the long-term health of their portfolios. By making reactive or emotional decisions without the historical context, they may end up hurting their long-term growth prospects more than if they had simply ridden out the storm.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YMUAKNXNDBNJNL6MUV5ATEDW7A.jpg)